web3.0

web3.0 Ethereum (ETH) Price Surges 8% But Net 50,000 ETH Flow Into Derivative Exchange Raises Questions

Ethereum (ETH) Price Surges 8% But Net 50,000 ETH Flow Into Derivative Exchange Raises QuestionsIn a bullish trading week, Ethereum (ETH) surged by over 8% as its market price returned above the $2,600 price mark.

As the market price of Ethereum (ETH) returned above the $2,600 price mark in a bullish trading week, certain market developments have occurred which raises questions over the token’s future price movements.

Related Reading

Ethereum Price Consolidates: Preparing For The Next Move Higher

50,000 ETH Flow Into Derivative Exchange – Price To Rise Or Fall?

According to a Quicktake post on CryptoQuant, an analyst with username Amr Taha has reported there is a positive net flow of over 50,000 ETH valued at $132.12 million on derivative exchanges. In this context, net flow measures the difference between the amount of ETH deposited and the amount of ETH withdrawn from derivative exchanges, which are standard trading platforms for products such as options and futures contracts.

Hence, a positive net flow indicates a higher amount of ETH has been deposited than withdrawn on the last day. Analyzing the implications of this development on Ethereum’s price, Amr Taha has postulated two situations.

First, the analyst states that a positive net flow to derivative exchanges could indicate a potential rise in selling pressure as traders may be looking to offload their ETH either by opening a short position or selling through a futures contract at a predetermined price. Alternatively, a positive net flow may indicate that traders are depositing ETH to use as collateral for margin or future contracts betting that the price of ETH will rise, thus expressing confidence in the token’s profitability.

Essentially, this massive positive ETH net flow holds significant potential to swing Ethereum’s price either way based on traders’ actions.

Related Reading

Survey Finds Almost 70% Of Ethereum Institutional Investors Engaged In ETH Staking

Ethereum Prepares For Encounter With Crucial Resistance

In other news, Ethereum continues to trade at $2,636 reflecting gains of 1.11% and 12.89% in the last one and 30 days respectively. Meanwhile, the token’s daily trading volume is up by 12.89% and is valued at $17.06 billion.

However, despite these positive metrics, data from CoinMarketCap shows that market sentiment towards the altcoin is largely bearish as investors perhaps anticipate a price retracement following the ETH’s recent gain in the last week. Interestingly, the Ethereum daily chart shows the token is approaching a key resistance level at $2,700 which has served as a strong rejection zone over the last two months.

Albeit, the relative strength Index is still some significant distance away from the overbought zone indicating Ethereum’s price rally may be far from over and may break past this resistance level. In addition, analysts have observed an ascending triangle pattern on the ETH hourly chart indicating strong bullish potential to surge past $2,700 reaching as high as $2,870 in the coming days.

The above is the detailed content of Ethereum (ETH) Price Surges 8% But Net 50,000 ETH Flow Into Derivative Exchange Raises Questions. For more information, please follow other related articles on the PHP Chinese website!

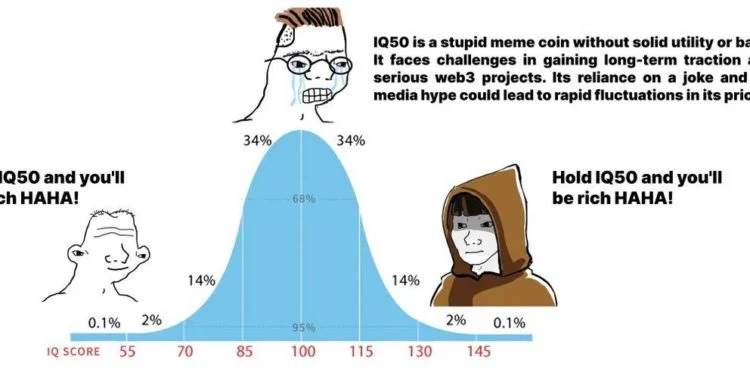

IQ50模因币免费空投教学!先签署ETH钱包再登记SOL链Mar 10, 2024 am 09:10 AM

IQ50模因币免费空投教学!先签署ETH钱包再登记SOL链Mar 10, 2024 am 09:10 AM一款名为“IQ50”的模因币项目近日引发社群热议,被戏称为“低智商才能暴富”的极具魔性。据悉,该Meme币将于今日北京时间下午5点(UTC9:00AM)在DeFi平台BakerySwap的BakeryLaunchpad上展开免费IDO,引起了投资者的关注。IQ50发行在Solana链上,总供应量505,050,505,050颗,其中80%(404,040,404,040颗)用于本次Launchpad空投,20%用于流动性池。如何参与IQ50的Launchpad?1.前往BakeryLaunchp

孙宇晨从币安撤资6000万美元,ETH占比最高,其次为AAVE、SHIB等Jan 24, 2024 pm 01:39 PM

孙宇晨从币安撤资6000万美元,ETH占比最高,其次为AAVE、SHIB等Jan 24, 2024 pm 01:39 PM最近,与波场创始人孙宇晨的加密货币生态系统相关的问题出现了一些骚动。首先,市值排名第五的稳定币TUSD在16日宣布与波场脱钩。然后,火币交易所在19日晚上8点发生了大规模故障。提领6,000万美元等值代币根据Lookonchain数据,从2023年12月18日开始,孙哥开始将资产从币安交易所撤出,并在链上大量囤币,总计提取价值达到6,000万美元等值的加密货币资产。这些资产包括多种加密货币,其中占比最高的是17,433枚ETH,价值高达4,300万美元。除此之外,在这一个月中,他还提取了68,9

