Technology peripherals

Technology peripherals AI

AI Microsoft breaks into Google's backyard, Google counterattacks Microsoft's home nest, staged a battle of the strong

Microsoft breaks into Google's backyard, Google counterattacks Microsoft's home nest, staged a battle of the strongMicrosoft breaks into Google's backyard, Google counterattacks Microsoft's home nest, staged a battle of the strong

When the coronavirus pandemic hit, some Google employees saw a once-in-a-lifetime opportunity.

As the world pivots sharply toward remote work, Google is urging its teams to redouble efforts to improve chat, video and security in its collaboration software in a bid to catch up with rivals Microsoft and the wildly popular Zoom. Google has expanded its sales to more large enterprises and schools, and even renamed "G Suite" to "Workspace." As one former employee put it, "This is a major shift."

Google Workspace revealed to the media that the company now has 9 million paid enterprises, last fall This number is 8 million. As of October 2021, it has 3 billion users. Still, insiders say Google has a tough road ahead of catching up with Zoom, which has since cut back on spending, while Microsoft's Office 365 product had 345 million paid business seats as of last year.

Insiders said that the entire company is vigorously developing artificial intelligence, which may bring a unique opportunity to Workspace. The company has asked employees to integrate new generative AI features into its Workspace suite and announced this week that it will begin testing the features in Gmail and Google Docs.

Leaders also want to promote other popular apps beyond Gmail to make the product more competitive with rivals like Dropbox and Zoom, according to a person familiar with the matter.

The company is also trying to catch up with Microsoft's ChatGPT. Google has always been AI-first, building industry-leading tools like the open source machine learning project TensorFlow and integrating AI into search and features like autocomplete, smart replies, and automated meeting transcriptions in workspaces.

For Google Meet video conferencing software, the company plans to launch real-time subtitle translation and automatic meeting recording in multiple languages this year.

According to the "Information News" report, Microsoft is also following the same path and integrating the popular chatbot ChatGPT into its Office products.

Since taking the helm of the company, Pichai has made cloud computing one of his top priorities. Cloud computing revenue exceeded $7 billion in the fourth quarter of 2022, but it was still a net loss. Meanwhile, Microsoft and Amazon remain far ahead in cloud offerings.

Workspace’s subscription model is a significant opportunity to generate recurring revenue. Tony Safoian, CEO of Google Cloud partner SADA Systems, said on Twitter that Google Cloud CEO Thomas Kurian spent a lot of time talking about Workspace issues at partner meetings.

Five current employees and 11 former employees and contractors said in interviews that work at Workspace is difficult. Insiders say Microsoft often loses deals because of its deep-rooted internal political issues rather than product quality issues. Microsoft's new AI arsenal will further intensify this competition.

A Google spokesperson said in a statement, “Google Workspace has accelerated the pace of innovation, delivering more than 300 powerful new features in 2022 alone to help teams get their work done. Globally, More than 9 million paying businesses and more than 3 billion users rely on Google Workspace to communicate and collaborate. From the U.S. Army moving 250,000 personnel to our secure communications and collaboration platform, to Korea transforming internal business systems with Docs and Drive Aviation, Google Workspace has become the world’s most popular productivity tool.” There has been substantial growth. According to IT data and analysis company IDC, the video conferencing market revenue increased by 28.1% in 2021 to US$10.1 billion, and revenue this year will reach US$14 billion.

According to a 2022 study by Forrester, among information workers who use video conferencing for work, 37% most often choose Microsoft Teams, and 19% most often use Zoom. Meanwhile, only 6% of information workers use Google Meet most often.

The pandemic should have given Google an ideal opportunity to sell Workspace, but insiders say the company didn’t pivot fast enough and didn’t invest enough. The company said that Google is indeed growing rapidly, with peak daily usage of Google Meet increasing 30 times, and Google Meet users participating in more than 6 billion meetings between March 2020 and 2021.

Now, Workspace’s growth has stabilized at 22%, down from a peak of 41% in early 2020, according to estimates from Alphabet analyst Bernstein. A current employee familiar with Google's internal data confirmed that sales numbers have slowed over the past five years.

