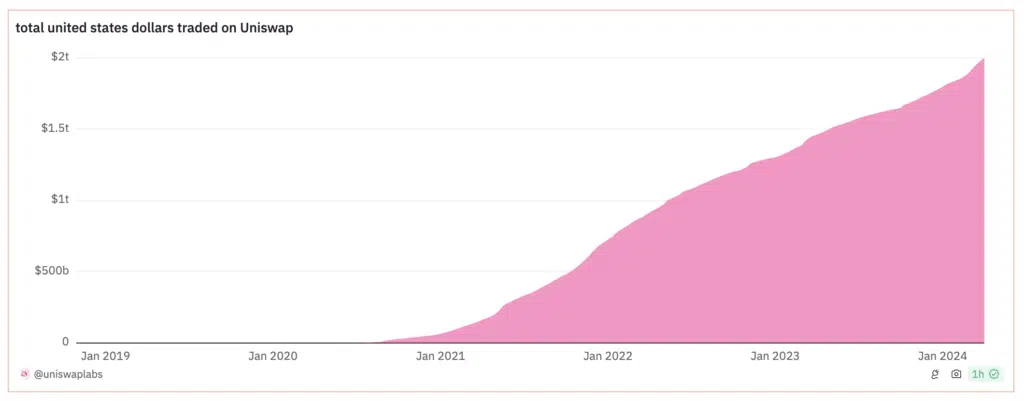

Since launching in late 2018, on-chain data shows that the DEX has processed over $2 trillion in cumulative volume on the Ethereum mainnet.

Uniswap, a decentralized exchange (DEX) built on Ethereum (ETH), has now processed over $2 trillion in cumulative volume on the network.

The DEX launched in late 2018 and has since seen a steady climb in processed volume, according to on-chain data. This growth highlights Uniswap's expansion over the years and the team's commitment to maintaining the platform's original design.

Unlike centralized exchanges such as Binance or Coinbase, Uniswap utilizes smart contracts to facilitate swaps. All transactions are initiated from a non-custodial wallet like MetaMask, ensuring that the holder maintains control of their assets throughout the process. No transaction is approved without the wallet owner's authorization.

Thanks to its unique value proposition, Uniswap has experienced remarkable growth. The latest figures from DeFiLlama show that the DEX commands over $4.9 billion in assets under management.

At this level, Uniswap ranks as the sixth-largest DeFi protocol, further cementing the dominance of Ethereum-based decentralized applications (dapps).

While users have the option to trade across three protocol versions, the latest iteration, v3, boasts the highest liquidity, managing over $3 billion. Notably, Uniswap v3 was the first DEX to introduce concentrated liquidity for better capital efficiency.

In addition to v3, Uniswap also enables swaps on multiple chains, including BNB Chain and Avalanche. However, DEX trading via Uniswap is predominantly concentrated on Ethereum, where the exchange manages over $3.9 billion.

As DeFi continues to gain traction and more traders prioritize trustless swaps, Uniswap is likely to process even higher volumes of transactions. Significantly, the DEX might lead DEX trading on Ethereum layer-2s, judging by the trends. According to DeFiLlama, the dapp has a total value locked (TVL) of over $277 million.

Considering the DEX's role on Ethereum and the fact that it's among the largest contributors to gas fees, UNI could stand to benefit in the coming sessions. On the daily chart, UNI is forming impressive higher highs and approaching a key resistance level.

After bottoming out at $4.7 in early August, the token has nearly doubled in valuation and is now poised to print fresh Q4 2024 highs. A breakout above $8.5 could trigger a wave of demand, potentially carrying UNI towards the $12 price point.

The above is the detailed content of Uniswap Processes Over $2 Trillion On Ethereum. For more information, please follow other related articles on the PHP Chinese website!

Uniswap 历史总交易量达到2万亿美元Apr 06, 2024 pm 06:37 PM

Uniswap 历史总交易量达到2万亿美元Apr 06, 2024 pm 06:37 PM去中心化交易所Uniswap自五年半前启动以来,其交易量已超过2万亿美元。根据DuneAnalytics的数据,Uniswap的交易量在4月5日跨越了一个重要水平。在创下新纪录之前,Uniswap团队发布了一条消息,称2万亿美元的交易量将在24小时内达成。UniswapLabs表示,将向首个记录并向该公司发送视频片段的人转账200个美元代币(USDC),该视频片段更新了DuneAnalytics仪表板,显示Uniswap的交易量已经超过2亿美元。DefiLlama数据显示,Uniswap是所有去

ATOM and UNI Holders Shift Focus to New Altcoin Rollblock, Set to 100x in DeFi Crypto MarketSep 12, 2024 pm 06:42 PM

ATOM and UNI Holders Shift Focus to New Altcoin Rollblock, Set to 100x in DeFi Crypto MarketSep 12, 2024 pm 06:42 PMUniswap's recent settlement with the CTFC has ignited a price surge, creating waves in the crypto world. Meanwhile, ATOM holders have started shifting their focus to a new altcoin that is catching everyone's eye.

