Technology peripherals

Technology peripherals AI

AI Five ways to reduce compliance costs with artificial intelligence and automation

Five ways to reduce compliance costs with artificial intelligence and automationFive ways to reduce compliance costs with artificial intelligence and automation

While regulations are enacted to protect consumers and the marketplace, they are often complex, costly, and difficult to comply with.

Highly regulated industries such as financial services and life sciences must bear the cost of compliance. Research firm Deloitte estimates that banks' compliance costs have increased by 60% since the financial crisis in 2008, and the International Risk Management Association found that 50% of financial institutions spend 6% to 10% of their revenue on compliance.

Artificial intelligence and intelligent automated processes such as robotic process automation (RPA) and natural language processing (NLP) can help increase efficiency and reduce costs to meet compliance. The method is as follows:

1. Use RPA and NLP to manage regulatory changes

In one year, financial institutions may need to deal with as many as 300 million pages of new regulations, which come from the U.S. federal, state or municipalities through various channels. The manual effort of collecting, collating and understanding these changes and mapping them to the appropriate business areas is time consuming.

While RPA can be programmed to collect regulatory changes, there is also a need to understand the regulations and apply them to business processes. This is where sophisticated optical character recognition, natural language processing and artificial intelligence models come into play.

- Optical character recognition can convert regulatory text into machine-readable text.

- Natural language processing is used to process text and understand complex sentences and complex regulatory terms.

- Next, the AI model can leverage the output to provide options for policy changes based on similar past cases and filter through new regulations to flag regulations that are relevant to the business.

All these features can save analysts a lot of time, thus reducing costs.

2. Simplify regulatory reporting

One of the biggest time consumers in regulatory reporting is determining what needs to be reported, when and how. This requires analysts to not only review regulations but also interpret them, write text about how the regulations apply to their business, and translate them into code so that relevant data can be retrieved.

Alternatively, AI can quickly parse unstructured regulatory data to define reporting requirements, interpret it based on past rules and circumstances, and generate code to trigger automated processes to access multiple company resources to build Report. This approach to regulatory intelligence is gaining traction to support financial services reporting as well as life sciences-related businesses that need to submit new product approvals.

3. Shorten the review process of marketing materials

The process of selling in a highly regulated market requires marketing materials to be compliant. However, the process of approving the ongoing flow of new marketing materials can be onerous.

The trend among pharmaceutical companies toward personalized marketing content is driving up compliance costs at an exponential rate as compliance staff need to ensure every piece of content complies with drug labels and regulations. Since adding manpower to scale these policies can significantly increase costs, artificial intelligence is now used to scan content and determine compliance faster and more efficiently. In some cases, AI bots are even used to edit and write regulatory-compliant marketing copy.

4. Reduce errors in transaction monitoring

Traditional rule-based transaction monitoring systems in financial services are prone to producing too many false positives. In some cases, the false alarm rate has reached 90%, and every alert needs to be reviewed by compliance staff.

By integrating artificial intelligence into traditional transaction monitoring systems, false compliance alerts can be minimized and review costs reduced. High-risk issues that are deemed legitimate can be escalated to compliance staff, and these are not issues that can be resolved automatically. Since compliance staff only handle high-risk-flagged transactions, these resources can be redeployed where they can add more value. AI can also be used to update traditional rule engines and monitoring systems as new trends are identified.

5. Conduct background and legal checks

To limit criminal activity and money laundering, banks need to conduct due diligence to ensure new customers comply with the law and maintain this behavior throughout the relationship. Depending on certain individuals' risk levels, background checks may take anywhere from 2 to 24 hours. Much of the time is spent gathering documents, checking databases and reviewing media. Artificial intelligence and automation can streamline this process. Bots can be used to crawl web content and use sentiment analysis to flag negative content. Natural language processing technology can scan court documents for signs of illegal activity and media reports most relevant to analysis.

The above is the detailed content of Five ways to reduce compliance costs with artificial intelligence and automation. For more information, please follow other related articles on the PHP Chinese website!

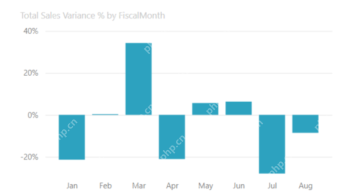

Most Used 10 Power BI Charts - Analytics VidhyaApr 16, 2025 pm 12:05 PM

Most Used 10 Power BI Charts - Analytics VidhyaApr 16, 2025 pm 12:05 PMHarnessing the Power of Data Visualization with Microsoft Power BI Charts In today's data-driven world, effectively communicating complex information to non-technical audiences is crucial. Data visualization bridges this gap, transforming raw data i

Expert Systems in AIApr 16, 2025 pm 12:00 PM

Expert Systems in AIApr 16, 2025 pm 12:00 PMExpert Systems: A Deep Dive into AI's Decision-Making Power Imagine having access to expert advice on anything, from medical diagnoses to financial planning. That's the power of expert systems in artificial intelligence. These systems mimic the pro

Three Of The Best Vibe Coders Break Down This AI Revolution In CodeApr 16, 2025 am 11:58 AM

Three Of The Best Vibe Coders Break Down This AI Revolution In CodeApr 16, 2025 am 11:58 AMFirst of all, it’s apparent that this is happening quickly. Various companies are talking about the proportions of their code that are currently written by AI, and these are increasing at a rapid clip. There’s a lot of job displacement already around

Runway AI's Gen-4: How Can AI Montage Go Beyond AbsurdityApr 16, 2025 am 11:45 AM

Runway AI's Gen-4: How Can AI Montage Go Beyond AbsurdityApr 16, 2025 am 11:45 AMThe film industry, alongside all creative sectors, from digital marketing to social media, stands at a technological crossroad. As artificial intelligence begins to reshape every aspect of visual storytelling and change the landscape of entertainment

How to Enroll for 5 Days ISRO AI Free Courses? - Analytics VidhyaApr 16, 2025 am 11:43 AM

How to Enroll for 5 Days ISRO AI Free Courses? - Analytics VidhyaApr 16, 2025 am 11:43 AMISRO's Free AI/ML Online Course: A Gateway to Geospatial Technology Innovation The Indian Space Research Organisation (ISRO), through its Indian Institute of Remote Sensing (IIRS), is offering a fantastic opportunity for students and professionals to

Local Search Algorithms in AIApr 16, 2025 am 11:40 AM

Local Search Algorithms in AIApr 16, 2025 am 11:40 AMLocal Search Algorithms: A Comprehensive Guide Planning a large-scale event requires efficient workload distribution. When traditional approaches fail, local search algorithms offer a powerful solution. This article explores hill climbing and simul

OpenAI Shifts Focus With GPT-4.1, Prioritizes Coding And Cost EfficiencyApr 16, 2025 am 11:37 AM

OpenAI Shifts Focus With GPT-4.1, Prioritizes Coding And Cost EfficiencyApr 16, 2025 am 11:37 AMThe release includes three distinct models, GPT-4.1, GPT-4.1 mini and GPT-4.1 nano, signaling a move toward task-specific optimizations within the large language model landscape. These models are not immediately replacing user-facing interfaces like

The Prompt: ChatGPT Generates Fake PassportsApr 16, 2025 am 11:35 AM

The Prompt: ChatGPT Generates Fake PassportsApr 16, 2025 am 11:35 AMChip giant Nvidia said on Monday it will start manufacturing AI supercomputers— machines that can process copious amounts of data and run complex algorithms— entirely within the U.S. for the first time. The announcement comes after President Trump si

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Dreamweaver Mac version

Visual web development tools

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

SublimeText3 English version

Recommended: Win version, supports code prompts!