They noted, "It's not trending upward. If you're in a saturated market and you're the market leader, that's fine. But alas, Google is far from the market leader."

At the same time, Zoom is also moving quickly to provide free services to schools. Microsoft has actively matched contract prices and made its team collaboration software available to its large existing Windows and Office 365 customers, driving down the prices of Zoom, Slack and Workspace.

Some factors are beyond Google's control. Insiders say selling software to larger businesses has become more difficult during the remote-work boom because those businesses are less willing to take risks on new software suites.

Additionally, Office 365 is already so ingrained in large organizations that people have even built their careers on tools like Excel, making sales that much harder. It is reported that old Microsoft Office customers do not want to switch to Workspace because it requires additional training.

A former Google employee said, "If you threaten someone that they will lose Word, lose Excel, then even if they are not a power user, they will feel like you are 'beating their child.'"

As a result, the number of Microsoft Teams users surged during the epidemic. The company reportedly had 270 million monthly active users early last year, up from 250 million in 2021. According to one former employee, "Google missed the market. They could have invested more if they wanted to. But as a result they acted too conservatively. I can sympathize with Google. This was a huge opportunity. The market for Workspace was not It can be bigger."

Competing with Microsoft

Google often loses deals because of politics or mergers, sources said. For example, LinkedIn was a Workspace customer before it was acquired by Microsoft, while Meta uses Microsoft because Google is its direct competitor. Other major customers, such as Deutsche Bank, use Google Cloud for cloud infrastructure but use Microsoft Office for collaboration software. Google said its Workspace customers were previously acquired through acquisitions, such as Digital First Media.

Salespeople have also been told to use older versions of Microsoft Teams to target customers, but Google's sales strategy - which Kurian borrowed heavily from Oracle - hasn't proven effective.

Google sells the majority of Workspace seats through customers who visit the Workspace website directly or a partner website. According to internal data, 97% of the new Workspace customers Google won in 2021 were sold this way, which means sales representatives accounted for only 3% of new customers. Google says many of its deals with enterprise customers are done through salespeople, but insiders say enterprise customers make up a small percentage of Workspace's overall customer base.

With Microsoft focused on large enterprise customers, employees said Google should prioritize targeting new companies that haven't yet established themselves at Microsoft. Google does have a large customer base, including Etsy, Asana and Deliveroo. Google has also missed an opportunity to shift more of its attention to areas where it already has an advantage: to smaller, more technology-focused groups it often calls "digital natives," employees say. of businesses selling products.

A current employee said, "When the new crown epidemic hit, the company was in trouble and digital natives emerged. And we missed this opportunity."

Today, Google faces New threat with Microsoft-backed ChatGPT. One employee said that when employees asked Workspace leadership how to address this issue, they emphasized that Google is a leader in artificial intelligence and will continue to look for more opportunities to integrate artificial intelligence into its products.

Leadership reshuffle and new opportunities in artificial intelligence

Workspace has experienced some leadership changes recently. Last year, Workspace head Javier Soltero left the company, as did Greg Tomb, the product's vice president of sales. Under Soltero's leadership, G Suite was renamed Workspace, and Google's dispersed video teams like Duo and Meet were brought together.

Soltero also pioneered the creation of consistent branding across Workspace products like Calendar and Meet, although its rollout was "fairly unpopular" among Google employees because their logos looked too similar.

Now, the torch has been passed to Aparna Pappu, a senior engineer who has worked at Google for more than 15 years. Insiders say Google needs to change its strategy if it wants to win in the cloud, especially as Workspace growth continues to stagnate.

This strategy may be working now. As Google scrambles to catch up with rivals in artificial intelligence, Pappu is pushing the Workspace team to integrate new generative AI capabilities into Workspace. Soon, the company says, Workspace users will be able to generate documents or compose emails by entering basic prompts, such as asking Google Docs to create "Job Posting for Sales Representative," which will create a look-alike in seconds. Professional job description.

The company also plans to roll out generative AI capabilities in other apps, including generating new backgrounds in Google Meet and images, audio and video in Google Slides.

The new features put Google once again in serious competition with Microsoft, which has begun demoing its own generative tools for its suite of productivity apps.

