The dilemma of VC: liquidity change and trust mechanism reshaping

- DDDOriginal

- 2025-03-04 21:39:01259browse

Consensus HK News: VC Winter and the Rise of Meme Financing

At the recent Consensus HK conference, the deepest feeling was the difficult situation of the VC industry, which is in sharp contrast to the booming Meme currency market. Many VCs face difficulties in fundraising, team loss, transformational strategic investors and even consider Meme financing. Many peers choose to leave, join the project party or transform into KOLs, and seek higher cost-effective career development. This prompted me to think about the challenges facing the VC industry and the way to break the deadlock.

VC Golden Age has passed

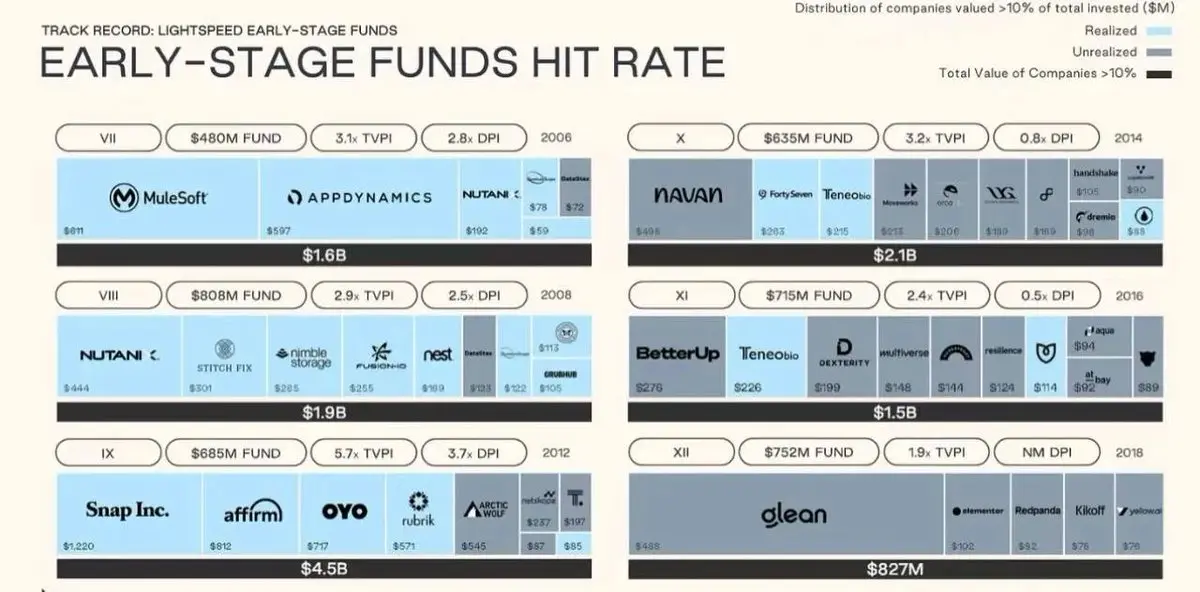

It must be admitted that, regardless of China and the United States, VC, as an investment asset class, has passed its golden age. Lightspeed's early-stage fund returns data support this: its best-performing fund (2012) invested in Snap, Affirm, OYO, and DPI reached 3.7X, but since 2014, it has become difficult to even make a return. (DPI: Allocated multiple returns)

Chinese VCs have also experienced a similar cycle. The rapid development of mobile Internet and consumer Internet has created giants such as Alibaba, Meituan, ByteDance, and 2015 is its peak moment. Since then, factors such as tightening of regulation, declining liquidity, fading of industry dividends, and blocking of IPO exit have led to a significant decline in the VC return rate and a large number of employees have been lost. Crypto VCs were not spared either.

Scarce liquidity and breakage of value chain

In the past, the value chain of VC investment was clear: the project party provided innovation, VC provided support and resources, KOL amplified market influence, and CEX completed value discovery. All parties bear different risks and obtain corresponding returns.

However, nowadays, liquidity is extremely scarce and market game is intensifying, making this value chain difficult to maintain. The value provided by VC is far more than early investment, but also includes resource docking, strategic advice, team building, etc. However, due to insufficient liquidity, the advantages of the VC model are difficult to reflect.

Capital flow changes: the root cause of VC dilemma

The main driving force of this bull market is the influx of US Bitcoin spot ETFs and institutional investors. But the path of fund transmission has changed:

- Institutional funds mainly flow to BTC, BTC ETFs and index funds, rather than altcoin markets;

- Lack of technology/product innovation, altcoins are difficult to maintain high valuations.

This has led to strong doubts about the VC mode. Retail investors believe that VCs have information advantages, and this information asymmetry leads to the collapse of market trust and further depletion of liquidity. In a highly competitive environment, retail investors require "absolute fairness", while the "relative fairness" of the VC model is difficult to accept. The rise of Meme financing is a response to this demand of "absolute fairness".

Meme financing model: fairness and risk coexist

The core of Meme financing is:

- Fair Participation Mechanism: Retail investors can track information on the chain data and obtain early bargaining chips under a relatively fair mechanism;

- Lower entry threshold: Lower entry threshold: Lowered the entry threshold for developers, "there are assets first, then products."

But this is not without problems:

- Extremely low signal-to-noise ratio: Low-cost distribution leads to the emergence of a large number of garbage projects;

- Insufficient information transparency: High liquidity Meme projects focus more on short-term games rather than long-term construction;

- Soar in trust costs: High liquidity means high game and lacks a long-term interest binding mechanism.

VC's role transformation in new mode

Meme financing model is not perfect, but it reflects the impact of the wave of populist capitalism on the financial ecology. VC will not disappear, but it must adapt to changes. Under the impact of Meme financing, VCs need to find a balance point with Meme financing model, which not only needs to utilize their own information and resource advantages, but also needs to adapt to the market's higher requirements for fairness and transparency.

The key is that no matter how the market changes, the ones that really determine long-term value are still outstanding founders with vision, strong execution, and continuous construction. VCs need to re-examine their role and find their position in the new market environment.

The above is the detailed content of The dilemma of VC: liquidity change and trust mechanism reshaping. For more information, please follow other related articles on the PHP Chinese website!