5 Big Data Interpretation of the Current Market: Is it in the stage bottom range?

- Susan SarandonOriginal

- 2025-03-05 15:48:04281browse

In-depth analysis of the crypto market: has the bottom arrived? Five big data interprets the current market

Since December 2024, the crypto market has continued to fluctuate, investors have suffered heavy losses and market sentiment is sluggish. The macroeconomic environment is turbulent, geopolitical risks are intensifying, market liquidity is tightening, and negative emotions are spreading. This article will conduct in-depth analysis of the current market conditions from five key indicators and explore whether it has bottomed out.

1. The panic index continues to be sluggish: market sentiment is extremely pessimistic

CoinMarketCap Fear and Greed Index shows that from July to early October 2024, the market experienced panic selling (the index is below 40), and then rebounded briefly. At present, the Panic Index has fallen below 40 again and has continued to operate at a low level since February, indicating that market sentiment is extremely pessimistic and may be at a stage bottom.

2. Bitcoin capital interest rate plummeted: the willingness to go long has dropped significantly

The 7-day average capital interest rate of perpetual contracts is an important indicator to measure market sentiment. In March 2024, the BTC capital interest rate once exceeded 0.06%, reflecting the extremely FOMO sentiment of the market. At present, the interest rate of funds has fallen to 0.004%, down 85% from the December peak, indicating that the willingness to go long has dropped significantly and the market sentiment is pessimistic.

3. ETH profit ratio hits a 4-month low: Ethereum performed weakly

Ethereum price fell 36% from its high 7 weeks ago, its profit ratio hit a 4-month low, and the number of profitable tokens also fell to a 3-month lowest. As the second largest cryptocurrency, Ethereum's weak performance further confirms the overall negative sentiment of the market.

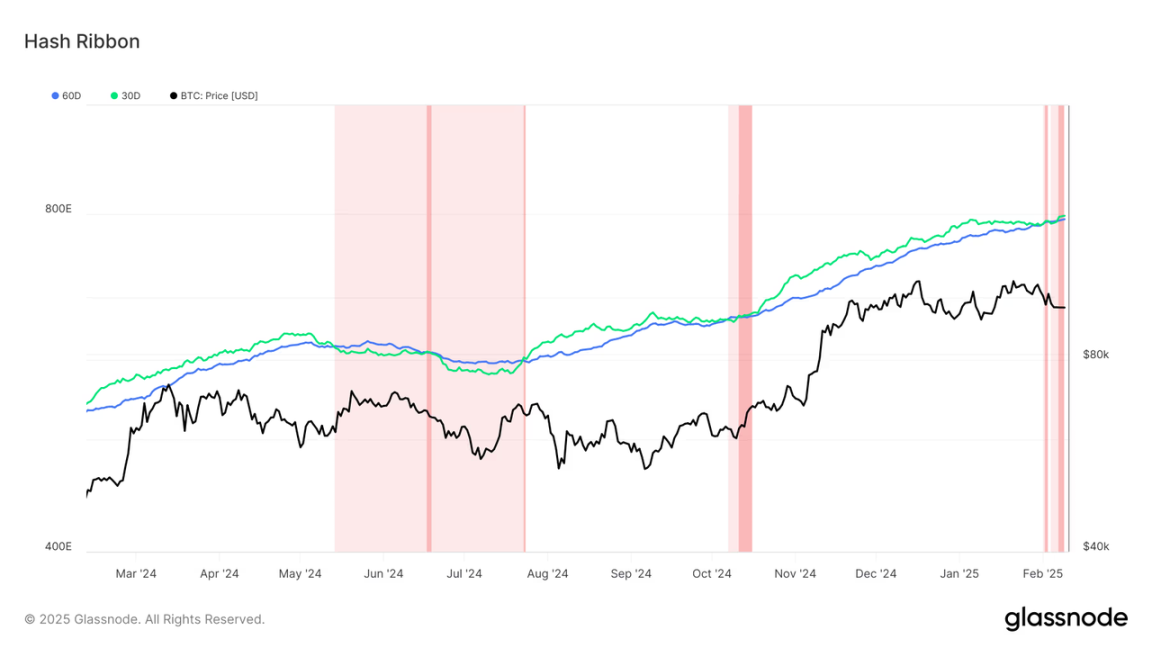

IV. Bitcoin miners "surrendered" again: mining difficulty hits a new high

Bitcoin miners "surrendered" is usually regarded as a signal at the bottom of the market. Since 2025, Bitcoin miners have "surrendered" again since February, but the difficulty of mining has hit a record high of 114.7T. This may imply that some miners are still optimistic about the long-term value of Bitcoin, which has a certain positive impact on market sentiment.

5. Stablecoin market value grows against the trend: stable capital inflows

Stablecoin market value is an important indicator to observe the flow of market capital. In the past month, USDT's market value has increased by 3.4% (US$4.676 billion), while USDC has increased by 22.73% (US$10.396 billion). This shows that despite the sluggish market sentiment, the trend of capital flowing into stablecoins remains.

Summary

Combining the above five indicators, the current crypto market is showing extremely pessimistic sentiment, but some data also suggest potential bottom signals. The sluggish panic index, plummeting capital interest rates and "surrender" from miners all point to the possibility that the market may be in a phased bottom range. However, the growth in the market value of stablecoins and the new highs in Bitcoin mining difficulty also bring a positive signal to the market. Investors need to observe market trends carefully and make rational decisions.

The above is the detailed content of 5 Big Data Interpretation of the Current Market: Is it in the stage bottom range?. For more information, please follow other related articles on the PHP Chinese website!