Detailed explanation of price trends after Ethereum upgrade

The impact of Ethereum (ETH) upgrade on currency price has attracted much attention. This article will conduct in-depth analysis of its price trend after upgrading. In the short term, the upgrade is expected to raise the ETH price, and the successful implementation will further push up, but if the upgrade fails, it may lead to a price drop. In the long run, ETH prices are affected by multiple factors such as the actual effect of technological improvement, ecosystem development, market competition, macroeconomics and regulatory policies. The article will explore the price trends in various scenarios such as successful upgrades, general effects and unfavorable macroeconomic situations, and recommend investors to conduct in-depth research, rational analysis, control risks, and adopt long-term holding strategies to cope with the complex situation of ETH price fluctuations.

The upgrade of Ethereum (ETH) is an important milestone in the development of blockchain technology. It often has an impact on the market with performance improvement and functional enhancement. Understanding the price trend after Ethereum’s upgraded price is crucial for digital currency investors. This article will analyze the possible price trends after Ethereum upgrade from multiple perspectives and explore the influencing factors.

Short-term effects of upgrades:

Normally, Ethereum upgrade will have a more obvious impact on price in the short term:

Expected speculation: During the publicity period before the upgrade, the market often speculates around the expectations of upgrading, and investors will make arrangements in advance to drive ETH prices to rise. This rise is based on expectations for success in upgrading and good future benefits. Successfully implemented: If the upgrade is completed smoothly and the effect is in line with or even exceeds expectations, investor confidence will be further enhanced, pushing ETH prices to continue to rise. The rise at this time is based on actual technological improvements. Risk release: However, if problems occur during the upgrade process, or the effect after the upgrade is not as expected, market sentiment may change, causing the price of ETH to fall.

Key factors affecting long-term price trends:

It is not enough to focus solely on the short-term effects of upgrading. More importantly, it is to analyze the key factors that affect the long-term price trend of ETH:

The practical effect of technological improvements: Does the upgrade really solve the challenges faced by the Ethereum network, such as transaction speed, handling fees, scalability, etc. Only by actually solving these problems can we attract more users and developers and lay the foundation for the long-term growth of ETH. Ecosystem development: The value of Ethereum ultimately depends on the level of prosperity of its ecosystem. After the upgrade, whether more developers can be attracted to build applications on their platform and whether more users can use these applications are important factors that affect the long-term price of ETH. Market competition pattern: The blockchain field is fiercely competitive, and there are many other public chains and platforms. Whether Ethereum's upgrade can maintain its advantage in competition is also an important factor affecting its price trend. Macroeconomic environment: The digital currency market does not exist independently, it is affected by the macroeconomic environment. For example, the global economic situation, inflation, interest rate policies, etc. will have an impact on the price of ETH. Regulatory policy: Governments’ regulatory policies on digital currencies will also have an important impact on the price of ETH. Positive regulatory policies are conducive to market development, while strict regulatory policies may have negative impacts on the market.

Possible trend scenario analysis:

Based on the above factors, we can imagine several possible ETH price trend scenarios:

Scenario 1: Successful upgrade and prosperity of the ecosystem: The upgrade effectively improves the performance and functions of Ethereum, attracts more developers and users, and the ecosystem flourishes. In this case, ETH price is expected to continue to rise and hit new highs. Scenario 2: The upgrade effect is average and competition is intensifying: The upgrade effect is not as expected, or the competitors have launched more attractive solutions, resulting in a decline in Ethereum's market share. In this case, the price of ETH may face downward pressure. Scenario 3: The macroeconomic is unfavorable, and supervision is tightened: The global economic situation deteriorates, or the tightening of regulatory policies of governments on digital currencies, resulting in an impact on the entire digital currency market. In this case, the price of ETH is also difficult to survive and may experience a sharp decline.

Investment advice:

The price trend of Ethereum after its upgrade is a complex issue and is affected by a variety of factors. Investors should:

In-depth research: Understand the specific content and impact of Ethereum upgrades, as well as the key factors that affect its long-term price trend. Rational analysis: Rationally analyze various possible scenarios and formulate corresponding investment strategies. Risk control: There are risks in digital currency investment, and investors should do a good job in risk control and do not invest more funds than they can afford. Long-term holding: The development of Ethereum is a long-term process, and investors should view the investment value of ETH from a long-term perspective.

