Can Excel do derivatives and how?

Yes, Excel can perform derivative calculations using the RATE function, which calculates the periodic interest rate given the present value, future value, and number of periods. To calculate the derivative, you can use the following formula:

<code>=RATE(nper, -pv, fv)</code>

where:

- nper is the number of periods

- pv is the present value

- fv is the future value

What are the types of derivatives that Excel can do?

Excel can calculate the following types of derivatives:

- Interest rate derivatives: These derivatives are used to hedge against interest rate risk. Examples include futures, options, and swaps.

- Currency derivatives: These derivatives are used to hedge against currency risk. Examples include forwards, options, and swaps.

- Commodity derivatives: These derivatives are used to hedge against commodity price risk. Examples include futures, options, and swaps.

- Equity derivatives: These derivatives are used to hedge against equity price risk. Examples include futures, options, and swaps.

Can Excel do derivatives calculations?

Yes, Excel can perform derivatives calculations using the DERIVATIVE function. This function calculates the derivative of a function at a specified point. The syntax of the DERIVATIVE function is as follows:

<code>=DERIVATIVE(fx, x0, n)</code>

where:

- fx is the function for which you want to calculate the derivative

- x0 is the point at which you want to calculate the derivative

- n is the order of the derivative

The above is the detailed content of can excel do derivatives. For more information, please follow other related articles on the PHP Chinese website!

MEDIAN formula in Excel - practical examplesApr 11, 2025 pm 12:08 PM

MEDIAN formula in Excel - practical examplesApr 11, 2025 pm 12:08 PMThis tutorial explains how to calculate the median of numerical data in Excel using the MEDIAN function. The median, a key measure of central tendency, identifies the middle value in a dataset, offering a more robust representation of central tenden

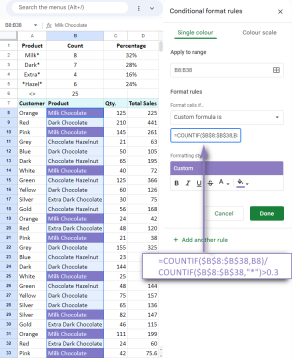

Google Spreadsheet COUNTIF function with formula examplesApr 11, 2025 pm 12:03 PM

Google Spreadsheet COUNTIF function with formula examplesApr 11, 2025 pm 12:03 PMMaster Google Sheets COUNTIF: A Comprehensive Guide This guide explores the versatile COUNTIF function in Google Sheets, demonstrating its applications beyond simple cell counting. We'll cover various scenarios, from exact and partial matches to han

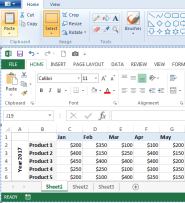

Excel shared workbook: How to share Excel file for multiple usersApr 11, 2025 am 11:58 AM

Excel shared workbook: How to share Excel file for multiple usersApr 11, 2025 am 11:58 AMThis tutorial provides a comprehensive guide to sharing Excel workbooks, covering various methods, access control, and conflict resolution. Modern Excel versions (2010, 2013, 2016, and later) simplify collaborative editing, eliminating the need to m

How to convert Excel to JPG - save .xls or .xlsx as image fileApr 11, 2025 am 11:31 AM

How to convert Excel to JPG - save .xls or .xlsx as image fileApr 11, 2025 am 11:31 AMThis tutorial explores various methods for converting .xls files to .jpg images, encompassing both built-in Windows tools and free online converters. Need to create a presentation, share spreadsheet data securely, or design a document? Converting yo

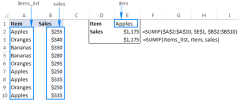

Excel names and named ranges: how to define and use in formulasApr 11, 2025 am 11:13 AM

Excel names and named ranges: how to define and use in formulasApr 11, 2025 am 11:13 AMThis tutorial clarifies the function of Excel names and demonstrates how to define names for cells, ranges, constants, or formulas. It also covers editing, filtering, and deleting defined names. Excel names, while incredibly useful, are often overlo

Standard deviation Excel: functions and formula examplesApr 11, 2025 am 11:01 AM

Standard deviation Excel: functions and formula examplesApr 11, 2025 am 11:01 AMThis tutorial clarifies the distinction between standard deviation and standard error of the mean, guiding you on the optimal Excel functions for standard deviation calculations. In descriptive statistics, the mean and standard deviation are intrinsi

Square root in Excel: SQRT function and other waysApr 11, 2025 am 10:34 AM

Square root in Excel: SQRT function and other waysApr 11, 2025 am 10:34 AMThis Excel tutorial demonstrates how to calculate square roots and nth roots. Finding the square root is a common mathematical operation, and Excel offers several methods. Methods for Calculating Square Roots in Excel: Using the SQRT Function: The

Google Sheets basics: Learn how to work with Google SpreadsheetsApr 11, 2025 am 10:23 AM

Google Sheets basics: Learn how to work with Google SpreadsheetsApr 11, 2025 am 10:23 AMUnlock the Power of Google Sheets: A Beginner's Guide This tutorial introduces the fundamentals of Google Sheets, a powerful and versatile alternative to MS Excel. Learn how to effortlessly manage spreadsheets, leverage key features, and collaborate

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SublimeText3 English version

Recommended: Win version, supports code prompts!

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

WebStorm Mac version

Useful JavaScript development tools

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

SublimeText3 Linux new version

SublimeText3 Linux latest version