Technology peripherals

Technology peripherals AI

AI AI performance beats traditional fund managers. Do you feel safe handing your money to AI?

AI performance beats traditional fund managers. Do you feel safe handing your money to AI?AI performance beats traditional fund managers. Do you feel safe handing your money to AI?

AI relies on larger and more diverse data sets to automatically analyze and select stocks, bonds, trading funds and other investment products, helping retail investors gain a better understanding of the financial market. The power of war.

With lower fees and looser portfolios, digital portfolios have gained an upper hand in the competition with fund managers.

Whether you have personal experience or not, we are dealing with AI every day. From asking Siri about the weather to in-car assisted driving functions, AI has penetrated into almost every aspect of our lives - and the investment field is no exception. AI even has the potential to surpass traditional fund managers in its ability to design investment portfolios.

The Limitations of Professional Fund Managers

Every day, professional fund managers spend a lot of time reviewing stock data, investment models and other key information to determine Whether a certain stock or other investment is suitable for inclusion in the fund's portfolio. This method is only suitable for actively managed investment funds, and its operation method is fundamentally different from index funds.

And even though Wall Street fund managers have to work more than 60 hours a week, they still cannot break through the limits of human ability. People need to sleep, and it is impossible to grasp the content and patterns of news and data as soon as they are released. There is only so much information that humans can remember and process, and there is basically no room for further improvement in work speed.

It is true that humans do many tasks better than computers. But with the advancement of AI and machine learning, these advantages may disappear one by one. At least when it comes to designing stock portfolios, AI is already several levels above the best that humans can achieve.

AI does better

The reason why AI can do better is because professional fund managers can only analyze the market through currently available information, but AI can use big data and Internet information builds highly complex models to accurately predict future market trends.

Specifically, the AI investment portfolio relies on the "cluster model", which is to predict events that will occur in the future through asset allocation modeling. These models take large amounts of stock data, create scatter plots based on the absolute values of relative risk in a portfolio, and arrange these scatter plots in a hierarchical structure. Of course, this is only one of the commonly used AI models in asset management, and there are many other model design ideas.

The models formed by these scatter plots will reflect future trends and can go beyond the linear correlation between stocks that most fund managers focus on and incorporate a series of non-linear relationships. This not only reduces investment risks, but is also expected to bring new opportunities to expand the market.

Why is AI so powerful?

Better Accessibility

Retail investors are often afraid to participate in active investment funds because the fees of such funds are much higher than those of popular low-cost index funds. AI investment portfolios can reduce handling fees and provide looser investment options, allowing retail investors to enter this new world that used to belong only to financial elites.

Reduce costs and entry barriers

Actively managed investment funds generally charge a variety of fees to investors. The most basic is a fixed annual fee. Affluent hedge fund investors often pay an annual fee equivalent to 20% of profits based on the actual investment scale.

Generally, the cost of AI investment portfolios is much lower than similar products managed by fund managers. In addition, AI funds have lower investment requirements and the annual fees are more approachable. Currently, the more popular mutual funds require a starting investment of at least US$5,000, but AI funds have greatly lowered this threshold.

Safer

Fund managers can only react to market dynamics after the fact, which is a typical "past determines the present". However, AI can provide dual risk prevention measures for market fluctuations and accurately assess future investment risks. AI investment portfolios can automatically reallocate funds based on potential risks, protecting investors' rights far faster than fund managers can react.

Beyond Human

Sometimes, retail investors and fund managers may have conflicting judgments on market trends. AI is capable of analyzing stock market transactions and financial data feeds, adjusting portfolios in near real-time, and even analyzing sentiment data from news summaries and forum posts. I believe everyone knows that a few seconds of advantage in automated trading often has a huge impact.

Summary of AI Portfolio Features

Of course, some friends must be worried that handing over investments to a completely virtual system sounds unreliable. Let’s take a look at what you need to pay attention to when choosing an AI investment portfolio:

Diversification of financial securities: AI investment portfolio should be able to sort out the market and focus on diversified stocks, bonds, and exchange-traded funds and other securities. A more diversified portfolio is better suited to the venture capital environment.

Data input quality: How good the data is, how good the AI model is. Therefore, high-quality data sources must be carefully selected for AI investment models.

Transparent Portfolio Performance: Investment funds must meet reporting requirements and maximize information transparency beyond the basics. A good AI portfolio should help users understand how their investments are performing and compare the results to major market benchmarks.

Fees and entry barriers: Monthly/annual fees for AI portfolios, or other forms of minimum usage fees, should be lower than for traditional investment services.

