'Selling kidneys must keep Bitcoin', Strategy's long bet is subject to liquidation concerns

- Linda HamiltonOriginal

- 2025-03-04 12:51:01448browse

MicroStrategy: stick to Bitcoin and target 10 billion profits

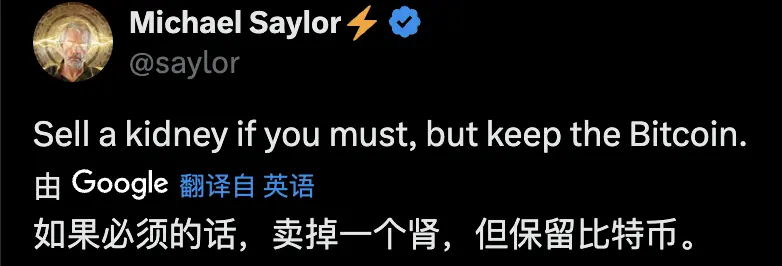

MicroStrategy founder Michael Saylor recently said that he would rather sell his kidney than keep Bitcoin, which fully demonstrated his firm belief in the long-term value of digital currency. The crypto market has been sluggish recently. MicroStrategy, as a heavy holding of Bitcoin, has attracted market attention.

High-risk bets: What is the risk of liquidation?

MicroStrategy currently holds a large amount of Bitcoin and faces the dual pressure of profit retracement and stock price decline. Data shows that its Bitcoin holdings have dropped significantly. The stock price also fell sharply from its high this year, and the market is worried that it may be forced to liquidate Bitcoin assets. Crypto analysts pointed out that the decline in MicroStrategy's market value and its Bitcoin assets' premium rate suggest that it will be more difficult for it to increase its holdings in Bitcoin in the future.

However, the analysts believe that the possibility of forced liquidation is extremely low. Its convertible bond structure, strong financing capabilities and the high proportion of voting rights held by Saylor together form an effective risk buffer. Even if Bitcoin’s price drops sharply, its assets will still far exceed their liabilities. MicroStrategy's debt maturity date is far away, providing it with plenty of time to deal with it. In addition, its Bitcoin assets are not directly used for mortgage loans, reducing the risk of forced liquidation.

MicroStrategy has a large number of large institutional investors, which enhances its market reputation and capital support and further reduces liquidation risks.

Add to increase positions against the trend and long-term layout

Despite the market sluggishness, Saylor is firmly bullish on Bitcoin and even continues to increase its holdings when the price falls. He believes Bitcoin will become a global reserve asset and predicts its market value will grow significantly in the coming years. Saylor also said that he would donate personal shares to charities that support Bitcoin after his death, once again demonstrating his long-term commitment to digital currency.

MicroStrategy has recently rebranded, further emphasizing its Bitcoin-centric business strategy. The company actively participates in industry development, promotes the construction of the Bitcoin ecosystem, and participates in the formulation of a digital asset supervision framework.

MicroStrategy plans to adopt new accounting standards in the first quarter of 2025, which may enable it to meet the requirements for inclusion in the S&P 500 and further enhance its market influence. The company has set a 2025 Bitcoin earnings target of $10 billion.

The above is the detailed content of 'Selling kidneys must keep Bitcoin', Strategy's long bet is subject to liquidation concerns. For more information, please follow other related articles on the PHP Chinese website!