Token issuance has gone from venture capital-led to community-driven. Is community fundraising really a good thing or a trap?

- Barbara StreisandOriginal

- 2025-03-05 11:33:01123browse

Community-driven token issuance: Challenges to balance community with financial incentives

The community-led token issuance model is reviving, posing a challenge to the traditional institutional investor-led model. This article will analyze this trend, explore cases such as Hyperliquid and Echo, and evaluate community sentiment and market performance of different token allocation methods.

Community-led token issuance: Emerging Trends

Community-driven financing activities have rebounded significantly in recent months. There are multiple factors behind this:

1. The market's positive sentiment towards community financing

Under the traditional venture capital-led token issuance model, the token performance is often poor after issuance, and the low circulation, uneven distribution and strict unlocking plans have led to continuous decline in prices. Hyperliquid's success stories prove that mature products combine with good communities can reduce their reliance on venture capital and avoid price plunges after issuance. In order to stand out from the competition, the project also attaches more importance to community participation and promotes the return of "fair issuance". This also provides retail investors with more opportunities to participate.

Under the traditional venture capital-led token issuance model, the token performance is often poor after issuance, and the low circulation, uneven distribution and strict unlocking plans have led to continuous decline in prices. Hyperliquid's success stories prove that mature products combine with good communities can reduce their reliance on venture capital and avoid price plunges after issuance. In order to stand out from the competition, the project also attaches more importance to community participation and promotes the return of "fair issuance". This also provides retail investors with more opportunities to participate.

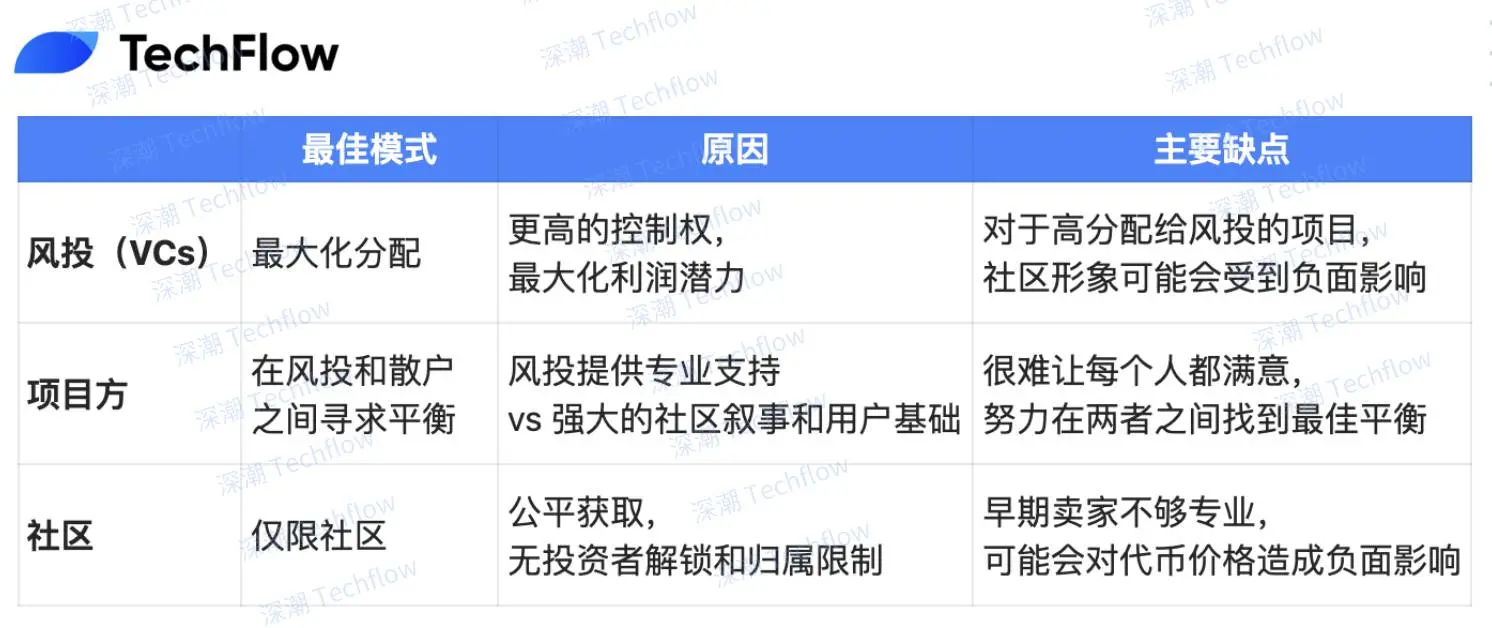

Users are increasingly skeptical about the projects where venture capital receives most of the token allocations, and the project team faces a dilemma: how to maintain fair distribution of tokens while ensuring funds? The community-driven model is fairer, but it also brings uncertainty about financial stability and strategic investor support. However, its advantages are: establish a loyal user base, promote product iteration, and focus on long-term value creation. Excessive reliance on institutional investors may lead to mismatch between short-term price fluctuations and long-term strategic goals and weaken retail investors' voice in governance.

Common Pain Points:

Privacy Issue:

- Early investors and advisers get more favorable token terms.

