web3.0

web3.0 FED Interest Rate Decision: The Fed is set to cut rates by 25 basis points, bringing them to 4.5%-4.7%.

FED Interest Rate Decision: The Fed is set to cut rates by 25 basis points, bringing them to 4.5%-4.7%.US FOMC Meeting: Powell’s comments on Trump’s economic policies could impact future rate cuts, with inflation concerns at play. Bitcoin’s rally may face hurdles if Powell signals higher rates due to inflation risks from Trump’s policies.

The Federal Reserve is set to announce a 25-basis-point rate cut on Thursday, bringing them to the 4.5%-4.7% range.

The move is largely priced in by markets, but traders will be closely watching Fed Chair Jerome Powell’s comments on President-elect Trump’s economic plans, which could impact future rate cuts and, in turn, Bitcoin’s rally.

The Federal Reserve is expected to announce a 25-basis-point rate cut on Thursday, likely bringing rates down to the 4.5%-4.7% range. But everyone’s already expecting this move, so it might not make waves on its own. The real buzz will come after Fed Chair Jerome Powell speaks about how he sees President-elect Trump’s economic plans playing out.

Trump’s policies—especially his tax cuts, loose fiscal approach, and proposed tariffs on countries like China and Mexico—could fuel inflation, complicating the Fed’s current plan to ease rates.

Moreover, it will all depend, on Powell’s signals that Trump’s policies could push inflation higher, the Fed might have to rethink its rate cuts, and that could rattle both traditional markets and the crypto space. Bitcoin, which recently hit $75,000, has been on a strong rally, partly due to hopes that Trump’s administration will bring friendlier crypto regulations. But any hint of inflation concerns could shake up Bitcoin’s momentum, adding a new layer of uncertainty for investors.

The Fed's recent 50-basis-point cut in September was to ease the cycle to support growth, as inflation has cooled somewhat. The current rate of 4.75%-5% is above the “neutral” level, meaning the Fed has room to ease further, with additional cuts expected through 2025. But Trump’s planned fiscal expansion could force the Fed to rethink its course.

Bank of America’s research team suggests that if tariffs and fiscal spending boost inflation, the Fed might have to pause its cuts or even reverse course, keeping rates higher for longer.

Thursday’s Fed meeting might not change much in terms of rates, but traders are more focused on Powell’s comments about Trump’s economic plans. If Powell downplays inflation risks, Bitcoin could continue its upward trajectory. But if he hints that the Fed will need to keep rates elevated due to Trump’s policies, it could rattle the markets, including cryptocurrencies like Bitcoin, that thrive in low-rate cuts.

Interestingly, after misreading inflation in 2021, the Fed is now more cautious, and Powell’s response to Trump’s policies could be a game-changer. If the Fed hints at a slower rate-cutting pace or higher rates in the long run, markets will need to adjust expectations. Bitcoin’s rally may face hurdles, and broader financial markets could see turbulence as the Fed walks a fine line between supporting growth and managing inflation risks triggered by Trump’s fiscal agenda.

The Fed is scheduled to announce its decision at 2:00 PM ET on November 7, with a press conference featuring Fed Chair Jerome Powell at 2:30 PM ET.

The FOMC Meeting lasts two days i.e on 7th and 8th of november and concludes with the FOMC releasing its policy decision at 2 pm Eastern time.

The above is the detailed content of FED Interest Rate Decision: The Fed is set to cut rates by 25 basis points, bringing them to 4.5%-4.7%.. For more information, please follow other related articles on the PHP Chinese website!

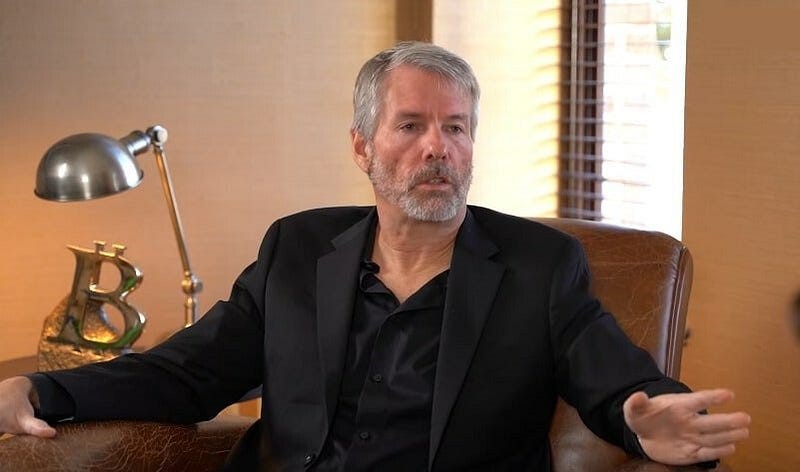

Michael Saylor Drops New Bitcoin Price Prediction, Now Targeting $13M per Coin by 2045Jul 27, 2024 pm 09:12 PM

