Learn the advanced techniques of contract trading and improve your trading winning rate and profit potential. This article introduces seven strategies, including: quantitative trading, arbitrage trading, hedging trading, algorithmic trading, high-frequency trading, community trading and planned trading. By employing these techniques, traders can take advantage of market volatility, reduce risk and maximize returns.

Contract Trading Skills: Advanced Strategy Guide

Key Points:

- Master advanced contract trading skills to increase your trading winning rate and profit potential.

Technique 1: Quantitative Trading

- Use technical indicators and algorithmic models to conduct quantitative analysis of the market.

- Automated trading strategies to reduce the impact of emotional swings and impulsive decisions.

- Common quantitative trading strategies: moving average crossover, Bollinger Bands, MACD.

Tip 2: Arbitrage Trading

- Trade on multiple markets or exchanges simultaneously and profit from price differences.

- Common arbitrage strategies: triangle arbitrage, cross-market arbitrage, futures and spot arbitrage.

- You need to pay close attention to real-time market data and handling fee costs.

Tip 3: Hedging

- Offset market risk by taking opposite positions.

- Common hedging strategies: futures hedging, options hedging, synthetic hedging.

- Helps reduce overall portfolio volatility and risk.

Tip 4: Algorithmic Trading

- Integrate complex trading algorithms directly into the trading platform.

- Use high-frequency trading and artificial intelligence technology to seize fleeting market opportunities.

- Requires certain programming and math skills.

Tip 5: High Frequency Trading

- Extremely high-frequency trading strategies that take advantage of millisecond-level market fluctuations to make profits.

- Requires high-performance computing systems, proprietary algorithms and low-latency connections.

- Extremely high risk, suitable for experienced traders.

Tip 6: Community Trading

- Follow the trading strategies of industry experts, successful traders or signal providers.

- Copy or follow their trades and get outside guidance and expertise.

- It is very important to identify reliable signal providers.

Tip 7: Plan your trade, trade plan

- Develop a clear trading plan in advance, including trading goals, risk management strategies and exit rules.

- Plans should be based on market analysis, risk tolerance and investment objectives.

- Avoid making hasty transactions without a concrete plan.

The above is the detailed content of What are the techniques for contract trading?. For more information, please follow other related articles on the PHP Chinese website!

什么是永续合约交易?永续合约交易怎么玩新手入门Feb 12, 2024 am 08:50 AM

什么是永续合约交易?永续合约交易怎么玩新手入门Feb 12, 2024 am 08:50 AM永续合约交易是一种加密货币衍生品交易方式,也被称为永久合约或无期限合约。它是一种新型合约种类,由传统的期货合约演变而来。在加密货币交易市场中,主要有两种合约类型:正向合约(计价货币本位合约)和反向合约(加密货币本位合约)。相比于期货合约,永续合约不存在到期日或交割日,交易者可以根据自己的预测方向一直持有。新手入门永续合约交易,首先需要关注以下几个方面:1、选择交易平台:选择一个信誉良好的数字资产交易平台,确保注册和身份验证以保护账户安全。技术分析和市场趋势是交易中不可或缺的重要工具。它们帮助我

保持合约交易稳健:避免合约爆仓的有效技巧和策略Jan 26, 2024 pm 02:15 PM

保持合约交易稳健:避免合约爆仓的有效技巧和策略Jan 26, 2024 pm 02:15 PM数字货币市场上玩合约交易确实可以在短时间内获得较高的收益,但也会有合约爆仓的发生,很多投资者对于合约交易还处于新手阶段,就开始进行高倍杠杆交易,所以造成了爆仓事件的发生,那合约交易如何才能不被爆仓?想要不爆仓首先不要满仓交易,及时追加保证金以及不贸然开仓,当然还需要掌握一些技巧,那合约交易不被爆仓有啥技巧和方法吗?合约避免爆仓没有一成不变的规则技巧,市场多变,投资者还是需要以不变应万变。接下来小编为大家详细说一说。合约交易如何才能不被爆仓?合约交易都有爆仓的可能,为防止爆仓投资者做好相应准备,因

什么是币圈合约交易,什么是币圈开仓Feb 01, 2024 pm 03:39 PM

什么是币圈合约交易,什么是币圈开仓Feb 01, 2024 pm 03:39 PM什么是币圈合约交易,什么是币圈开仓1.什么是合约交易?合约交易可以双向交易,可以买涨也可以买跌2.什么是开仓?开仓就是开通了仓位,开始进⾏买⼊开多或卖出开空的交易⾏为。3.什么是持仓?交易者开仓之后未进⾏平仓之前就是持仓。4.什么是平仓?平仓就是结束交易,是开仓的反向操作。开仓是买⼊(开多),那平仓时就要卖出,叫做卖出平多;反之,开仓是卖出(开空)那平仓时就要买⼊,叫做买⼊平空。5.买⼊开多什么意思?看涨⾏情—买⼊开多—卖出平仓这是认为币价会上涨时使⽤的策略,当预期币价接下来会涨时,⾃然是要买⼊

最新比特币合约交易时间和规则Oct 11, 2024 am 11:11 AM

最新比特币合约交易时间和规则Oct 11, 2024 am 11:11 AM<p>了解最新比特币合约交易时间和规则至关重要,以最大程度地利用交易机会并管理风险。本文将提供有关比特币合约交易时间的全面信息,包括开盘和收盘时间、假期安排以及其他相关规定。此外,还将讨论交易规则,例如最小交易规模、杠杆限制和止损止盈策略。掌握这些知识将使交易者能够做出明智的决策并制定有效的交易策略。</p>

