web3.0

web3.0 Bitcoin (BTC) Mining Difficulty Hits All-Time High of 95.67 TH as Mining Revenue Rises; Signals Upcoming Bull Run

Bitcoin (BTC) Mining Difficulty Hits All-Time High of 95.67 TH as Mining Revenue Rises; Signals Upcoming Bull RunBitcoin (BTC) Mining Difficulty Hits All-Time High of 95.67 TH as Mining Revenue Rises; Signals Upcoming Bull Run

Bitcoin mining difficulty jumps 3.9%, hits 95.67T on Tuesday, amid record hashrate.

Bitcoin mining difficulty hit a record high on Tuesday, rising by 3.9% to 95.67 terahashes (T), amid all-time high hashrate.

According to Glassnode data, Bitcoin mining difficulty reached a new all-time high on Tuesday, hitting 95.67 terahashes (T) after a 3.9% increase. Mining difficulty serves as a measure of how challenging it is to mine a new block on the Bitcoin network.

So far in 2024, there have been 22 difficulty adjustments, with 13 being positive. As a result, the difficulty has risen from 72T to 92T, marking a 27% year-to-date increase. The network adjusts the difficulty every 2,016 blocks, which takes about two weeks, to ensure that blocks are mined every 10 minutes on average.

The recent surge in mining difficulty comes as the Bitcoin network hashrate also reached record highs, hitting all-time highs of over 700 exahashes per second (EH/s). Hashrate refers to the combined computational power used to mine and process transactions on a proof-of-work blockchain.

As difficulty increases, the mining industry faces more pressure to generate profits. This is because higher operational costs are incurred as more computational power must be invested in more efficient mining equipment.

Weak miners being purgedPart of the downward pressure on bitcoin, since the April halving, has come from unprofitable miners selling holdings. These miners, mainly small private miners, couldn’t sustain themselves due to higher costs. After the halving, these miners started to unplug from the network leading to a 15% decrease in hashrate or started selling bitcoin in order to fund operating costs.

Looking at Glassnode data, we see that miner balances dropped this year as weaker miners knew the halving was approaching and were trying to fund operations to get ahead of the game. From November 2023 to July 2024, we saw over 30,000 bitcoin leave miner wallets, one of the longest distribution periods from miners on record. However, we can now observe that since July, miner balances have been relatively flat and have shown signs of accumulation, telling us remaining miners on average can handle the new environment. The mining industry will continue to consolidate into stronger hands, with public miners controlling a record share of almost 30%.

Bitcoin bull run commencing soonBitcoin bull runs and surging miner revenue coincide; as price increases, so does mining revenue. Glassnode data shows that on a 7-day moving average (7-DMA), the total dollar mining revenue is over $35 million, an increase of over $10 million since the September low.

Since the halving in April, the mining revenue has been below the 365-simple moving average (SMA), currently priced at $40 million. Historically, once the total miner revenue climbs above the 365-SMA, this coincides with a bitcoin bull run, which has been seen historically.

The above is the detailed content of Bitcoin (BTC) Mining Difficulty Hits All-Time High of 95.67 TH as Mining Revenue Rises; Signals Upcoming Bull Run. For more information, please follow other related articles on the PHP Chinese website!

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AM

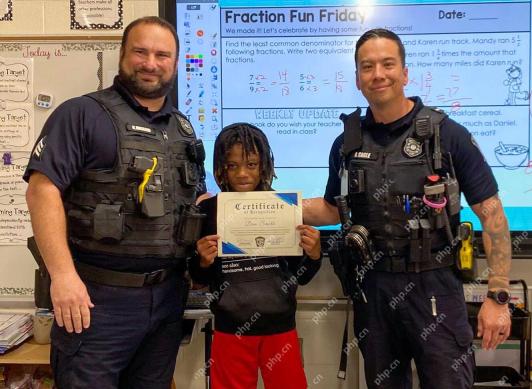

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AMFayetteville Police Department officers Kevin Ingram and David Cagle present Spring Hill Elementary fifth grader Dan Smith with a certificate of recognition for his heroic actions. By FPD

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AM

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AMArtificial Intelligence (AI) has begun to penetrate all aspects of human life, and governance is next. On April 14, the government of the United Arab Emirates (UAE) approved the implementation of what the media is calling the first AI-powered legisla

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AM

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AMOn-chain data reveals that large Shiba Inu investors, referred to as whales, sold their tokens as the coin's value declined.

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AM

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AMSmart crypto investors are looking for an asset with real-world utility and early potential gains in 2025. XRP and Chainlink (LINK) remain the bedrock of solid portfolios but new opportunities

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AM

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AMAs Bitcoin flirts with the $100,000 milestone and Ethereum climbs closer to the $2,000 mark, the eyes of crypto enthusiasts and investors alike are beginning to focus

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AM

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AMU.S. President Donald Trump’s media company, called Trump Media & Technology Group, is exploring yet another crypto-related venture, the company said in a letter to shareholders on Tuesday.

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AM

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AMTop 10 digital currency trading apps: 1. OKX, 2. Binance, 3. Coinbase, 4. Kraken, 5. Huobi, 6. KuCoin, 7. Bitfinex, 8. Gemini, 9. Bitstamp, 10. Poloniex, these platforms are all known for their security, user experience and diverse features, suitable for users with different needs to conduct digital currency transactions.

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AM

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AMA video by DA CONTENT TV on YouTube dives deep into a bold new prediction for Pi Network (PI). According to the discussion, there is growing optimism that the Pi price could surge dramatically, potentially hitting $5 much sooner than many expected.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

SublimeText3 English version

Recommended: Win version, supports code prompts!

SublimeText3 Linux new version

SublimeText3 Linux latest version

Notepad++7.3.1

Easy-to-use and free code editor