Coinbase财报:第一季净利逾11亿美元!持有9千枚BTC、9万枚ETHMay 03, 2024 pm 03:40 PM

Coinbase财报:第一季净利逾11亿美元!持有9千枚BTC、9万枚ETHMay 03, 2024 pm 03:40 PM本站(120bTC.coM):美国合规交易所Coinbase在2024年第一季创造了16亿美元的收入,较上去年同期增长112%。净利逾11亿美元。而Coinbase自身因投资持有的加密资产,在本季增值认列了6.5亿美元的收益,股价持稳在200美元上方。交易收入大增,第一季营收达16亿美元Coinbase在2024年第一季创造了16亿美元的收入,较上去年同期增长112%。其中国际交易所(International)贡献了17%的收入。第一季消费者交易收入为9.35亿美元,季增99%。第一季消费者交

Pirate Nation将发币!免费Mint创世海盗NFT地板价暴涨1.3枚ETHJun 13, 2024 pm 01:20 PM

Pirate Nation将发币!免费Mint创世海盗NFT地板价暴涨1.3枚ETHJun 13, 2024 pm 01:20 PM本站(120btC.coM):在去年9月获得知名风投a16z领投3,300万美元种子轮融资的链游开发商ProofofPlay,在2022年4月推出链上RPG游戏PirateNation的beta测试版版本并测试至今,该链游最初在Polygon上线,后来转移至ArbitrumNova上。PirateNation目前仅开放有邀请码或持有PirateNation创世海盗NFT的用户游玩,游戏背景设定在一个海盗国度之中,玩家扮演海盗船长,需要建造船只、招募船员,为领地赚取经验、制作物品、升级装备,与具有

黄立成砸962枚ETH抄底FRIEND:币价上涨至10美元May 07, 2024 pm 01:43 PM

黄立成砸962枚ETH抄底FRIEND:币价上涨至10美元May 07, 2024 pm 01:43 PM基于Layer2网络Base的去中心化社交平台Friend.tech在去年8月正式上线后,因空投预期、获Paradigm等知名风投加持而迅速爆红,但这波热潮在去年10月就大幅消退,直到上月预告即将推出V2和开放空投申领后,才再度重拾社群关注。而Friend.tech在3日终于正式开放代币FRIEND空投申领,并在4日上线V2版本,不过FRIEND申领却惹出争议,社群抱怨申领网站太卡无法申领、以及无法全部申领,Friend.tech的V2版本引入主要新功能club,只有加入club,才有机会领取全

Ethereum (ETH) Open Interest Soars as Spot ETFs Go Live, Signaling Bullish Sentiment and Impending VolatilityJul 30, 2024 am 01:04 AM

Ethereum (ETH) Open Interest Soars as Spot ETFs Go Live, Signaling Bullish Sentiment and Impending VolatilityJul 30, 2024 am 01:04 AMThe value of Ether (ETH) has been on the rise lately, and so has Ethereum's open interest. While this signals bullish sentiment from traders, it also indicates

美国48名国会议员联名上书!要SEC主席讲清楚ETH是不是证券Mar 27, 2024 pm 09:20 PM

美国48名国会议员联名上书!要SEC主席讲清楚ETH是不是证券Mar 27, 2024 pm 09:20 PM美国国会再度施压美国证券交易委员会(SEC)澄清以太坊(ETH)是否为「证券」。两位具权威影响力的共和党众议员,即众议院金融服务委员会主席PatrickMcHenry和农业委员会主席Glenn“GT”Thompson,今日发表了一封联名信。他们要求SEC主席GaryGensler澄清,作为第一家数字资产证券特殊目的经纪商(SPBD)的Prometheum将如何在以太坊(ETH)尚未被定义为「证券」之前,合法地向客户提供ETH托管服务。这一举措引发了市场和监管机构之间对数字资产监管的持续关注,尤其

最强加密货币ETF要来了?BTC、ETH和SOL联合基金将出现申请Jul 23, 2024 am 09:10 AM

最强加密货币ETF要来了?BTC、ETH和SOL联合基金将出现申请Jul 23, 2024 am 09:10 AM本站(120bTC.coM):以太坊现货ETF正式上市的预期在经过多次落空之后,目前看来美东时间本周23日上市正逐渐成为现实。据芝加哥期权交易所(Cboe)显示,该平台已新增VanEck、Invesco、Fidelity、21Shares、FranklinTempleton等5档以太坊现货ETF信息,预计开放交易的时间就在7月23日。“我们很高兴地宣布,一种交易所交易产品(ETP)将于2024年7月23日在Cboe上架并作为新发行产品开始交易,这有待监管的有效性。”Cboe官网信息未来几个月内将

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

WebStorm Mac version

Useful JavaScript development tools

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.