Bitcoin Turns 16: From Cash Alternative to Digital Gold and a Network Reshaping Finance

Sixteen years ago, Bitcoin's whitepaper sparked a financial revolution, introducing a deflationary, decentralized currency that defies central bank control and inflationary manipulation.

Sixteen years ago, Bitcoin's whitepaper sparked a financial revolution. Today, the world's largest cryptocurrency continues to serve two roles: Bitcoin the asset—a “digital gold” store of value known for scarcity and censorship resistance—and Bitcoin the network—a decentralized payment protocol with growing potential in global finance.

Emerging from the 2008 crisis, Bitcoin's deflationary design was initially conceived as a peer-to-peer cash alternative to fiat currencies, known for their inflationary potential and central bank control. However, as Bitcoin's value and transaction costs rose over time, it gradually shifted toward being used more as a store of value than a medium of exchange.

This dual nature of Bitcoin has sparked contrasting perspectives. Critics, like Ulrich Bindseil of the European Central Bank, question Bitcoin's economic legitimacy in a paper, arguing that its promoters downplay any economic function to justify its valuation. Bindseil contends that Bitcoin is largely a speculative investment, benefiting early adopters at the expense of others.

In response to such critiques, Bitcoin's proponents argue that central bankers are overlooking its true utility as both an asset and a resilient payment network, operating outside central control. As central banks introduce their own digital currencies, supporters like Christian Catalini of MIT emphasize Bitcoin's unique value as “the basis for a truly open and neutral protocol for money.”

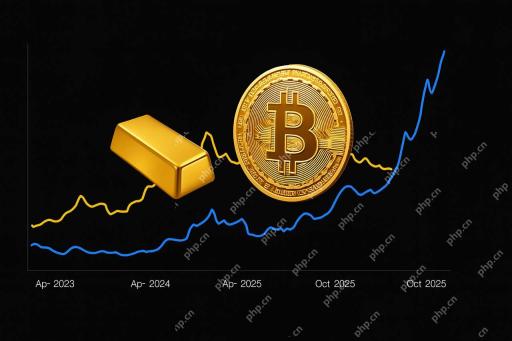

Bitcoin's deflationary design lies at the heart of its appeal and function. Originally envisioned as a cash alternative, Bitcoin's rising value and transaction costs made it less practical for everyday payments, shifting its role more toward a store of value. Its fixed supply sets it apart from fiat currencies, which central banks can inflate at will. This scarcity makes Bitcoin appealing to those concerned about monetary debasement, positioning it as “digital gold”—a means to preserve wealth and guard against inflation.

From Cash to Digital Gold

Last week, Bindseil, Director General of Market Infrastructure and Payments at the ECB, questioned Bitcoin's economic legitimacy in a paper, claiming that promoters of this investment vision put little effort into relating Bitcoin to an economic function which would justify its valuation. Bindseil argues that Bitcoin is largely a speculative investment, benefiting early adoptives at the expense of others—a stance reflecting traditional finance's skepticism of Bitcoin's lack of economic utility.

While central bankers argue that Bitcoin's appeal is based on speculation, its proponents insist that central banks are missing the point. “Early Bitcoin adopters are no different from the Rothschilds in banking, the Vanderbilts in railroads, or Gates in software,” says Catalini, who is also the co-founder of Lightspark and the founder of the MIT Cryptoeconomics Lab. For Catalini, Bitcoin's actual utility lies in its network's resistance to central control and deflationary nature, offering a powerful alternative to fiat currency's inflationary limitations. However, as he explains, “Bitcoin the network is as important as Bitcoin the asset. It’s the basis for a truly open and neutral protocol for money.”

Bitcoin sparked a vast crypto ecosystem, driving innovations like stablecoins and decentralized finance (DeFi) that are transforming traditional finance. Ethereum's 2015 launch of smart contracts accelerated crypto's growth, and by September 2024, active blockchain addresses surpassed 220 million, with crypto wallets reaching 29 million users. Stablecoins alone processed $8.5 trillion in Q2 2024—double Visa's $3.9 trillion—leading major players like Stripe, Visa, and Mastercard to embrace crypto wallets and stablecoin technology.