But Google may have an advantage: The fact that Workspace is entirely web-based could make it easier for the company to deploy and update artificial intelligence tools in its applications, according to a person familiar with the company's strategy.

This person added that while Gmail is undoubtedly the most popular application in the Workspace suite, Pappu hopes to create more popular applications in the suite, including Drive and Meet.

A source familiar with the strategy said, "They want to lead Workspace not only from a Gmail perspective, but from other areas. For example, while Gmail may be the preferred email application, leadership believes that in the cloud In terms of storage applications, Dropbox still has higher brand awareness than Google Drive."

They added that leaders want to continue to increase the price of Workspace, which has recently increased.

Sources say Kurian wants more growth, although he has previously prioritized cloud infrastructure growth over Workspace's software. That may change given the renewed focus on artificial intelligence. At a town hall meeting in February, Kurian also said Google should sell both Workspace and GCP to customers, according to a person who attended the meeting.

Looking ahead, Google sees significant opportunities with public sector customers, and last year it launched a division to focus on the industry. In October this year, Google announced that it had reached an agreement with the US Army, and up to 250,000 people would receive Workspace accounts.

Just because a customer uses Microsoft Office doesn't mean they can't use Workspace. According to 2022 Forrester research, 44% of software purchasers among enterprises that plan to use or are currently using Microsoft collaboration software also use Google Workspace.

Google is currently facing a tough economic environment, but this could be an opportunity for Workspace. Although Google Cloud is still not profitable, losses have dropped to $480 million from $890 million last year. Analysts at Bernstein wrote that "much of the growth is likely due to the surprising strength of the Workspace SaaS business."

One former employee said, "GCP needs to work hard to catch up, which is more strategic for Google than Workspace Meaning. I don't blame TK - he was referring to Thomas Kurian - for not investing as much in Workspace as in the cloud platform. We are trying to catch up with AWS and Azure."

The above is the detailed content of Microsoft breaks into Google's backyard, Google counterattacks Microsoft's home nest, staged a battle of the strong. For more information, please follow other related articles on the PHP Chinese website!

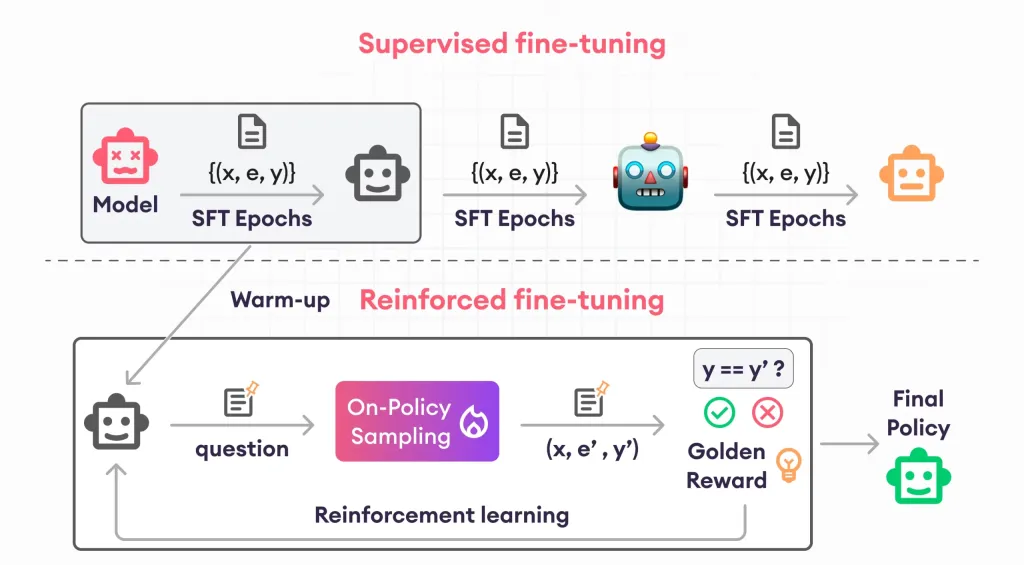

Guide to Reinforcement Finetuning - Analytics VidhyaApr 28, 2025 am 09:30 AM

Guide to Reinforcement Finetuning - Analytics VidhyaApr 28, 2025 am 09:30 AMReinforcement finetuning has shaken up AI development by teaching models to adjust based on human feedback. It blends supervised learning foundations with reward-based updates to make them safer, more accurate, and genuinely help