Summary

With more diverse stocks, lower usage costs and faster response times, AI portfolios have begun to surpass traditional human fund managers. The subsequent lower entry threshold may mean that the era of financial inclusion in which retail investors are king is slowly beginning.

The above is the detailed content of AI performance beats traditional fund managers. Do you feel safe handing your money to AI?. For more information, please follow other related articles on the PHP Chinese website!

How to Run LLM Locally Using LM Studio? - Analytics VidhyaApr 19, 2025 am 11:38 AM

How to Run LLM Locally Using LM Studio? - Analytics VidhyaApr 19, 2025 am 11:38 AMRunning large language models at home with ease: LM Studio User Guide In recent years, advances in software and hardware have made it possible to run large language models (LLMs) on personal computers. LM Studio is an excellent tool to make this process easy and convenient. This article will dive into how to run LLM locally using LM Studio, covering key steps, potential challenges, and the benefits of having LLM locally. Whether you are a tech enthusiast or are curious about the latest AI technologies, this guide will provide valuable insights and practical tips. Let's get started! Overview Understand the basic requirements for running LLM locally. Set up LM Studi on your computer

Guy Peri Helps Flavor McCormick's Future Through Data TransformationApr 19, 2025 am 11:35 AM

Guy Peri Helps Flavor McCormick's Future Through Data TransformationApr 19, 2025 am 11:35 AMGuy Peri is McCormick’s Chief Information and Digital Officer. Though only seven months into his role, Peri is rapidly advancing a comprehensive transformation of the company’s digital capabilities. His career-long focus on data and analytics informs

What is the Chain of Emotion in Prompt Engineering? - Analytics VidhyaApr 19, 2025 am 11:33 AM

What is the Chain of Emotion in Prompt Engineering? - Analytics VidhyaApr 19, 2025 am 11:33 AMIntroduction Artificial intelligence (AI) is evolving to understand not just words, but also emotions, responding with a human touch. This sophisticated interaction is crucial in the rapidly advancing field of AI and natural language processing. Th

12 Best AI Tools for Data Science Workflow - Analytics VidhyaApr 19, 2025 am 11:31 AM

12 Best AI Tools for Data Science Workflow - Analytics VidhyaApr 19, 2025 am 11:31 AMIntroduction In today's data-centric world, leveraging advanced AI technologies is crucial for businesses seeking a competitive edge and enhanced efficiency. A range of powerful tools empowers data scientists, analysts, and developers to build, depl

AV Byte: OpenAI's GPT-4o Mini and Other AI InnovationsApr 19, 2025 am 11:30 AM

AV Byte: OpenAI's GPT-4o Mini and Other AI InnovationsApr 19, 2025 am 11:30 AMThis week's AI landscape exploded with groundbreaking releases from industry giants like OpenAI, Mistral AI, NVIDIA, DeepSeek, and Hugging Face. These new models promise increased power, affordability, and accessibility, fueled by advancements in tr

Perplexity's Android App Is Infested With Security Flaws, Report FindsApr 19, 2025 am 11:24 AM

Perplexity's Android App Is Infested With Security Flaws, Report FindsApr 19, 2025 am 11:24 AMBut the company’s Android app, which offers not only search capabilities but also acts as an AI assistant, is riddled with a host of security issues that could expose its users to data theft, account takeovers and impersonation attacks from malicious

Everyone's Getting Better At Using AI: Thoughts On Vibe CodingApr 19, 2025 am 11:17 AM

Everyone's Getting Better At Using AI: Thoughts On Vibe CodingApr 19, 2025 am 11:17 AMYou can look at what’s happening in conferences and at trade shows. You can ask engineers what they’re doing, or consult with a CEO. Everywhere you look, things are changing at breakneck speed. Engineers, and Non-Engineers What’s the difference be

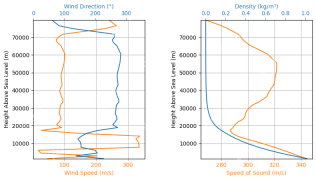

Rocket Launch Simulation and Analysis using RocketPy - Analytics VidhyaApr 19, 2025 am 11:12 AM

Rocket Launch Simulation and Analysis using RocketPy - Analytics VidhyaApr 19, 2025 am 11:12 AMSimulate Rocket Launches with RocketPy: A Comprehensive Guide This article guides you through simulating high-power rocket launches using RocketPy, a powerful Python library. We'll cover everything from defining rocket components to analyzing simula

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Dreamweaver Mac version

Visual web development tools

WebStorm Mac version

Useful JavaScript development tools

Zend Studio 13.0.1

Powerful PHP integrated development environment