web3.0

web3.0 With Donald Trump Set to Return to the White House, Investors Are Closely Watching What a Second Term Could Mean for the U.S. Economy, Financial Markets, and Bitcoin

With Donald Trump Set to Return to the White House, Investors Are Closely Watching What a Second Term Could Mean for the U.S. Economy, Financial Markets, and BitcoinWith Donald Trump Set to Return to the White House, Investors Are Closely Watching What a Second Term Could Mean for the U.S. Economy, Financial Markets, and Bitcoin

Trump’s proposed economic agenda includes corporate tax cuts, deregulation, and increased tariffs on imports—policies that could shift market trends, raise inflation concerns

Donald Trump’s return to the White House will undoubtedly have a profound impact on the U.S. economy, financial markets, and Bitcoin.

Trump's proposed economic agenda includes corporate tax cuts, deregulation, and increased tariffs on imports. These policies are likely to shift market trends, raise inflation concerns, and influence the Federal Reserve's monetary strategies.

Anticipation of these measures is already causing fluctuations in asset prices, ranging from U.S. Treasuries to crypto, as markets prepare for a growth-oriented but potentially inflationary environment.

Trump's plans to reduce the corporate tax rate to 15% for U.S.-based manufacturers, down from the current 21%, have sparked賛否両論. He maintains that these cuts will bolster U.S. businesses and contribute to stock market growth.

If implemented, these policies could boost corporate earnings and improve investor sentiment. However, critics caution that the reduced taxes may燃料add to inflation by increasing spending in an already expanding economy.

Moreover, broader tax cuts could worsen government debt. Trump's proposals are estimated to add over $7 trillion to the federal deficit over the next decade. Rising debt, coupled with inflationary pressures, might compel the Federal Reserve to reconsider its current easing of interest rates, potentially complicating the financial outlook for businesses and consumers.

In addition to tax reforms, Trump's proposal to impose tariffs as high as 60% on Chinese imports and 10% across the board aims to protect American manufacturing. While this could support domestic production, it also risks disrupting supply chains and driving up consumer costs.

Deutsche Bank estimates that Trump’s economic policies, excluding tariffs, could raise U.S. GDP by 0.5%, though the tariffs may offset half of that growth.

As inflation concerns grow, Bitcoin and other cryptocurrencies may gain popularity as a hedge against eroding purchasing power. During Trump’s first term, crypto markets experienced heightened volatility, partly influenced by his outspoken views on the dollar and economic policy.

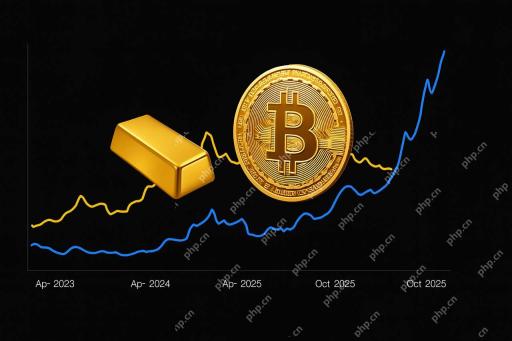

Renewed inflation could strengthen Bitcoin's narrative as “digital gold,” while Trump's regulatory actions could further reshape the crypto industry.

Wall Street is already reacting to Trump's policies. 10-year Treasury yields have reached multi-month highs, and rising volatility across stocks and commodities may follow. While equity markets could benefit initially from lower corporate taxes, concerns over rising debt and inflation may dampen optimism, keeping investors largely cautious.

The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

The above is the detailed content of With Donald Trump Set to Return to the White House, Investors Are Closely Watching What a Second Term Could Mean for the U.S. Economy, Financial Markets, and Bitcoin. For more information, please follow other related articles on the PHP Chinese website!

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PM

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PMThis sharp drop happened as investor interest faded and a major scandal hit the highly speculative market.

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PM

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PMDespite being pretty much the iconic example of “random” – well, that and dice rolls – we can't help but feel like there's some element of skill involved. Especially when we lose.

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AM

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AMBitwise, a leading digital asset manager, has announced the listing of four of its crypto Exchange-Traded Products (ETPs) on the London Stock Exchange (LSE).

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AM

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AMBitcoin may be poised for a massive rally—but only if gold continues its upward climb, according to Joe Consorti, Head of Growth at Theya.

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AM

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AMThe Shiba Inu price continues to attract the attention of analysts, who are watching for its next potential move. By Samuele Piar. Updated April 14, 2025.

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AM

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AMThe joint motion of Ripple and U.S. Securities and Exchange Commission (SEC) to hold the appeal in abeyance has been granted by the Circuit Judge Jose A. Cabranes.

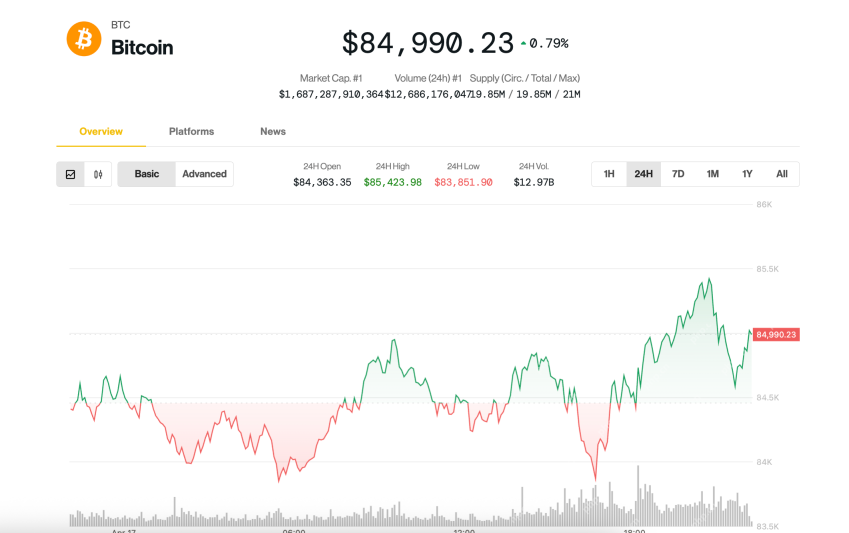

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AM

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AMBitcoin (BTC) was treading water just below $85,000 late Thursday as tensions between U.S. President Donald Trump and Federal Reserve Chair Jerome Powell added another layer of uncertainty for investors.

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AM

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AMToday, AB DAO officially announced the launch of a dual reward campaign in collaboration with Bitget (bitget.com), the world's second-largest digital asset trading platform.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

WebStorm Mac version

Useful JavaScript development tools

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

Atom editor mac version download

The most popular open source editor