Contract trading can certainly magnify profits, but the risks are also high. In order to increase the success rate, traders need to fully understand contract trading and take steps to reduce risks. Specific strategies include: choosing a reputable exchange; understanding the mechanisms of margin trading and leverage trading, as well as the concept of contract expiration; formulating a clear trading plan, analyzing market trends and conducting risk management; strictly controlling emotions and discipline, and staying calm and rational ; Manage position risks, use leverage appropriately, and diversify investments; regularly review and adjust trading strategies, summarize experiences and lessons, and keep learning. By following these principles, traders can effectively reduce contract transaction risks and improve transaction success rates.

How to reduce the risk of contract trading

Contract trading is an advanced derivatives trading method, although it can be enlarged Profitable, but also comes with huge risks. This article aims to provide a comprehensive guide to help traders understand and take steps to reduce the risks of contract trading, thereby increasing the success rate of trading.

1. Choose the right exchange

- The choice of exchange is crucial as it affects the safety, liquidity and security of trading.

- Choose reputable and well-regulated exchanges such as Binance, Huobi, and Ethereum.

- Check the exchange’s trading volume and liquidity to ensure execution speed and effective pricing.

- Understand the exchange’s handling fees and pledge requirements to avoid unexpected expenses that affect profits.

2. Understand the mechanism of contract trading

- Understand the difference between margin trading and leverage trading, and understand the amplification effect of leverage.

- Understand the concept of contract expiration and different delivery methods, such as spot delivery and spread delivery.

- Master the use of stop-loss and take-profit orders and set a clear risk management strategy.

3. Develop a clear trading plan

- Define clear trading goals and risk tolerance.

- Analyze market trends, conduct technical analysis and fundamental research, and formulate trading strategies.

- Avoid making all-or-nothing decisions, follow the principles of position management, and control the size of your position.

4. Strictly control emotions and discipline

- Stay calm and rational and avoid impulsive trading.

- Follow the trading plan and do not deviate from it due to market sentiment.

- Stop losses in time to protect principal and prevent losses from expanding.

5. Manage position risks

- Determine a reasonable leverage level based on the trading strategy and avoid excessive leverage operations.

- Diversify your investment, make arrangements on different contract types or trading pairs, and spread risks.

- Set up take-profit and stop-loss points and strictly abide by them to prevent profit taking or expansion of losses.

6. Regular review and adjustment

- Regularly evaluate the effectiveness of the trading strategy and make adjustments according to market changes.

- Analyze transaction records, summarize experiences and lessons, and improve trading levels.

- Keep learning and improving, and master new trading techniques and risk control measures.

The above is the detailed content of How to reduce the risk of contract trading. For more information, please follow other related articles on the PHP Chinese website!

什么是永续合约交易?永续合约交易怎么玩新手入门Feb 12, 2024 am 08:50 AM

什么是永续合约交易?永续合约交易怎么玩新手入门Feb 12, 2024 am 08:50 AM永续合约交易是一种加密货币衍生品交易方式,也被称为永久合约或无期限合约。它是一种新型合约种类,由传统的期货合约演变而来。在加密货币交易市场中,主要有两种合约类型:正向合约(计价货币本位合约)和反向合约(加密货币本位合约)。相比于期货合约,永续合约不存在到期日或交割日,交易者可以根据自己的预测方向一直持有。新手入门永续合约交易,首先需要关注以下几个方面:1、选择交易平台:选择一个信誉良好的数字资产交易平台,确保注册和身份验证以保护账户安全。技术分析和市场趋势是交易中不可或缺的重要工具。它们帮助我

保持合约交易稳健:避免合约爆仓的有效技巧和策略Jan 26, 2024 pm 02:15 PM

保持合约交易稳健:避免合约爆仓的有效技巧和策略Jan 26, 2024 pm 02:15 PM数字货币市场上玩合约交易确实可以在短时间内获得较高的收益,但也会有合约爆仓的发生,很多投资者对于合约交易还处于新手阶段,就开始进行高倍杠杆交易,所以造成了爆仓事件的发生,那合约交易如何才能不被爆仓?想要不爆仓首先不要满仓交易,及时追加保证金以及不贸然开仓,当然还需要掌握一些技巧,那合约交易不被爆仓有啥技巧和方法吗?合约避免爆仓没有一成不变的规则技巧,市场多变,投资者还是需要以不变应万变。接下来小编为大家详细说一说。合约交易如何才能不被爆仓?合约交易都有爆仓的可能,为防止爆仓投资者做好相应准备,因

什么是币圈合约交易,什么是币圈开仓Feb 01, 2024 pm 03:39 PM

什么是币圈合约交易,什么是币圈开仓Feb 01, 2024 pm 03:39 PM什么是币圈合约交易,什么是币圈开仓1.什么是合约交易?合约交易可以双向交易,可以买涨也可以买跌2.什么是开仓?开仓就是开通了仓位,开始进⾏买⼊开多或卖出开空的交易⾏为。3.什么是持仓?交易者开仓之后未进⾏平仓之前就是持仓。4.什么是平仓?平仓就是结束交易,是开仓的反向操作。开仓是买⼊(开多),那平仓时就要卖出,叫做卖出平多;反之,开仓是卖出(开空)那平仓时就要买⼊,叫做买⼊平空。5.买⼊开多什么意思?看涨⾏情—买⼊开多—卖出平仓这是认为币价会上涨时使⽤的策略,当预期币价接下来会涨时,⾃然是要买⼊

