The probability of US Bitcoin reserves on Polymarket is 43%! Two FCC directors turn their cryptocurrency position

- Mary-Kate OlsenOriginal

- 2025-03-05 18:09:01437browse

The change in attitudes of the two Federal Reserve directors may promote the US Bitcoin reserve plan?

According to FOX Business reporter Eleanor Terrett, two Fed directors have recently changed their stance on cryptocurrencies.

Last Friday, Republicans Michelle Bowman and Christopher Waller expressed a more open attitude towards digital assets and their future in the financial system. The shift is significant for the following reasons:

- Trump may appoint one of them to replace Michael Barr as the Fed’s vice chairman of oversight, responsible for oversight matters and the Fed’s interaction with banks and cryptocurrencies.

- This move marks a change in the attitudes of the two directors towards cryptocurrencies. Previously, they all voted for policies that restrict banks from participating in cryptocurrencies and opposed digital asset bank Custodia to become a member of the Federal Reserve system.

Federal governors' position change

Terrett's tweet pointed out that Bowman emphasized the importance of clear and reasonable regulation in his February 7 speech that should encourage rather than curb financial innovation. She acknowledged that the overly de-risk regulatory approaches in the past are ineffective for emerging technologies such as cryptocurrencies. Bowman also said “regulatory soft power” should not be used to hinder new technologies and warns that excessive focus on security and robustness could threaten long-term innovation in the banking system. She also stressed that banking regulatory policies should meet the needs of unbanked people rather than restricting legal customers and businesses from accessing banking services.

Waller pointed out in a recent speech that under a good regulatory framework, stablecoins will expand the influence of the US dollar, consolidate the US dollar's position as the world's reserve currency, and supplement the existing US payment system.

Possibility of U.S. Bitcoin National Reserves

Although Federal Reserve Chairman Jerome Powell said in December that the Fed had no intention of participating in any government action to establish Bitcoin reserves, the law does not allow the Fed to hold Bitcoin, the shift in the stance on cryptocurrency regulation, especially one of them may become the vice chairman in charge of regulation, has increased expectations that the Fed will turn open and may also affect its position on Bitcoin strategic reserves.

Recently, many signs have shown that Trump's plan to establish a strategic reserve of Bitcoin is advancing, including issuing executive orders for research and evaluation, and directing the Treasury and Commerce Department to establish a U.S. sovereign wealth fund within the next 12 months. In addition, several states actively promote legislation to establish state-level Bitcoin reserves, and Wyoming Republican Senator Cynthia Lummis, who suggested last year that the United States purchases 1 million BTCs within five years, served as chairman of the Senate Bank Digital Assets Group, have further enhanced the possibility of the United States establishing Bitcoin reserves.

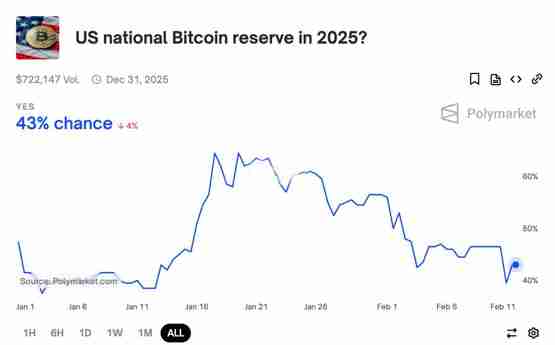

Polymarket forecast: The probability of the United States establishing Bitcoin reserves this year will reach 43%

Predictive market data shows that the probability of the United States establishing a strategic reserve of Bitcoin in 2025 is about 43% (it was previously down below 40%), with a maximum of 65%. If the forecast comes true, it will be the biggest catalyst for the cryptocurrency market this year.

The above is the detailed content of The probability of US Bitcoin reserves on Polymarket is 43%! Two FCC directors turn their cryptocurrency position. For more information, please follow other related articles on the PHP Chinese website!