Uniswap (UNI) Price Prediction 2024: Can UNI Price Extend to the $10 Mark This Week?Sep 12, 2024 pm 03:29 PM

Uniswap (UNI) Price Prediction 2024: Can UNI Price Extend to the $10 Mark This Week?Sep 12, 2024 pm 03:29 PMSince 2022, the Uniswap (UNI) price has been struggling to sustain over the $7 mark. In Q1 2024, the UNI buyers managed to smash the $7 mark but failed to sustain above that level.

一文详解以太坊Uniswap跨链意图新标准ERC7683Jun 08, 2024 am 10:04 AM

一文详解以太坊Uniswap跨链意图新标准ERC7683Jun 08, 2024 am 10:04 AM什么是跨链意图新标准ERC7683?ERC7683给我们带来什么?ERC7683有什么作用?以太坊ETF的通过预期,又点燃了ETHBeta的淘金热。主网交易的复苏,也势必辐射到以太坊的各L2生态上,例如Farcaster宣布巨额融资使得DEGEN又被关注,ETHBeta浪潮中大家又开始追逐OP...今天本站小编给大家详细介绍ERC7683跨链意图新标准,喜欢的朋友一起看看吧!Uniswap协议上L2的总交易量即将达到3000亿美元但回归到实际操作上,由于即时热点在各链随机出现,当用户想快速追热点

Uniswap 协议费用分配提案引爆市场,对 DeFi 的未来有何影响?Feb 27, 2024 am 08:22 AM

Uniswap 协议费用分配提案引爆市场,对 DeFi 的未来有何影响?Feb 27, 2024 am 08:22 AM在2月23日晚,Uniswap基金会治理负责人(GovLead)ErinKoen向Uniswap治理论坛发起提案提议,建议使用费用机制奖励那些已经委托并质押了他们代币的UNI代币持有者。自Uniswap在2020年9月中下旬宣布代币空投后的几年以来,一直有关于UNI是否应该捕获协议费用增加代币实用性的讨论,但几乎都无疾而终。而本次由Uniswap基金会负责人提出的提议则正式将UNI代币实用性摆放在治理层面上去讨论,也因此引起了不少持有者的狂欢,并带动了UNI以及其他一些DeFi协议代币的上涨。首

100% 的投票者支持Uniswap费用奖励提案Mar 03, 2024 pm 04:46 PM

100% 的投票者支持Uniswap费用奖励提案Mar 03, 2024 pm 04:46 PM摘要:•Uniswap社区正在支持一项将协议费用重新分配给UNI代币持有者的提案。•区块链分析公司TokenTerminal指出,UNI持有者可以获得超过5000万美元的收入。•自提案提出以来,UNI一直呈上升趋势,观察人士认为还有进一步上涨的空间。Uniswap是一家基于以太坊的去中心化交易所(DEX),正处于去中心化金融(DeFi)领域变革的边缘。旨在将协议费用重新分配给UNI代币持有者,这标志着网络民主化的重大进步。Uniswap社区支持新提案快照投票显示,社区对费用奖励提案给予压倒性的支

如何查询Uniswap币最新价格?Mar 05, 2024 pm 03:30 PM

如何查询Uniswap币最新价格?Mar 05, 2024 pm 03:30 PM如何查询Uniswap币最新价格Uniswap是一种基于以太坊区块链的去中心化交易平台,用户可以在该平台上进行加密货币交易。Uniswap代币(UNI)是Uniswap协议的治理代币,持有者可以参与对平台未来发展的投票。这种去中心化的交易所模式为用户提供了更大的自主权和透明度,使他们能够更直接地参与到平台的发展和决策过程中。Uniswap的开放性和透明性为加密货币交易带来了新的范式,同时也推动了区块链技术的发展查询Uniswap币最新价格的步骤:选择一个可靠的价格查询网站或应用程序。一些常用的价

OKX率先将Uniswap Labs API全面纳入OKX DeFi板块,推出OKX DEX意图交易功能Mar 07, 2024 am 10:30 AM

OKX率先将Uniswap Labs API全面纳入OKX DeFi板块,推出OKX DEX意图交易功能Mar 07, 2024 am 10:30 AM3月1日,领先的Web3科技公司OKX与备受信赖的DeFi公司UniswapLabs共同宣布,OKX已成为首批将UniswapLabs的交易API完全集成至其产品中的重要合作伙伴。本次集成主要是指在OKXDEX上推出意图交易模式功能,通过UniswapX聚合更广泛的流动性。OKXDEX的意图交易模式功能允许用户在以太坊网络上快速直观地交换代币,而无需支付gas费用。该功能通过UniswapLabs的UniswapX协议直接集成到OKXDEX界面中。UniswapX是一个开源的无许可协议,用于在公

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),