In one article, learn about former Tether CEO Oreeve Collins launches the income stablecoin protocol Pi Protocol and stablecoin USP

- Linda HamiltonOriginal

- 2025-03-04 11:03:01688browse

Former Tether CEO Reeve Collins announces the launch of Pi Protocol and its stablecoin USP, a new income stablecoin protocol, aiming to attract investors by providing returns and enter the highly competitive stablecoin market, Bloomberg reported.

Pi Protocol: "Evolution" of Stablecoins

Collins' latest project Pi Protocol is expected to be launched on Ethereum and Solana blockchain within this year. This protocol uses smart contracts, allowing users to mint USP stablecoins using earnings tokens USI or other collateral. USP will be backed by physical assets such as bonds and structured notes, but its specific anchor currency is not yet clear.

Collins calls Pi Protocol the "evolved version" of stablecoins, emphasizing its fairer benefits distribution mechanism, intending to challenge Tether's market leadership. "Tether proves the market demand for stablecoins, but they monopolize all gains. We believe that the market is ready for change in ten years." He said that earnings reward users will inspire ecological participation and system operations, while more transparent and compliant asset reserve management will enhance market confidence.

Competition in the stablecoin market has intensified, and supervision has become the key

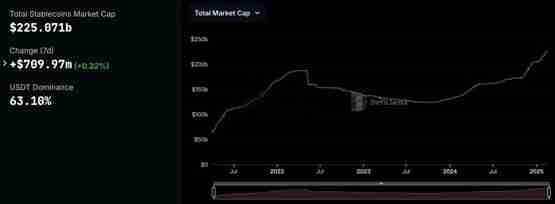

At present, Tether's USDT, Circle's USDC, Ethena's USDe and MakerDAO's DAI dominate the stablecoin market with a total market value of more than US$225 billion. The addition of Pi Protocol will further intensify the competition.

It is worth noting that USDC grew rapidly last year, with market share rising to 25% from 20.2% in November, while USDT fell from 70% to 63.1%. USDC is committed to transparent regulation and is expected to benefit from the EU Crypto Asset Market Regulation MiCA.

Tether

under regulatory pressureThe increasingly tightening of stablecoin regulation, especially the new framework proposed by the United States, will have a huge impact on Tether. Tether has long been criticized for lack of public audits and transparent reserves, which puts it under enormous regulatory pressure. At the end of last year, Tether had already left the EU market because he could not meet MiCA requirements. In the future, tightening of U.S. regulation may lead to greater challenges for Tether, creating opportunities for other stablecoin issuers. The U.S. proposal requires stablecoin issuers to maintain transparent asset reserves and only hold low-risk assets such as U.S. Treasury bonds.

Whether Pi Protocol and Circle can challenge Tether's hegemony depends on their technology implementation and regulatory compliance capabilities. Regulatory dynamics will be the biggest variable in this competition, and the power change in the stablecoin market has just begun.

The above is the detailed content of In one article, learn about former Tether CEO Oreeve Collins launches the income stablecoin protocol Pi Protocol and stablecoin USP. For more information, please follow other related articles on the PHP Chinese website!