web3.0

web3.0 Africa's Digital Asset Market Records Fastest Growth, With Telegram Playing a Primary Role in Attracting New Users

Africa's Digital Asset Market Records Fastest Growth, With Telegram Playing a Primary Role in Attracting New UsersAfrica's Digital Asset Market Records Fastest Growth, With Telegram Playing a Primary Role in Attracting New Users

The predominant group in these communities is the young and tech-savvy. The report found that those aged 25 and below constitute over 55% of the communities.

Africa’s digital asset market has recorded the fastest growth since the beginning of last year, with Telegram playing a primary role in attracting new users, a new report has found.

The report by Seychelles-based digital asset exchange Bitget revealed that between January 2023 and August 2024, digital asset-focused Telegram communities in Africa grew 189% and now boast over three million users.

The predominant group in these communities is the young and tech-savvy. The report found that those aged 25 and below constitute over 55% of the communities.

This comes as no surprise. Africa’s population is the youngest globally, with 60% of its population aged below 25 and a median age of 19. In comparison, Europe’s median age is the highest at 44, with North America, Asia and Latin America at 39, 32 and 31, respectively.

This presents some challenges, such as a much higher demand for education and job opportunities for the millions joining the workforce each year. However, it also presents massive opportunities. One of these is a higher propensity for adopting new technologies, which has naturally translated into high adoption of digital assets and blockchain in the region.

According to the Chainalysis adoption index this year, Nigeria ranked second globally for digital asset adoption, a position it has now held for two consecutive years. Kenya was also previously placed atop the global rankings for peer-to-peer trading three years in a row.

The Bitget study expects this trendsetting by African nations to continue. By 2025, over 54 million Africans will be using digital assets, with Nigeria and South Africa expected to have the highest numbers.

According to the exchange, the youthful population is one of several factors pushing adoption in the region, with the others being “economic instability, limited access to banking services and the active advancement of innovation in digital finance.”

Africa embraces digital assets

For Africa, digital assets represent much more than speculation and quick gains, as revealed by data from Chainalysis. In its report a month ago, the New York analytics firm revealed that Africa ranks highly for blockchain use cases that extend beyond trading. In decentralized finance (DeFi), for instance, the region ranked first globally for DeFi value as a share of overall volume.

Stablecoins have also become vastly popular in the continent, and last year, they became the most used digital asset. Africans have been using stablecoins to send value across borders as other traditional options remain costly and inaccessible to those who need them the most. Speaking to CoinGeek earlier this year, Yellow Card, one of the largest pan-African exchanges, revealed that stablecoins now constitute the bulk of its business.

Previously, stablecoins were the preserve of retail traders, but as currency devaluations hit most African economies, institutions are turning to the relative stability of the United States dollar that stablecoins offer, revealed Rob Downes, an executive at Absa, one of the five largest banks on the continent.

“Our institutional clients are particularly interested in using stablecoins as a tool for managing liquidity and reducing exposure to currency volatility. I think stablecoins are going to be the primary use case for crypto in South Africa over the next three to five years,” he stated.

Like every other region globally, Africa’s digital asset revolution faces challenges that threaten its progress. The biggest is regulations, with most authorities now becoming more involved after years of a hands-off approach.

In some countries like Nigeria, regulations have been a major hurdle. The Central Bank of Nigeria (CBN) barred banks from servicing virtual asset service providers (VASPs) for years, and when this was finally overturned, other agencies started their crackdown, alleging digital assets were behind the naira’s woes.

In Kenya, the government is threatening hefty taxes, while in Tanzania, Cameroon, Tunisia and other countries, the central banks have continuously discouraged citizens from buying digital assets.

Scammers have also tarnished the sector’s image. According to the latest Bitget report, these fraudsters have used social media and instant messaging apps to target their victims with devastating consequences.

Telegram, in particular, has become a haven for these scammers. The privacy-focused messaging app offers tools for users to easily create communities and groups, which scammers exploit to target newbies. In Kenya, one scam targeted users through Telegram and WhatsApp this year, alleging to offer cloud mining services and claiming affiliation with U.S.-based Marathon Digital Holdings (NASDAQ: MARA).

However, Marathon denied any links to the Kenyan firm, with a representative telling CoinGeek that the company “does not do business in Kenya, and we are not in the business of renting machines.”

“The only way to invest in our company is to buy our stock which trades in the US on Nasdaq, ticker MARA,” he added.

The firm shut down shortly after our inquiry, closed its offices and took off with millions of dollars from Kenyan

The above is the detailed content of Africa's Digital Asset Market Records Fastest Growth, With Telegram Playing a Primary Role in Attracting New Users. For more information, please follow other related articles on the PHP Chinese website!

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AM

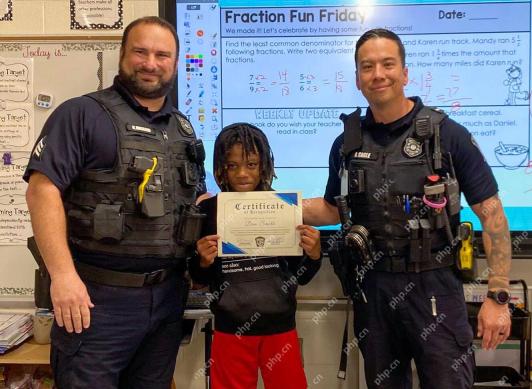

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AMFayetteville Police Department officers Kevin Ingram and David Cagle present Spring Hill Elementary fifth grader Dan Smith with a certificate of recognition for his heroic actions. By FPD

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AM

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AMArtificial Intelligence (AI) has begun to penetrate all aspects of human life, and governance is next. On April 14, the government of the United Arab Emirates (UAE) approved the implementation of what the media is calling the first AI-powered legisla

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AM

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AMOn-chain data reveals that large Shiba Inu investors, referred to as whales, sold their tokens as the coin's value declined.

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AM

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AMSmart crypto investors are looking for an asset with real-world utility and early potential gains in 2025. XRP and Chainlink (LINK) remain the bedrock of solid portfolios but new opportunities

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AM

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AMAs Bitcoin flirts with the $100,000 milestone and Ethereum climbs closer to the $2,000 mark, the eyes of crypto enthusiasts and investors alike are beginning to focus

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AM

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AMU.S. President Donald Trump’s media company, called Trump Media & Technology Group, is exploring yet another crypto-related venture, the company said in a letter to shareholders on Tuesday.

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AM

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AMTop 10 digital currency trading apps: 1. OKX, 2. Binance, 3. Coinbase, 4. Kraken, 5. Huobi, 6. KuCoin, 7. Bitfinex, 8. Gemini, 9. Bitstamp, 10. Poloniex, these platforms are all known for their security, user experience and diverse features, suitable for users with different needs to conduct digital currency transactions.

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AM

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AMA video by DA CONTENT TV on YouTube dives deep into a bold new prediction for Pi Network (PI). According to the discussion, there is growing optimism that the Pi price could surge dramatically, potentially hitting $5 much sooner than many expected.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

SublimeText3 Chinese version

Chinese version, very easy to use

Dreamweaver CS6

Visual web development tools

Notepad++7.3.1

Easy-to-use and free code editor

WebStorm Mac version

Useful JavaScript development tools