Among the 45 million immigrants living in the United States, many people face an unexpected problem: sending money to their motherland. Whether it’s repaying loans and bills, or helping your family, you’ll soon find out that the banking system is not on your side.

There is a lack of unified network connections among global banks. While some banks have established partnerships to simplify the process, overall, remitting hard-earned dollars to low- and middle-income countries can be particularly tricky, not to mention expensive.

In complex international remittance networks, the exchange rates used by banks are often very unfavorable to the remitter. This will automatically reduce the value of your funds, and the transfer fee in the receiving country may be as high as 10% to 20% of the amount of the remittance.

Thankfully, technology has found a solution—this time in the form of fast and inexpensive international remittance applications.

Remitly

Remitly was founded in 2011 and supports remittances to more than 100 destinations from the United States and 16 other countries (mainly from developed countries). Matt Oppenheimer, co-founder of the app, experienced many inconveniences of international remittances while working for Barclays in Kenya, so the app focuses on covering small African countries such as Côte d'Ivoire and Liberia.

Remitly provides bank accounts and mobile wallet remittance services, which are usually cheaper than bank remittances. It also provides cash withdrawal and cash delivery services, depending on the availability of the country of collection. The platform covers most major banks and supports mobile wallets extensively.

Remitly was founded in 2011 and supports remittances to more than 100 destinations from the United States and 16 other countries (mainly from developed countries). Matt Oppenheimer, co-founder of the app, experienced many inconveniences of international remittances while working for Barclays in Kenya, so the app focuses on covering small African countries such as Côte d'Ivoire and Liberia.

[Related: Change of banks may help slow the climate crisis]

In mid-July 2021, we tried five different currencies for three consecutive days, and Remitly's US dollar foreign exchange rate averaged 2% lower than the real-time exchange rate on the CNBC information board. This means the app offers a slightly lower dollar value than the forex market. For example, if 1 USD is worth 743 Chilean pesos in these markets, Remitly will only offer 729.30 pesos.

Remitly is available for free on iOS and Android and on the Internet.

Wise was originally launched in 2010, called TransferWise, and currently has approximately 10 million users worldwide. The platform allows you to send international money from the United States, the United Kingdom and Europe to over 80 countries, many of which are located in Eastern Europe.

Wise also generates local account numbers so you can send and receive payments in 10 different currencies just like you do local transactions.

Wise covers a wide range of coverage and allows you to send money to almost any bank, but it does not provide cash withdrawals or payments to utility bills or mobile wallets. But the platform has shortcomings in terms of services and has performed well in terms of foreign exchange rates. We compared five different currencies, and Wise offers the highest dollar value each time. For example, if 1 USD on the CNBC information board is worth 5.26 BRL, Wise will give the same price.

Wise's handling fee is usually less than 5%, and the larger the transfer amount, the lower the handling fee. For example, if you send $100 to Peru, the handling fee is $4.37 (4.4%), while sending $1,000 to the Philippines costs $6.60 (0.7%).

Lastly, like Remitly, the speed at which your funds circulate globally depends on the country of receipt, ranging from minutes to three working days.

Wise Free to use on iOS, Android and the Internet.

WorldRemit

WorldRemit allows you to send money from the United States and 49 other countries to over 130 destinations. Similar to Remitly, the app has considerable influence in Africa and allows you to send money from six countries on the continent.

This platform provides banking and mobile wallet remittance, mobile phone recharge services and utility bill payment services. Cash withdrawals are also available, but WorldRemit covers fewer major banks than other applications on the list.

WorldRemit allows you to send money from the United States and 49 other countries to over 130 destinations. Similar to Remitly, the app has considerable influence in Africa and allows you to send money from six countries on the continent.

After using five different currencies for three consecutive days, WorldRemit's exchange rate averaged 1.6% lower than the real-time exchange rate shown on the CNBC dashboard. So if 1 dollar is worth 20 Mexican pesos, the app will quote 19.70 pesos, making it the second best choice for exchange rates among the four apps.

Similar to Wise, WorldRemit's transaction fee is less than 5%, and for amounts of $1,000 or more, the fee will drop to less than 1%, depending on the currency. In terms of speed, the platform can send your funds around the world in minutes to hours. You will mostly see the same-day transaction, but as in most cases on this list, it will depend on the country of receipt.

WorldRemit Free to use on iOS, Android and the Internet.

Xoom, a product under PayPal

Xoom entered the market in 2001 and was acquired by PayPal in 2015. At that time, it had more than 1 million global users. Now, the app has become part of a larger infrastructure serving over 250 million users, so this might be a good choice if you use PayPal. Xoom can be used to make international remittances from 32 markets in the United States, the United Kingdom and Europe to 160 countries including small island countries such as Seychelles and the Dominican Republic.

Xoom provides bank transfers, cash withdrawals, utility bill payments, mobile recharges and mobile wallet transfer services. Bank coverage is limited, depending on the country you send, so be sure to check the list to see if the recipient's financial institution is in it.