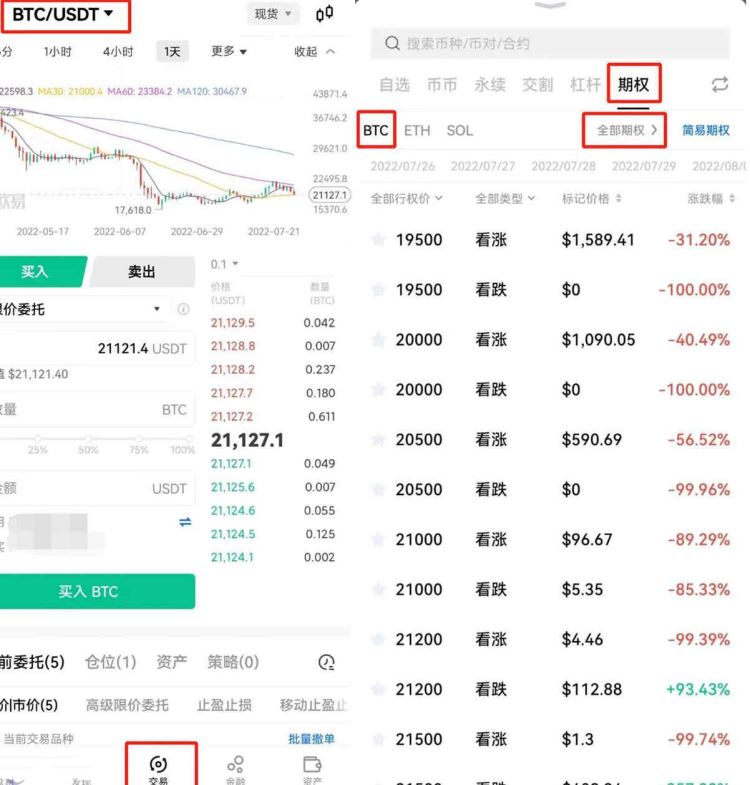

期权交易和合约交易:了解它们的不同之处Jan 19, 2024 pm 02:42 PM

期权交易和合约交易:了解它们的不同之处Jan 19, 2024 pm 02:42 PM在币圈中,期权交易和合约交易都比较受投资者喜爱,期权交易就是指在某一交易日以约定的价格买卖一定数量数字资产的权利,买方支付权利金获得期权,既可以权执行期权,也可放弃行权,因此期权也称为选择权,而合约交易是指买卖双方对约定未来某个时间按指定价格接收一定数量的某种资产的协议进行交易,并且合约交易是在现货远期合约交易基础上发展起来的,因此该交易也是标准化买卖的一种新方式,那么币圈期权交易和合约交易区别在哪?下面就由小编为大家详细介绍。期权交易和合约交易区别在哪?期权和合约是加密货币交易市场中两种不同的

Gate.io交易所永续合约交易操作教程Mar 05, 2025 pm 01:54 PM

Gate.io交易所永续合约交易操作教程Mar 05, 2025 pm 01:54 PM合约交易指南:规避风险,稳健获利本文旨在帮助您了解加密货币合约交易的基础知识,并掌握有效的风险管理策略,从而在波动市场中稳健获利。合约交易允许投资者在不持有实际资产的情况下,通过预测价格波动进行交易并获取利润。合约交易基础概念做多与做空:做多是指预测价格上涨,先买入后卖出获利;做空则预测价格下跌,先卖出后买入获利。保证金与杠杆:保证金是交易所需最低资金;杠杆放大交易规模,例如10倍杠杆意味着100USDT可控制1000USDT的合约,高杠杆放大收益的同时也显著提高风险。交

什么是币圈合约?币圈合约最稳的玩法指南Oct 11, 2024 am 11:39 AM

什么是币圈合约?币圈合约最稳的玩法指南Oct 11, 2024 am 11:39 AM币圈合约是一种金融衍生品,允许交易者在不持有标的资产的情况下,对资产价格的未来走势进行押注。它通过杠杆交易放大收益,同时增加了风险。本文将深入探讨币圈合约,提供一种稳健的玩法指南。

怎么看币圈合约?币圈合约看盘工具排名Nov 26, 2024 pm 02:10 PM

怎么看币圈合约?币圈合约看盘工具排名Nov 26, 2024 pm 02:10 PM币圈合约交易依赖于可靠的看盘工具,协助分析市场、识别机会和管理风险。本文评估了五个顶级合约看盘工具:TradingView、Coinigy、Cryptowatch、Bybit 和 Deribit。它们提供广泛的功能,包括技术指标、绘图工具、交易功能和市场覆盖。选择工具时,务必考虑功能、用户界面、市场覆盖、费用和声誉。了解如何使用这些工具和常见的合约交易策略,并注意合约交易中固有的风险,例如杠杆和市场波动。

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 Chinese version

Chinese version, very easy to use

WebStorm Mac version

Useful JavaScript development tools

Zend Studio 13.0.1

Powerful PHP integrated development environment

SublimeText3 Linux new version

SublimeText3 Linux latest version

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.