Is the copycat season already here? Why is the copycat season not coming yet?

- Linda HamiltonOriginal

- 2025-03-05 11:42:02845browse

2025: Dawn of the altcoin season? Data-driven market insights

2025 will be a critical year. This article will share data-based analysis and market insights to explore the arrival of the "altcoin season" and its outlook on macroeconomic issues in the coming year.

Is the altcoin season really coming?

Since Solana's strong performance in 2024, the Meme coin boom, the recovery of DeFi and the rise of AI agents, some believe that the altcoin season has arrived. However, we disagree.

Our reasons:

- Solana's strong rebound is largely an underrated correction in 2023.

- The Meme coin craze is more like a replica of the 2020 DeFi summer, heralding the arrival of the bull market in 2021.

- The recovery of DeFi (Aave, Hyperliquid, Aerodrome, etc.) is real, but DeFi is still a niche market, and its narrative share has declined in 2024.

- The rise of AI agents is more like a flash in the pan of the altcoin season.

Although there is a bubble in the market, the data will not lie.

Data Analysis:

- In the last cycle, the total market value of cryptocurrencies increased by US$431 billion in the fourth quarter of 2020, and Bitcoin contributed a 71.5% increase, and its dominance reached 72% (cycle peak) on January 3, 2021.

- In this cycle, the total market value of cryptocurrencies increased by $1.16 trillion in the fourth quarter, and Bitcoin contributed a 59.5% increase, and currently dominant is 56.4%, slightly lower than the 60% cycle peak set on November 21, 2024.

Some people believe that Bitcoin contributes a small share of market capitalization growth in this cycle, which means that the altcoin season has arrived. But looking back at 2021 (the last year of the previous cycle):

- From January 1 to May 11, 2021, the market value of cryptocurrencies increased by $1.75 trillion, and Bitcoin contributed only 31% of the increase, with its dominance falling to 44%.

- From May 11 to June 30, 2021, the total market value fell by nearly 50%, and Bitcoin also fell by about 50%.

- The market then rebounded, reaching a peak of US$3 trillion on November 8, 2021, and Bitcoin contributed only 38% of the gains.

Key points:

- Data shows that although some people think this is a "bitcoin cycle", Bitcoin actually performs stronger as it enters 2021.

- In the last cycle, the "altcoin season" came strongly at the beginning of the new year. From January to May, ETH rose 5.3 times, Avalanche rose 12 times, SOL rose 28 times, and DOGE rose 162 times. Bitcoin dominance has dropped by nearly 30%.

- We believe that the "altcoin season" has just begun, and Bitcoin's dominance declined from its 60% peak on November 21, 2024 is evidence.

- We predict that the total market value of cryptocurrencies will grow to US$7.25 trillion (113%) next year. The proportion of Bitcoin market value and price forecasts in different scenarios are shown below.

- We expect $2.5 trillion to flow into non-BTC assets this year — twice as much as in 2021. Solana, Avalanche and Terra Luna had a total market value of US$677 million on January 1, 2021, reaching a peak of US$146 billion (21,466% increase).

- We believe that the "altcoin season" has four main drivers: BTC wealth effect, media attention, innovation, and macro/liquidity conditions/Fed policy.

2025 Macroeconomic Framework

This section analyzes the key economic factors that affect risky assets (such as cryptocurrencies) and explores the possibilities of various results in 2025.

Inflation (PCE):

We believe that the Fed/market’s position on inflation is too extreme. The main drivers of inflation during COVID-19 are supply chain issues and fiscal spending zero interest rate policy. To predict a rebound in inflation, we need a catalyst. But there are also forces of deflation in the economy, such as artificial intelligence innovation and population aging. Our basic forecast is that inflation will remain basically near the current level (2.4% PCE) and may even decline. This benefits risky assets.

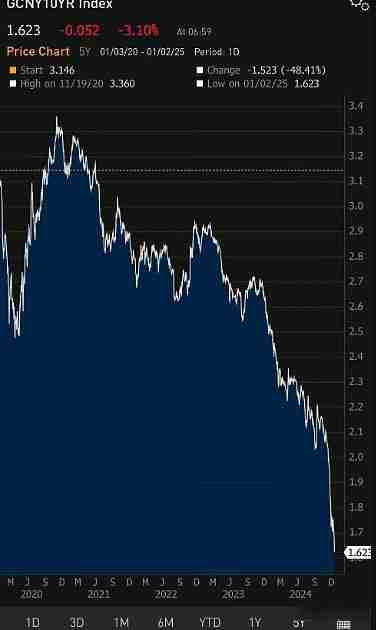

10-year rate of return:

The yield at the end of this year was 4.6%, higher than the level when the Fed began to cut interest rates. The bond market tightened monetary policy, which may be due to inflation concerns, fiscal spending concerns and growth expectations. We believe that the 10-year yield will reach 3.5-4%, or maybe even lower, which is also beneficial to risky assets.

Growth vs. S&P 500:

The economic growth rate in the first three quarters of 2024 was 3.1%, and the Atlanta Fed predicts 2.6% next year. The S&P 500 rose 25% last year and 24% in 23 years. The CAPE ratio is currently 37.04, which is higher than the historical average. We basically predict that the S&P 500 will grow 12.8% this year.

Short-term outlook:

The labor market is cooling down with an unemployment rate of 4.3%. The ISM index is 48.4, indicating a moderate contraction in manufacturing. The Fed has cut interest rates three times. We expect some fluctuations in the first quarter that will eventually lead to the Fed/Treasury injection of liquidity.

Conclusion:

We believe that the "altcoin season" has just begun, but macro and global liquidity conditions need to support the rotation of altcoin.

- We do not believe there is a risk of interest rate hikes;

- We do not believe there will be any recession risk in the future;

- We believe that the Fed/market’s position on inflation is too extreme;

- We believe that the labor market may show signs of further weakness in the first quarter;

- We believe yields will drop later this year;

- We still believe that there is upward risk this year;

- We expect some volatility as the debt ceiling debate unfolds in the coming weeks;

- The biggest risk is the black swan event.

The above is the detailed content of Is the copycat season already here? Why is the copycat season not coming yet?. For more information, please follow other related articles on the PHP Chinese website!