How to Build an Asset Class in Three Easy Steps

Kelly Ye, portfolio manager at Decentral Park Capital and Andy Baehr, head of product at CoinDesk Indices, trade views, active manager vs indexer, on what steps are most important to shape the capital markets and investment landscape for digital assets in a post U.S. election world.

Kelly Ye, portfolio manager at Decentral Park Capital, and Andy Baehr, head of product at CoinDesk Indices, trade views on what steps are most important to shape the capital markets and investment landscape for digital assets in a post U.S. election world.

Election 2024 coverage presented by

Andy: Kelly, the US election has concluded and Trump is headed back to the White House, bolstered by a GOP-lead Senate. Bitcoin has already posted a new all-time high, but we know there is no magic wand to transform crypto into a fully-functioning asset class. How will we get there?

Kelly: Let’s think about three parts: 1) regulatory infrastructure that allows projects to exist and to raise capital; 2) investment infrastructure that connects investors to the capital markets; and 3) an investment framework for allocators, big and small.

Tesla Is Moving Bitcoin; Trump-Supported Token Falls Flat

You're reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

Andy: Nicely framed. That’s a lot! Let’s hit topic 1 today: regulatory infrastructure. If crypto is meant to be decentralized, why is the U.S. so important?

Kelly: Though crypto is inherently decentralized, with users and investors worldwide, the U.S. remains crucial due to its concentration of capital and favorable business environment. Globally, investors recognize the U.S. as a hub for technology and innovation. A supportive administration can further enhance this landscape, benefiting the industry. In the long term, as blockchain fosters decentralized trust and governance, societies may organize less by nation and more by shared interests, transcending traditional boundaries.

Andy: From the capital markets side — new projects needing access to investor capital — I agree; it’s hard to build without participation from U.S. lenders and investors. However, for the global markets side — trading, derivatives, services to hedge funds — I think global crypto is doing pretty well, given the obvious constraints. Financial engineering in cities like London, Zurich, Singapore and Hong Kong, with deep talent pools and a history of innovation, is doing well. The U.S. did (impressively, in hindsight) launch futures contracts on bitcoin and ether, a few ETFs and ETF options (soon), but for depth, breadth and innovation, you have to get on an airplane.

Kelly: A primary barrier is the lack of regulatory clarity regarding whether digital assets qualify as securities or commodities. Currently, only bitcoin has a clear classification, while other tokens risk being labeled as unregistered securities. The SEC’s "regulation by enforcement" approach is unsustainable and may deter innovation within the U.S. This also has downstream implications for capital markets, as crypto-focused exchanges and custodians face the risk of offering unregistered securities under SEC guidance.

Andy: Indeed. As you have heard me rant about more than once, the regulatory “jump ball” between the CFTC and SEC is an impediment and a nuisance. This was true with basket swaps when Dodd Frank went into effect 12 years ago and it’s true now with crypto. I think about how the SFC in Hong Kong was out ahead creating regulatory structure around “virtual assets,” acknowledging their special properties and users. Now VARA in Dubai and, of course, MiCA in Europe are following suit in their own way. Much of this regulatory architecture is designed around existing assets and exchanges. You bring up an important point: new blockchain-based projects also deserve a clear path for financing and launch.

Kelly: How would you expect indices to be treated in a best-case scenario?

Andy: If the ultimate regulatory goal is investor protection, indices offer not only diversification of returns, but also of risk. If one index constituent fails, the index will replace it and survive. Not to say this removes risk, but non-systemic failures are not catastrophic. We think this provides a handy solution to regulators for index derivatives and index-based U.S. ETFs: if an index is demonstrably broad-based, it may not be necessary to make specific regulatory determinations about each and every constituent. If regulators insist on asset-by-asset regulation, users become concentrated into a small number of assets, even if those tend to be the largest, like bitcoin and ether.

So, we know what’s on our wish lists, but I guess we should end on an upbeat note. We are impatient, perhaps even frustrated, but also hopeful that the new administration can implement more crypto friendly policies, right, Kelly?

Kelly: Timing is critical, as other countries are competing to create a more favorable environment for blockchain technology builders. We are seeing significant developments with bitcoin, ETH ETFs and the CoinDesk 20 index, which offers investors broad-based exposure to the crypto market. However, to fully capture the growth potential of blockchain technology and its applications, active management expertise is essential

The above is the detailed content of How to Build an Asset Class in Three Easy Steps. For more information, please follow other related articles on the PHP Chinese website!