- Governance Insufficient Influence: Retail investors have limited influence in decision-making.

- Contradictory of strategy and market sentiment: The project team focuses on long-term development, but the token price is affected by short-term sentiment.

- Community preference: User concerns

The rise of social media discussions and platforms such as Echo show that users are dissatisfied with venture capital privileges and call for a more fair investment environment.

Equal investment opportunities

Clear token economic model- Inclusive participation mechanism

- Diversified participation pathways

- Structural considerations:

- Clear token unlocking mechanism

- Balanced governance structure

- Clear reward distribution mechanism

- Community-centric development

Trends of change: Impact on the market

More and more projects adopt community-centric strategies, bringing the following trends:

- Innovative token issuance mechanism: True community power, diversified participation rewards, long-term token economic model, and reduce dependence on venture capital.

- The main challenges facing the project: The balance of funds and control will promote long-term community growth, transparency, and build a sustainable income model.

Case Study: Hyperliquid's VC-free model

Hyperliquid's success story provides a reference for rejecting traditional venture capital financing, but the particularity of its user group (professional traders) makes it difficult to replicate universally. Its success does not rely entirely on community-driven, but rather on creating high-quality products.

Key differences between different methods

More investment opportunities more democratic

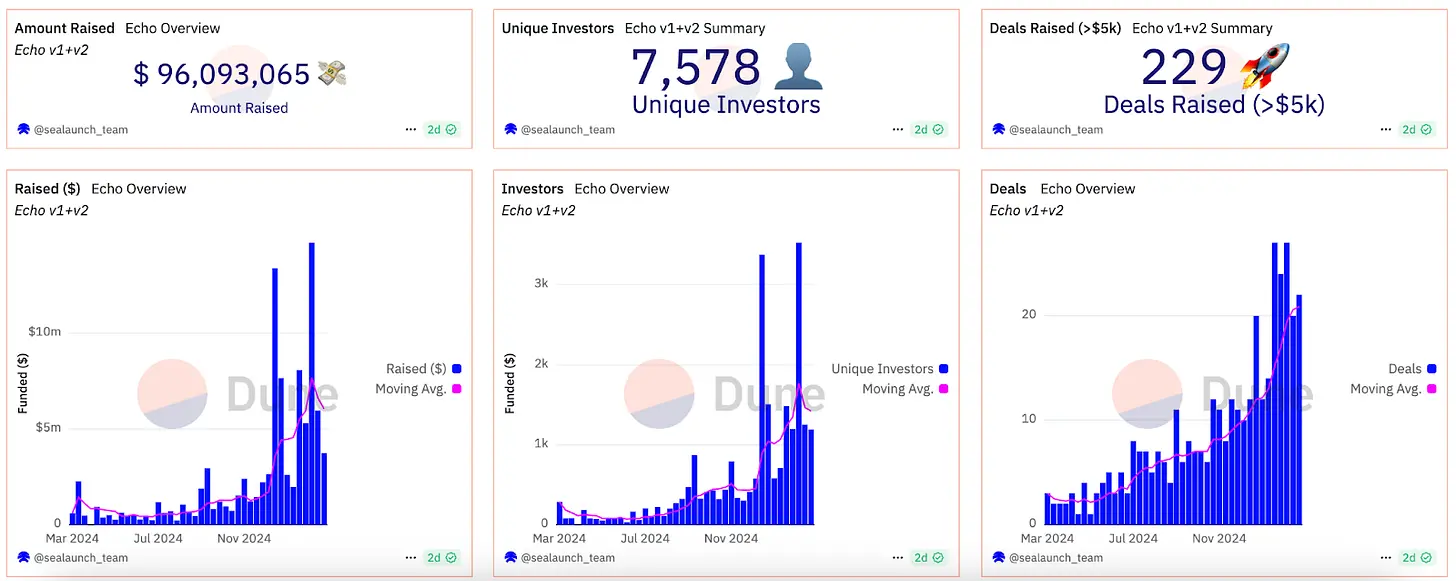

Platforms such as Echo and Legion simplify the investment process and allow more ordinary investors to participate.

Suggestions for future projects:

- Distribution strategy: Fair and transparent community sales, ensure that the interests of token holders are related to the successful project, develop innovative financing methods, and widely allocate governance rights.

- Community Participation: Establish open and transparent communication channels, reach community consensus, maintain long-term community activity, provide practical uses of tokens, and give community influence.

Winners and losers in different token models

The reality of hybrid models: The model of VC and community integration has its own gains, but management is more complicated.

Conclusions and Thoughts

The rise of community fundraising marks a major change. The key to success is to design a distribution mechanism that prioritizes community ownership and ensures long-term sustainability of projects. Although there is no "universal formula", new emerging elements must be carefully considered. Community participation is not a guarantee of project success. Retail investors pay more attention to short-term returns and lack mature exit strategies. The coming months will be a critical period to see if the community is truly gaining fair investment opportunities.

The above is the detailed content of Token issuance has gone from venture capital-led to community-driven. Is community fundraising really a good thing or a trap?. For more information, please follow other related articles on the PHP Chinese website!