Bitcoin's own network utility is expanding, too; recent innovations, such as Lightspark's Bitcoin-based network—co-founded by David Marcus, the former head of Facebook's Libra project—enable nearly free, self-custodial cross-border transactions, signaling Bitcoin's potential renewed role in global payments.

Ironically, while central banks often criticize Bitcoin, they increasingly adopt its underlying technology to develop centralized digital currencies. For example, the ECB's Digital Euro project plans to enforce Eurozone-wide adoption—a top-down model in stark contrast to Bitcoin's voluntary, grassroots expansion. Responding to Ulrich Bindseil's aforementioned Bitcoin critique, Christian Catalini remarked on X, “Status quo bias is hard to shake,” suggesting that while central banks recognize blockchain's benefits, they are hesitant to embrace its core principles of decentralization and deflationary nature.

As inflation erodes fiat's purchasing power, Bitcoin's fixed supply becomes increasingly appealing, especially in regions facing currency depreciation. For many, Bitcoin's independence and deflationary nature represent a compelling alternative to fiat, a way to store wealth free from the reach of monetary policy. And if central banks worry about Bitcoin rewarding early adopters, its open, permissionless design means they, too, are free to join.

At 16, Bitcoin stands at a crossroads between skepticism and rising adoption.

The above is the detailed content of Bitcoin Turns 16: From Cash Alternative to Digital Gold and a Network Reshaping Finance. For more information, please follow other related articles on the PHP Chinese website!

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PM

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PMThis sharp drop happened as investor interest faded and a major scandal hit the highly speculative market.

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PM

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PMDespite being pretty much the iconic example of “random” – well, that and dice rolls – we can't help but feel like there's some element of skill involved. Especially when we lose.

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AM

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AMBitwise, a leading digital asset manager, has announced the listing of four of its crypto Exchange-Traded Products (ETPs) on the London Stock Exchange (LSE).

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AM

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AMBitcoin may be poised for a massive rally—but only if gold continues its upward climb, according to Joe Consorti, Head of Growth at Theya.

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AM

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AMThe Shiba Inu price continues to attract the attention of analysts, who are watching for its next potential move. By Samuele Piar. Updated April 14, 2025.

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AM

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AMThe joint motion of Ripple and U.S. Securities and Exchange Commission (SEC) to hold the appeal in abeyance has been granted by the Circuit Judge Jose A. Cabranes.

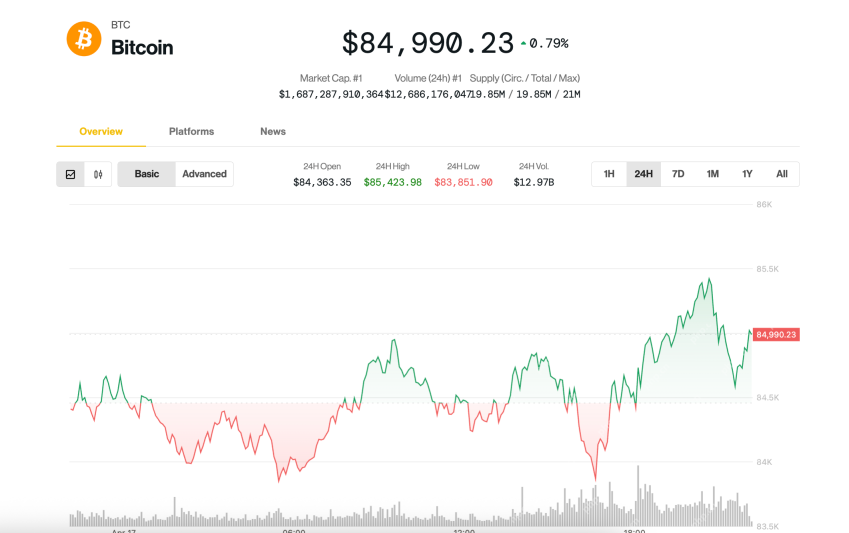

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AM

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AMBitcoin (BTC) was treading water just below $85,000 late Thursday as tensions between U.S. President Donald Trump and Federal Reserve Chair Jerome Powell added another layer of uncertainty for investors.

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AM

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AMToday, AB DAO officially announced the launch of a dual reward campaign in collaboration with Bitget (bitget.com), the world's second-largest digital asset trading platform.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

SublimeText3 Chinese version

Chinese version, very easy to use