Can ordinary people mine Bitcoin? A guide to zero-basis for Bitcoin mining participationMay 15, 2025 am 09:57 AM

Can ordinary people mine Bitcoin? A guide to zero-basis for Bitcoin mining participationMay 15, 2025 am 09:57 AMWith the popularity of Bitcoin, many people have become interested in Bitcoin mining, especially whether ordinary people can participate and become part of this digital currency world. Mining Bitcoin seems to be a complex process that requires professional knowledge and high-performance equipment, but in fact, ordinary people can also try to participate in Bitcoin mining. With some suitable tools and platforms, individuals with zero foundation can easily get started and conduct Bitcoin mining. However, before you start, it is crucial to understand some basic concepts and the requirements and steps of mining. This article will elaborate on how ordinary people participate in Bitcoin mining in no basis. How to get Bitcoin for ordinary people

The recent price action of PENGU is sending strong bullish signalsMay 15, 2025 am 09:54 AM

The recent price action of PENGU is sending strong bullish signalsMay 15, 2025 am 09:54 AMThe recent price action of PENGU is sending strong bullish signals, and technical indicators suggest another upward move

What is Midle (MIDLE) cryptocurrency? MIDLE price forecast and analysisMay 15, 2025 am 09:54 AM

What is Midle (MIDLE) cryptocurrency? MIDLE price forecast and analysisMay 15, 2025 am 09:54 AMMidle (MIDLE) is a Web3 marketing platform that rewards users by participating in blockchain and social media tasks. Its native token MIDLE has attracted attention for its unique practicality and recent price changes. This analysis explores MIDLE's current market performance, historical price trends, and future price forecasts. What is Midle(MIDLE)? Midle allows users to complete various tasks such as promoting projects on social media, engaging with blockchain protocols, and engaging in community-driven initiatives while earning their native cryptocurrency, MIDLE. What’s unique in the middle? Mid

Presale, ROI, APY, Deflationary Token, Buyback and Burn, GameFi, KYC, Smart Contract Audit, Tokenomics, Referral BonusMay 15, 2025 am 09:52 AM

Presale, ROI, APY, Deflationary Token, Buyback and Burn, GameFi, KYC, Smart Contract Audit, Tokenomics, Referral BonusMay 15, 2025 am 09:52 AMPresale – A funding phase before a cryptocurrency is launched to the public, offering early buyers lower prices and potentially higher returns.

Bitcoin vs. Solana: A comprehensive comparisonMay 15, 2025 am 09:51 AM

Bitcoin vs. Solana: A comprehensive comparisonMay 15, 2025 am 09:51 AMAs the cryptocurrency field develops, investors continue to compare old and mature cryptocurrencies with emerging innovative projects. Bitcoin and Solana are two such assets, which represent a completely different vision for blockchain technology. Bitcoin is a pioneer and digital gold standard for decentralized finance, while Solana provides a highly scalable platform built for speed and smart contract deployment. In this article, we will dive into the uniqueness of Bitcoin and Solana, highlighting their key differences, and discussing which one might be the better investment option based on your goals and risk tolerance. Bitcoin and

2025 Kennedy half dollar and proof 2025 American Buffalo gold coinMay 15, 2025 am 09:50 AM

2025 Kennedy half dollar and proof 2025 American Buffalo gold coinMay 15, 2025 am 09:50 AMEach was a top seller for the Mint.

Learn about DeFi Dev Corp's acquisition of SOL verification platform creates cash flow! DFDV stock price has risen by more than ten timesMay 15, 2025 am 09:48 AM

Learn about DeFi Dev Corp's acquisition of SOL verification platform creates cash flow! DFDV stock price has risen by more than ten timesMay 15, 2025 am 09:48 AMFollowing the popularity of micro-strategy Strategy's Bitcoin reserve strategy, another wave of SOL reserve strategy has emerged recently. DeFiDevelopment Corp. (stock code DFDV), which was acquired by former Kraken executives, is raising $1 billion recently to buy Solana. In addition, the company has acquired the SOL verification business platform for $3.5 million. Its pledge rewards will be integrated into the company's revenue stream, and the stock price has risen by more than ten times. DFDV acquires SOL verification platform DeFiDevelopmentCorp. (stock code DFDV) original name is Janover.

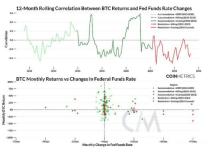

Coin Metrics Analysis: Is Bitcoin decoupled from the market?May 15, 2025 am 09:45 AM

Coin Metrics Analysis: Is Bitcoin decoupled from the market?May 15, 2025 am 09:45 AMKey point: Bitcoin’s correlation with stocks and gold has recently dropped to nearly zero, indicating a typical “decoupling” phase that usually occurs during major market events or shocks. Bitcoin’s correlation with interest rates is usually low, but changes in monetary policy have a certain impact on its performance, especially in the 2022-2023 interest rate hike cycle, Bitcoin’s strongest negative correlation with interest rates. Despite being called "digital gold", Bitcoin has historically shown a higher "Beta value", i.e. sensitivity to stock market rises

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

Zend Studio 13.0.1

Powerful PHP integrated development environment

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.