Let's Dance: Structured Movement To Fine-Tune Our Human Neural NetsApr 27, 2025 am 11:09 AM

Let's Dance: Structured Movement To Fine-Tune Our Human Neural NetsApr 27, 2025 am 11:09 AMScientists have extensively studied human and simpler neural networks (like those in C. elegans) to understand their functionality. However, a crucial question arises: how do we adapt our own neural networks to work effectively alongside novel AI s

New Google Leak Reveals Subscription Changes For Gemini AIApr 27, 2025 am 11:08 AM

New Google Leak Reveals Subscription Changes For Gemini AIApr 27, 2025 am 11:08 AMGoogle's Gemini Advanced: New Subscription Tiers on the Horizon Currently, accessing Gemini Advanced requires a $19.99/month Google One AI Premium plan. However, an Android Authority report hints at upcoming changes. Code within the latest Google P

How Data Analytics Acceleration Is Solving AI's Hidden BottleneckApr 27, 2025 am 11:07 AM

How Data Analytics Acceleration Is Solving AI's Hidden BottleneckApr 27, 2025 am 11:07 AMDespite the hype surrounding advanced AI capabilities, a significant challenge lurks within enterprise AI deployments: data processing bottlenecks. While CEOs celebrate AI advancements, engineers grapple with slow query times, overloaded pipelines, a

MarkItDown MCP Can Convert Any Document into Markdowns!Apr 27, 2025 am 09:47 AM

MarkItDown MCP Can Convert Any Document into Markdowns!Apr 27, 2025 am 09:47 AMHandling documents is no longer just about opening files in your AI projects, it’s about transforming chaos into clarity. Docs such as PDFs, PowerPoints, and Word flood our workflows in every shape and size. Retrieving structured

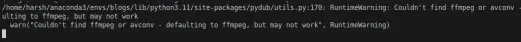

How to Use Google ADK for Building Agents? - Analytics VidhyaApr 27, 2025 am 09:42 AM

How to Use Google ADK for Building Agents? - Analytics VidhyaApr 27, 2025 am 09:42 AMHarness the power of Google's Agent Development Kit (ADK) to create intelligent agents with real-world capabilities! This tutorial guides you through building conversational agents using ADK, supporting various language models like Gemini and GPT. W

Use of SLM over LLM for Effective Problem Solving - Analytics VidhyaApr 27, 2025 am 09:27 AM

Use of SLM over LLM for Effective Problem Solving - Analytics VidhyaApr 27, 2025 am 09:27 AMsummary: Small Language Model (SLM) is designed for efficiency. They are better than the Large Language Model (LLM) in resource-deficient, real-time and privacy-sensitive environments. Best for focus-based tasks, especially where domain specificity, controllability, and interpretability are more important than general knowledge or creativity. SLMs are not a replacement for LLMs, but they are ideal when precision, speed and cost-effectiveness are critical. Technology helps us achieve more with fewer resources. It has always been a promoter, not a driver. From the steam engine era to the Internet bubble era, the power of technology lies in the extent to which it helps us solve problems. Artificial intelligence (AI) and more recently generative AI are no exception

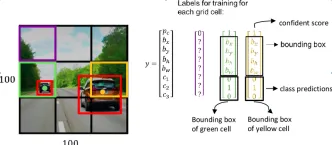

How to Use Google Gemini Models for Computer Vision Tasks? - Analytics VidhyaApr 27, 2025 am 09:26 AM

How to Use Google Gemini Models for Computer Vision Tasks? - Analytics VidhyaApr 27, 2025 am 09:26 AMHarness the Power of Google Gemini for Computer Vision: A Comprehensive Guide Google Gemini, a leading AI chatbot, extends its capabilities beyond conversation to encompass powerful computer vision functionalities. This guide details how to utilize

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

Atom editor mac version download

The most popular open source editor

SublimeText3 Mac version

God-level code editing software (SublimeText3)