In short, the price trend of Ethereum after its upgrade is not static. Investors need to constantly adjust their investment strategies according to changes in market conditions. I hope this article can provide you with some reference to help you better understand the price trend after Ethereum upgrade.

The above is the detailed content of Detailed explanation of price trends after Ethereum upgrade. For more information, please follow other related articles on the PHP Chinese website!

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PM

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PMThis sharp drop happened as investor interest faded and a major scandal hit the highly speculative market.

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PM

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PMDespite being pretty much the iconic example of “random” – well, that and dice rolls – we can't help but feel like there's some element of skill involved. Especially when we lose.

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AM

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AMBitwise, a leading digital asset manager, has announced the listing of four of its crypto Exchange-Traded Products (ETPs) on the London Stock Exchange (LSE).

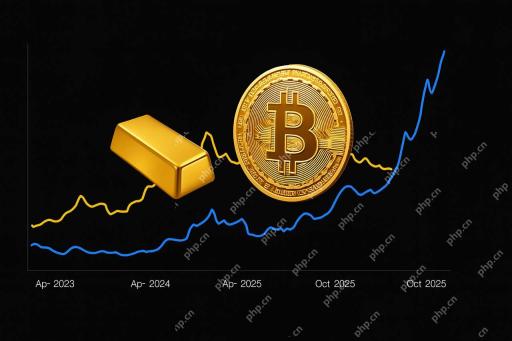

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AM

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AMBitcoin may be poised for a massive rally—but only if gold continues its upward climb, according to Joe Consorti, Head of Growth at Theya.

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AM

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AMThe Shiba Inu price continues to attract the attention of analysts, who are watching for its next potential move. By Samuele Piar. Updated April 14, 2025.

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AM

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AMThe joint motion of Ripple and U.S. Securities and Exchange Commission (SEC) to hold the appeal in abeyance has been granted by the Circuit Judge Jose A. Cabranes.

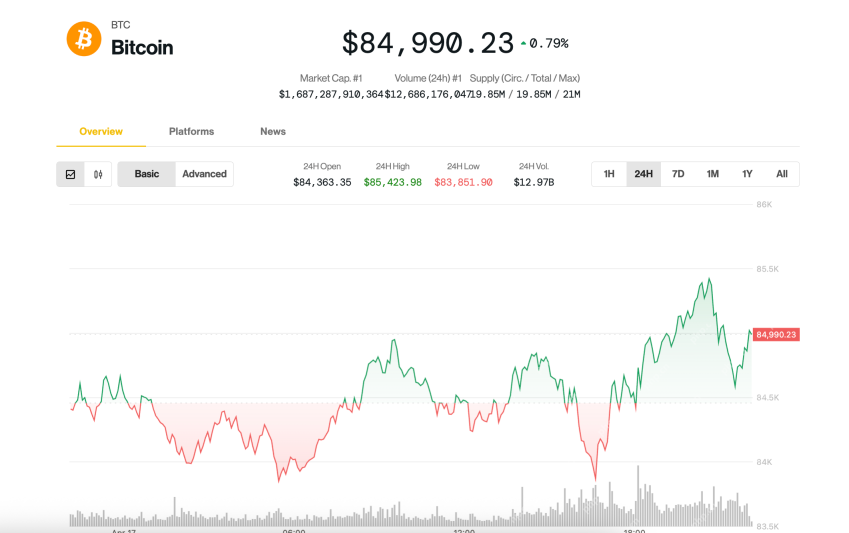

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AM

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AMBitcoin (BTC) was treading water just below $85,000 late Thursday as tensions between U.S. President Donald Trump and Federal Reserve Chair Jerome Powell added another layer of uncertainty for investors.

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AM

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AMToday, AB DAO officially announced the launch of a dual reward campaign in collaboration with Bitget (bitget.com), the world's second-largest digital asset trading platform.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

Dreamweaver Mac version

Visual web development tools

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.