Maker [MKR] Attempts a Recovery from Lower Price Levels Targeting 68% Discount

Its been a rough month and year for Maker [MKR] holders and perhaps a good one for MKR short sellers. Its price has been heavily focused on a downward

![Maker [MKR] Attempts a Recovery from Lower Price Levels Targeting 68% Discount](https://img.php.cn/upload/article/000/000/000/173040181936585.png?x-oss-process=image/resize,p_40)

After bottoming out at $1.006 on 25 October, Maker [MKR] has managed to achieve a 26% upside to reach $1.27. This recent bullish performance follows a massive pullback in the token since April, which amounts to a 68% discount from its previous price point.

However, despite being in the green for the last 6 days, MKR’s latest recovery is modest. Moreover, the token has been trading at a significant discount for months now. While the latest bullish efforts are promising, they may need to be sustained for MKR to achieve higher gains.

After rallying by over 50% in July, MKR attempted another bullish recovery from a lower price point this time around. This could mean that the token has the potential for higher gains. However, a major recovery also requires robust demand, which has been lacking for months.

MakerDAO joins list of top 10 dapps by weekly fees

Speaking of demand, MakerDAO was recently ranked 10th in the list of top dapps by weekly revenue and fees. It generated roughly $5.67 million in weekly fees, which indicated a decent level of utility. This, in turn, paints a rough picture of the level of demand for the platform.

✨ TOP DAPPS BY WEEKLY FEES GENERATED VS REVENUE GAINED@Tether_to $93.6M

@circle $28.9M

@jito_sol $28.7M

@RaydiumProtocol $22.3M

@LidoFinance $15.2M

@Uniswap $9.76M

@pancakeswap $8.92M

@pumpdotfun $6.94M

@Aave $6.70M

@MakerDAO $5.67M$USDT $JTO $RAY $LDO $UNI $CAKE $AAVE $MKR pic.twitter.com/24gcbvRdyx

— Chain Broker ?? (@chain_broker) October 30, 2024

A closer look at MakerDAO revenue and fees in the last 12 months revealed some interesting findings. The network generated $31,680 in fees and the same figure for revenues on 31 October 2023.

Fees on 30 October 2024 amounted to $847,750 while revenues came in at $517,600, confirming healthy year-over-year growth.

Source: DeFiLlama

The higher fees and revenue figures confirm that the decentralized finance (DeFi) platform is still able to capture growth from the resurging demand. Nevertheless, the competition has been intensifying, and this was evident by some of the higher ranking newer dapps on the list.

On-chain data also revealed that MKR volumes were significantly lower compared to 2021, especially in the few months near the market peak.

Source: DeFiLlama

The above observation may be a reflection of the current state of the market. Altcoins have relatively underperformed despite Bitcoin’s (BTC) latest momentum. These outcomes likely undermined potential demand for MKR.

A surge in demand for altcoins especially in the DeFi ecosystem may trigger more demand for MKR. However, we will have to wait and see if that will happen.

The above is the detailed content of Maker [MKR] Attempts a Recovery from Lower Price Levels Targeting 68% Discount. For more information, please follow other related articles on the PHP Chinese website!

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PM

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PMThis sharp drop happened as investor interest faded and a major scandal hit the highly speculative market.

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PM

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PMDespite being pretty much the iconic example of “random” – well, that and dice rolls – we can't help but feel like there's some element of skill involved. Especially when we lose.

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AM

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AMBitwise, a leading digital asset manager, has announced the listing of four of its crypto Exchange-Traded Products (ETPs) on the London Stock Exchange (LSE).

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AM

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AMBitcoin may be poised for a massive rally—but only if gold continues its upward climb, according to Joe Consorti, Head of Growth at Theya.

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AM

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AMThe Shiba Inu price continues to attract the attention of analysts, who are watching for its next potential move. By Samuele Piar. Updated April 14, 2025.

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AM

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AMThe joint motion of Ripple and U.S. Securities and Exchange Commission (SEC) to hold the appeal in abeyance has been granted by the Circuit Judge Jose A. Cabranes.

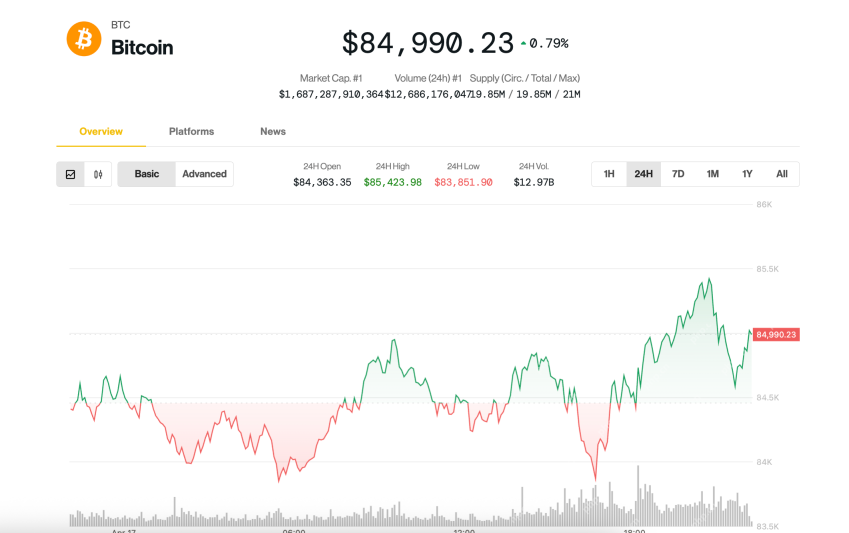

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AM

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AMBitcoin (BTC) was treading water just below $85,000 late Thursday as tensions between U.S. President Donald Trump and Federal Reserve Chair Jerome Powell added another layer of uncertainty for investors.

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AM

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AMToday, AB DAO officially announced the launch of a dual reward campaign in collaboration with Bitget (bitget.com), the world's second-largest digital asset trading platform.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Notepad++7.3.1

Easy-to-use and free code editor