CZ admits that there are flaws in Binance token listing process and needs detailed explanation of reform

- Susan SarandonOriginal

- 2025-03-05 12:39:01259browse

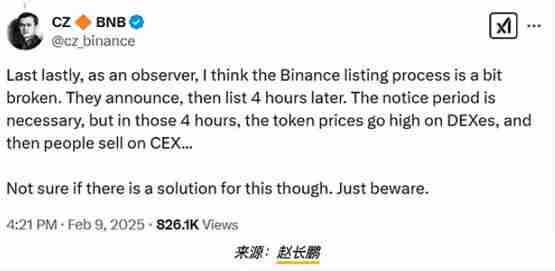

Cryptocurrencies are highly sought after after listing on centralized exchanges (CEXs), because the huge liquidity brought by CEX usually pushes up the coin price. However, Binance CEO Changpeng Zhao (CZ) pointed out that there are flaws in the current listing process, and the main problem is that the time between the announcement and the listing is too short.

CZ said there were problems with Binance's listing process because it only took 4 hours from the announcement to the market. Although the trailer period is necessary, the currency price on DEX will soar during this period, and then a selling wave will occur on CEX.

Senior traders usually use decentralized exchanges (DEXs) to discover new coins that are about to be listed in CEX in advance, and use this as a short-term buy signal, and sell after CEX goes public, causing huge selling pressure.

CZ Shortly before the comments above, Binance just launched the Test Coin (TST). Although TST was originally created as part of the BNB Chain tutorial, investors consider it as a meme coin.

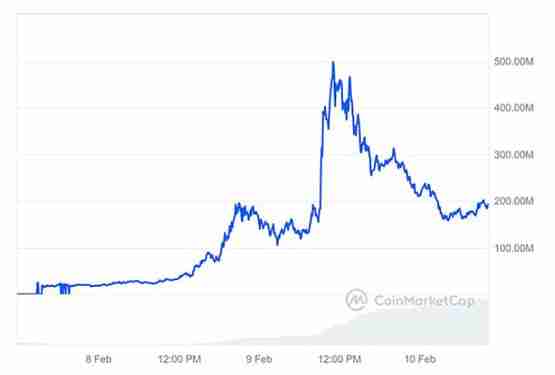

CoinMarketCap data shows that the TST currency price once peaked at US$489 million on February 9, and then plummeted by more than 50%, with its current market value of approximately US$192 million. The TST coin name only appears briefly for about one second in the BNB Chain tutorial video on the Four.Meme platform, purely for testing.

Although CZ clarified that the video "is not an endorsement of the token", some Chinese communities still vigorously promoted TST, pushing up its market value.

CEX listing process needs to be improved urgently, and should we imitate DEX's automation model be implemented?

The unexpected surge in TST's price prompted CZ to believe that the CEX listing process needs to be improved. He suggested that implementing an automatic listing mechanism like DEX may be one of the solutions, adding: "I think CEX should automatically (almost) list all tokens like DEX. But I no longer operate CEX." CZ emphasized that the above remarks are his view as an "outsider" and that he "has not participated in the listing process of Binance or other centralized exchanges."

Fair issuance may replace the CEX listing model

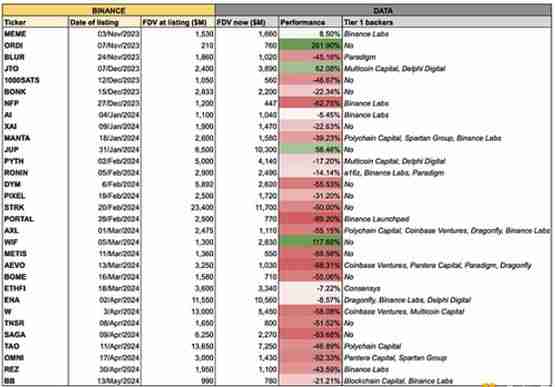

In recent years, people have been concerned about the CEX listing mechanism. According to Cointelegraph, as of May 2024, more than 80% of the tokens launched by Binance depreciated within six months of listing.

However, the decentralized issuance of Hyperliquid (HYPE) tokens may open a "new era" of fair issuance of cryptocurrencies on chain, with the project creating an airdrop record worth more than $7.5 billion, a milestone in cryptocurrency history.

Composability Labs co-founder and CEO Vitali Dervoed said: The launch of HYPE token marks the beginning of a new era between listing and on-chain trading of centralized exchanges, as HYPE was launched on its own Layer1 order book, not deployed on any centralized platform and is fairly priced by the crypto community.

The above is the detailed content of CZ admits that there are flaws in Binance token listing process and needs detailed explanation of reform. For more information, please follow other related articles on the PHP Chinese website!