Xoom entered the market in 2001 and was acquired by PayPal in 2015. At that time, it had more than 1 million global users. Now, the app has become part of a larger infrastructure serving over 250 million users, so this might be a good choice if you use PayPal. Xoom can be used to make international remittances from 32 markets in the United States, the United Kingdom and Europe to 160 countries including small island countries such as Seychelles and the Dominican Republic.

[Related: Seven Best Money Transfer Apps]

Xoom makes money by currency exchange, so its exchange rate is the most expensive on this list. Using five different currencies, Xoom's exchange rate shows the lowest value per dollar in four apps. So if 1 dollar on the CNBC information board is worth 50.24 Philippine pesos, Xoom will exchange rate at 48.16 pesos, which means a loss of 4%.

But even if the exchange rate is not Xoom's strength, its real benefit is the handling fee. In four different currencies, the handling fee for a $100 transfer ranges from $1 to $5, which is usually fixed, regardless of the amount you send. In fact, transfers over $100 in currencies such as Mexican peso or Philippine peso may be free.

Xoom Free to use on iOS and Android and on the Internet.

The above is the detailed content of 4 apps to safely transfer money internationally. For more information, please follow other related articles on the PHP Chinese website!

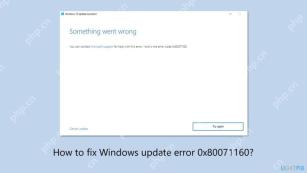

How to fix Windows update error 0x80071160?May 05, 2025 pm 10:00 PM

How to fix Windows update error 0x80071160?May 05, 2025 pm 10:00 PMWhile many users dont realize that, Windows updates are among the most important features for maintaining the systems stability and security, as well as ensurin

Must-Know Things: What to Check When Buying a Used LaptopMay 05, 2025 pm 08:01 PM

Must-Know Things: What to Check When Buying a Used LaptopMay 05, 2025 pm 08:01 PMThis MiniTool guide provides essential checks before buying a used laptop. It details how to assess the physical condition, test key hardware, and evaluate the software to ensure a sound purchase. Quick Navigation: What to Check When Buying a Used

What to Do Before Replacing a Hard Drive? Learn Essentials!May 04, 2025 pm 08:02 PM

What to Do Before Replacing a Hard Drive? Learn Essentials!May 04, 2025 pm 08:02 PMUpgrade the hard drive and improve the computer performance! This article will guide you the steps you need to take before replacing a hard drive on your Windows computer with a larger disk or SSD to avoid unnecessary hassle. Preparation: Choose the right hard drive: When choosing a hard disk, you should not only consider the difference between SSD and HDD, but also consider factors such as storage capacity, form factor size and budget. SSD capacity ranges from 256GB to 4TB or even larger, choose the capacity that suits your needs. Also, check which SSD slot is used for your laptop or desktop and make sure that the SSD you choose (such as 2.5-inch and 3.5-inch SATA SSD, M.2 2280/2230/2242 SSD, etc.) is compatible with your computer. Finally, according to

Sultan's Game Save File Location: A Detailed Roadmap GuideMay 04, 2025 pm 08:01 PM

Sultan's Game Save File Location: A Detailed Roadmap GuideMay 04, 2025 pm 08:01 PMMastering Sultan's Game: Save File Location and Backup Strategies This guide helps you locate and protect your Sultan's Game save files. Released on March 31st, 2025, Sultan's Game's engaging narratives and appealing visuals have made it a popular c

A Step-by-Step Guide to Copy ESXi VM to a USB DriveMay 03, 2025 pm 08:01 PM

A Step-by-Step Guide to Copy ESXi VM to a USB DriveMay 03, 2025 pm 08:01 PMOffsite VM backups are crucial. This guide demonstrates how to easily copy ESXi virtual machines to a USB drive for secure, accessible storage. Method 1: Manual VM File Download This method copies the core VM files. Power off the target VM in the V

Windows 10 KB5055612: New Features & What if It Failed to InstallMay 02, 2025 pm 08:01 PM

Windows 10 KB5055612: New Features & What if It Failed to InstallMay 02, 2025 pm 08:01 PMThis non-security update, KB5055612 for Windows 10 version 22H2 and related versions, released April 22, 2025, offers several quality improvements. This guide details installation and troubleshooting steps. KB5055612: Key Improvements This update enh

Unlock Helpful Methods to Fix KB5055642 Not InstallingMay 02, 2025 pm 06:01 PM

Unlock Helpful Methods to Fix KB5055642 Not InstallingMay 02, 2025 pm 06:01 PMTroubleshooting KB5055642 Installation Problems on Windows 11 This guide offers solutions for users encountering issues installing Windows 11 Insider Preview Build 26200.5562 (KB5055642), released April 21, 2025. This update introduces enhanced featu

How to fix Windows update error 0xca00a000?May 02, 2025 pm 06:00 PM

How to fix Windows update error 0xca00a000?May 02, 2025 pm 06:00 PMUpdates are vital to ensure that a Windows system runs well and is protected from potential outside threats, such as software vulnerabilities. Unfortunately, Wi

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Atom editor mac version download

The most popular open source editor

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

SublimeText3 Linux new version

SublimeText3 Linux latest version

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

Notepad++7.3.1

Easy-to-use and free code editor