Asian Stocks May Struggle as China Measures Underwhelm, Bitcoin Tops $81,000

- Asian stocks may struggle in early trading after Chinese economic measures underwhelmed and the release of anemic inflation data over the weekend. Bitcoin topped $81,000 after President-elect Donald Trump took a clean sweep of the seven US battleground states.

Asian stocks may struggle in early trading after underwhelming Chinese economic measures and anemic inflation data over the weekend, while Bitcoin topped $81,000 after President-elect Donald Trump took a clean sweep of the seven US battleground states.

Australian shares fell and futures in Tokyo and Hong Kong signaled losses after China’s 10 trillion yuan ($1.4 billion) plan to help local governments deal with hidden debt stopped short of including new measures to boost domestic demand. US futures edged higher after the S&P 500 rose 0.4% on Friday to cap stocks’ best week this year in anticipation of Trump’s pro-growth agenda.

A softer start is expected in Asia after the region’s stocks jumped 2.4% last week amid improved sentiment following the Federal Reserve’s rate cut and hopes for more stimulus in China. Investors are now shifting to assess how quickly Trump will implement his fiscal and protectionist trade policies, including proposed tariffs on China.

“The market’s next move will hinge on whether Trump prioritizes cutting taxes or raising tariffs, each having vastly different impact,” Tony Sycamore, an IG Markets analyst in Sydney, wrote in a note. “This clarification may still be months away and it’s worth remembering that back in 2016, Trump’s first move was to cut taxes which sent stock markets surging before tariffs on China caused headwinds.”

Bitcoin surged past $81,000 for the first time in early Asia hours, after hitting a record $80,000 on Sunday, fueled by the incoming president’s support for digital assets and the election of pro-crypto lawmakers.

Meantime, sentiment toward China is faltering as foreign direct investment slumps amid geopolitical tensions, competition from domestic industries and concerns over the nation’s economic outlook. Consumer inflation eased closer to zero in October, suggesting the government’s latest round of stimulus is far from sufficient to free the economy from the grip of deflation.

“Many feel that China is keeping its tactical powder in play for such time as the Trump-China tariff negotiations build, and they can respond in a more targeted fashion to stem the likely economic fallout,” Chris Weston, head of research at Pepperstone Group in Melbourne, wrote in a note. “In the short-term, however, it does suggest downside risk to China/Hong Kong equity and the yuan.”

The dollar edged higher against major peers in early Asian trading, extending last week’s gain amid concerns that Trump’s fiscal policies will stoke inflation. While the US Treasury yield curve flattened Friday, firms including BlackRock, JPMorgan Chase, and TCW Group are warning that the bond market selloff is likely far from over. Cash Treasuries are closed Monday for a holiday.

Federal Reserve Bank of Minneapolis President Neel Kashkari indicated at the weekend the central bank could ease rates less than previously expected amid a strong US economy. Kashkari emphasized, however, that it’s too early to determine the impact of Trump’s policies.

Oil was little changed near $70 a barrel in early Asian trading after falling 2.7% on Friday amid disappointment over China’s stimulus measures. Gold was steady.

This week, traders will be parsing data from Australian jobs to Chinese retail sales and industrial production, inflation from the US and Eurozone as well as growth readings in the UK and Japan. A swath of Federal Reserve officials are scheduled to speak which may help indicate the central bank’s thinking following the election result.

Some of the major moves in markets:

Stocks

Nikkei futures fell 0.2%

Topix futures lost 0.1%

S&P 500 futures rose 0.1%

Nasdaq 100 futures gained 0.1%

Australian equities decreased 0.3%

Hong Kong futures declined 0.3%

Shanghai Composite down 0.1%

MSCI All-Country World Index futures were steady

Currencies

Dollar Index advanced 0.1% to 94.206

Bloomberg Dollar Spot Index rose 0.1%

Euro slipped 0.1% to $1.0866

Yen was flat at 113.81 per dollar

Offshore yuan gained 0.1% to 7.0108 against the dollar

Cryptocurrencies

Bitcoin soared 0.6% to $81,184.9

Ethereum gained 0.2% to $2,226.08

Bonds

Indicative 10-year Treasury yields were steady at 1.62%

Australia’s 3-year yield decreased two basis points to 0.85%

Commodities

West Texas Intermediate crude was at $70.03 a barrel

Brent crude steadied at $73.68 a barrel

Gold was at $1,768

The above is the detailed content of Asian Stocks May Struggle as China Measures Underwhelm, Bitcoin Tops $81,000. For more information, please follow other related articles on the PHP Chinese website!

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AM

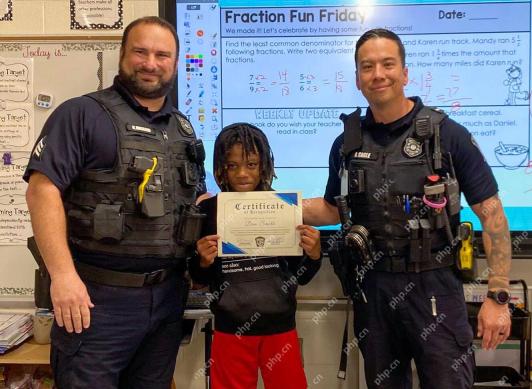

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AMFayetteville Police Department officers Kevin Ingram and David Cagle present Spring Hill Elementary fifth grader Dan Smith with a certificate of recognition for his heroic actions. By FPD

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AM

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AMArtificial Intelligence (AI) has begun to penetrate all aspects of human life, and governance is next. On April 14, the government of the United Arab Emirates (UAE) approved the implementation of what the media is calling the first AI-powered legisla

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AM

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AMOn-chain data reveals that large Shiba Inu investors, referred to as whales, sold their tokens as the coin's value declined.

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AM

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AMSmart crypto investors are looking for an asset with real-world utility and early potential gains in 2025. XRP and Chainlink (LINK) remain the bedrock of solid portfolios but new opportunities

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AM

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AMAs Bitcoin flirts with the $100,000 milestone and Ethereum climbs closer to the $2,000 mark, the eyes of crypto enthusiasts and investors alike are beginning to focus

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AM

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AMU.S. President Donald Trump’s media company, called Trump Media & Technology Group, is exploring yet another crypto-related venture, the company said in a letter to shareholders on Tuesday.

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AM

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AMTop 10 digital currency trading apps: 1. OKX, 2. Binance, 3. Coinbase, 4. Kraken, 5. Huobi, 6. KuCoin, 7. Bitfinex, 8. Gemini, 9. Bitstamp, 10. Poloniex, these platforms are all known for their security, user experience and diverse features, suitable for users with different needs to conduct digital currency transactions.

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AM

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AMA video by DA CONTENT TV on YouTube dives deep into a bold new prediction for Pi Network (PI). According to the discussion, there is growing optimism that the Pi price could surge dramatically, potentially hitting $5 much sooner than many expected.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

SublimeText3 Chinese version

Chinese version, very easy to use

Dreamweaver CS6

Visual web development tools

Notepad++7.3.1

Easy-to-use and free code editor

WebStorm Mac version

Useful JavaScript development tools