最新比特币合约交易时间和规则Oct 11, 2024 am 11:11 AM

最新比特币合约交易时间和规则Oct 11, 2024 am 11:11 AM<p>了解最新比特币合约交易时间和规则至关重要,以最大程度地利用交易机会并管理风险。本文将提供有关比特币合约交易时间的全面信息,包括开盘和收盘时间、假期安排以及其他相关规定。此外,还将讨论交易规则,例如最小交易规模、杠杆限制和止损止盈策略。掌握这些知识将使交易者能够做出明智的决策并制定有效的交易策略。</p>

期权交易和合约交易:了解它们的不同之处Jan 19, 2024 pm 02:42 PM

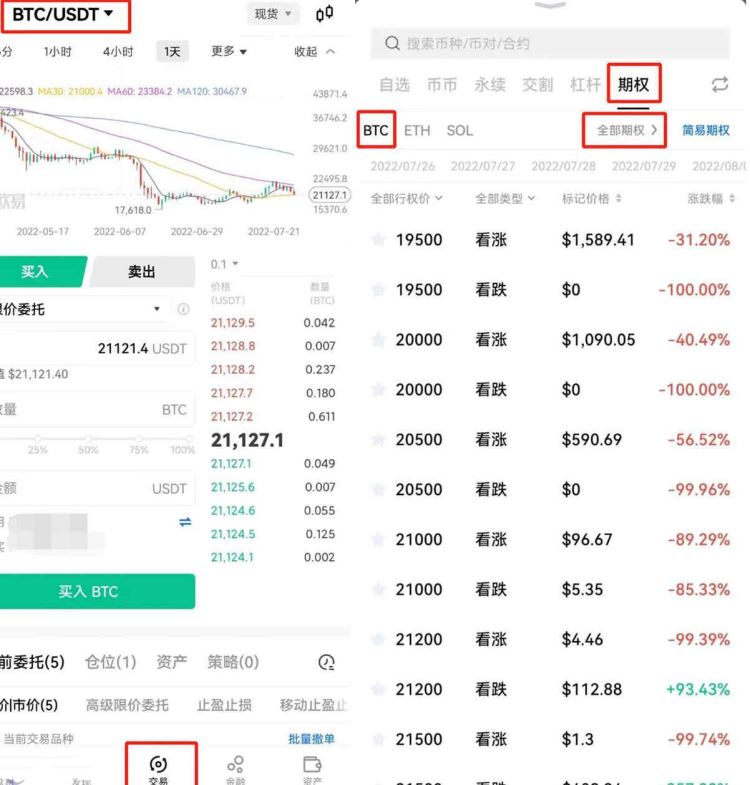

期权交易和合约交易:了解它们的不同之处Jan 19, 2024 pm 02:42 PM在币圈中,期权交易和合约交易都比较受投资者喜爱,期权交易就是指在某一交易日以约定的价格买卖一定数量数字资产的权利,买方支付权利金获得期权,既可以权执行期权,也可放弃行权,因此期权也称为选择权,而合约交易是指买卖双方对约定未来某个时间按指定价格接收一定数量的某种资产的协议进行交易,并且合约交易是在现货远期合约交易基础上发展起来的,因此该交易也是标准化买卖的一种新方式,那么币圈期权交易和合约交易区别在哪?下面就由小编为大家详细介绍。期权交易和合约交易区别在哪?期权和合约是加密货币交易市场中两种不同的

什么是币圈合约?币圈合约最稳的玩法指南Oct 11, 2024 am 11:39 AM

什么是币圈合约?币圈合约最稳的玩法指南Oct 11, 2024 am 11:39 AM币圈合约是一种金融衍生品,允许交易者在不持有标的资产的情况下,对资产价格的未来走势进行押注。它通过杠杆交易放大收益,同时增加了风险。本文将深入探讨币圈合约,提供一种稳健的玩法指南。

Gate.io交易所永续合约交易操作教程Mar 05, 2025 pm 01:54 PM

Gate.io交易所永续合约交易操作教程Mar 05, 2025 pm 01:54 PM合约交易指南:规避风险,稳健获利本文旨在帮助您了解加密货币合约交易的基础知识,并掌握有效的风险管理策略,从而在波动市场中稳健获利。合约交易允许投资者在不持有实际资产的情况下,通过预测价格波动进行交易并获取利润。合约交易基础概念做多与做空:做多是指预测价格上涨,先买入后卖出获利;做空则预测价格下跌,先卖出后买入获利。保证金与杠杆:保证金是交易所需最低资金;杠杆放大交易规模,例如10倍杠杆意味着100USDT可控制1000USDT的合约,高杠杆放大收益的同时也显著提高风险。交

比特币合约交易技巧有哪些?比特币合约交易怎么玩?Jun 25, 2024 pm 06:58 PM

比特币合约交易技巧有哪些?比特币合约交易怎么玩?Jun 25, 2024 pm 06:58 PM比特币市场的不断发展以及参与人数的增加,让比特币合约已经成为投资者不可缺少的一部分。投资者在玩比特币合约时,可以通过做多或做空比特币价格变动来获取利润,也因为不需要投资者实际拥有比特币,为此合约交易在有高回报的同时,也具有高风险。作为新手投资者来说,就需要了解完比特币合约交易技巧究竟有哪些?就已有资料分析来看,投资者需要深入了解市场、掌握交易技巧和有效的风险管理等,下面小编为大家详细说说。比特币合约交易技巧究竟有哪些?比特币合约交易技巧主要就是熟悉市场动态、合理运用杠杆、设定止盈止损、多元化投资

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

Dreamweaver Mac version

Visual web development tools

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Notepad++7.3.1

Easy-to-use and free code editor