Michael Saylor Drops New Bitcoin Price Prediction, Now Targeting $13M per Coin by 2045Jul 27, 2024 pm 09:12 PMMichael Saylor popular Bitcoin activist and co-founder of MicroStrategy, a business intelligence firm has dropped his latest prediction for Bitcoin price in the ongoing Bitcoin 2024 conference in Nashville.

SHIB Price Could Reach $0.0007 by 2050 if It Follows Bitcoin to Hit $2.9MJul 27, 2024 pm 06:25 PM

SHIB Price Could Reach $0.0007 by 2050 if It Follows Bitcoin to Hit $2.9MJul 27, 2024 pm 06:25 PMShiba Inu price could potentially reach unprecedented heights if SHIB follows Bitcoin should the premier crypto asset hit $2.9 million as predicted by VanEck.

Senator Bill Hagerty Welcomes Former US President Donald Trump to Nashville for Bitcoin 2024 ConferenceJul 27, 2024 am 07:22 AM

Senator Bill Hagerty Welcomes Former US President Donald Trump to Nashville for Bitcoin 2024 ConferenceJul 27, 2024 am 07:22 AMOne of the most important points of focus in the US Presidential race has been the policy of both parties regarding Bitcoin and cryptocurrencies.

Trump Courts Crypto Cash as Bitcoin Enthusiasts Unite Behind His Bid for the White HouseJul 27, 2024 pm 09:09 PM

Trump Courts Crypto Cash as Bitcoin Enthusiasts Unite Behind His Bid for the White HouseJul 27, 2024 pm 09:09 PMMany of the nation's leading cryptocurrency companies, executives, investors and fanatics are beginning to unite around former president Donald Trump's bid for the White House

Ferrari Expands Cryptocurrency Payment Option to European Merchants by End of July 2024Jul 25, 2024 pm 02:28 PM

Ferrari Expands Cryptocurrency Payment Option to European Merchants by End of July 2024Jul 25, 2024 pm 02:28 PMFollowing CNF's earlier update that Ferrari is accepting Bitcoin, Ripple (XRP), and other cryptocurrencies as payment for its cars, it is now reported that Ferrari will expand its cryptocurrency payment option to European dealers by the end o

Kamala Harris Won't Be Speaking at Bitcoin 2024 Conference, David Bailey Indirectly Shows Support for Donald TrumpJul 25, 2024 pm 02:31 PM

Kamala Harris Won't Be Speaking at Bitcoin 2024 Conference, David Bailey Indirectly Shows Support for Donald TrumpJul 25, 2024 pm 02:31 PMWith the American President Joe Biden deciding not to run for re-election, Vice President Kamala Harris is now a top contender for the presidential race. Recently, she spoke about Bitcoin and cryptocurrencies, making her stance clear.

Trump's Bitcoin Embrace Shakes Democrats 'to the Core,' Says Anthony Scaramucci Ahead of BTC ConferenceJul 27, 2024 pm 09:46 PM

Trump's Bitcoin Embrace Shakes Democrats 'to the Core,' Says Anthony Scaramucci Ahead of BTC ConferenceJul 27, 2024 pm 09:46 PMFormer White House Communications Director Anthony Scaramucci weighed in on the possible impact on Bitcoin (BTC) prices if former President Donald Trump wins his second term in the upcoming elections.

VanEck CEO Jan van Eck Doubles Down on Bitcoin, Says 'Way Over 30%' of His Portfolio Is in BTCJul 27, 2024 pm 06:14 PM

VanEck CEO Jan van Eck Doubles Down on Bitcoin, Says 'Way Over 30%' of His Portfolio Is in BTCJul 27, 2024 pm 06:14 PMJan van Eck, the CEO of the investment management company VanEck, highlighted some of Bitcoin's most notable merits during the ongoing BTC Conference in the States.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 English version

Recommended: Win version, supports code prompts!

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

WebStorm Mac version

Useful JavaScript development tools

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function