web3.0

web3.0 Bitcoin (BTC) Bullish Thesis Above $100,000 Solidifies as ETF Market Crosses $20B in Total Net Flows

Bitcoin (BTC) Bullish Thesis Above $100,000 Solidifies as ETF Market Crosses $20B in Total Net FlowsBitcoin (BTC) Bullish Thesis Above $100,000 Solidifies as ETF Market Crosses $20B in Total Net Flows

Bitcoin (BTC), crypto's sole trillion-dollar asset, will inevitably cross six figures per coin due to a combination of institutional, macroeconomic, and on-chain factors

(Bitcoin price analysis) Bitcoin’s bullish case for hitting and surpassing $100,000 in upcoming months has only strengthened in recent weeks, Bitwise CIO Matt Hougan asserted in a new X post.

Bitcoin (BTC), crypto’s sole trillion-dollar asset, will inevitably cross six figures per coin due to a combination of institutional, macroeconomic, and on-chain factors, Hougan explained.

Exchange-traded fund expert Eric Balchunas stated that U.S. spot Bitcoin exchange-traded funds saw over $20 billion in total net flows. The American Bitcoin ETF complex enjoyed over $65 billion in assets under management following $1.5 billion in inflows this week.

Balchunas highlighted that ETFs tracking legacy assets, such as gold, took several years to reach these numbers. In contrast, Bitcoin products achieved this milestone within a year, signaling strong demand from both retail and institutional investors.

Bitcoin ETFs crossed $20b in total net flows (the most important number, most difficult metric to grow in the ETF world) for the first time after a huge week of $1.5b. For context, it took gold ETFs about 5yrs to reach the same number. Total assets now $65b, also a high water mark. pic.twitter.com/edldEimfqd

Hougan, together with QCP Capital and other experts, highlighted the upcoming U.S. presidential elections as a further catalyst for BTC price acceleration. Pro-Bitcoin candidate Donald Trump has led several on-chain betting polls on platforms like Kalshi and Polymarket.

There is also a growing outlook suggesting that BTC price will perform strongly irrespective of which party gains control of the White House.

Another bullish indicator mentioned by Hougan is the accumulation of Bitcoin by whales. Data from CryptoQuant showed that large Bitcoin holders have been purchasing the asset at record rates. According to CryptoQuant founder Ki Young Ju, Bitcoin open interest hit an all-time high of $20 billion, with new whale wallets now controlling 9.3% of the total supply.

New whale wallets now hold 1.97M #Bitcoin.

Each has over 1K BTC, average coin age under 155 days, excluding exchange and miner wallets, likely custodial.

Their BTC balance surged 813% YTD, taking up 9.3% of the total supply, valued at $132B today. pic.twitter.com/pxq0tcqMuW

Crypto proponents widely expect liquidity to flow into risk assets in the coming period, citing seasonal trends, new stock price highs, and global rate cuts by central banks, including the Federal Reserve.

Bitcoin has historically tended to gain during the fourth quarter, and experts suggest that the low-funding rate environment could further support this performance.

The above is the detailed content of Bitcoin (BTC) Bullish Thesis Above $100,000 Solidifies as ETF Market Crosses $20B in Total Net Flows. For more information, please follow other related articles on the PHP Chinese website!

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AM

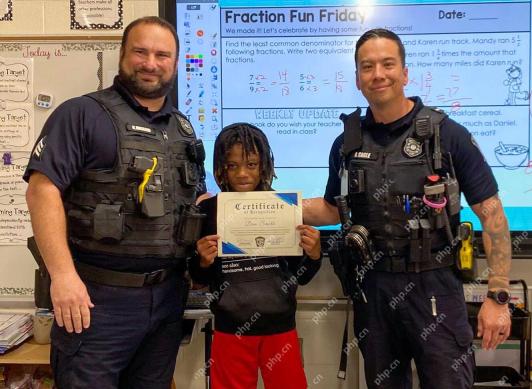

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AMFayetteville Police Department officers Kevin Ingram and David Cagle present Spring Hill Elementary fifth grader Dan Smith with a certificate of recognition for his heroic actions. By FPD

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AM

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AMArtificial Intelligence (AI) has begun to penetrate all aspects of human life, and governance is next. On April 14, the government of the United Arab Emirates (UAE) approved the implementation of what the media is calling the first AI-powered legisla

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AM

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AMOn-chain data reveals that large Shiba Inu investors, referred to as whales, sold their tokens as the coin's value declined.

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AM

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AMSmart crypto investors are looking for an asset with real-world utility and early potential gains in 2025. XRP and Chainlink (LINK) remain the bedrock of solid portfolios but new opportunities

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AM

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AMAs Bitcoin flirts with the $100,000 milestone and Ethereum climbs closer to the $2,000 mark, the eyes of crypto enthusiasts and investors alike are beginning to focus

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AM

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AMU.S. President Donald Trump’s media company, called Trump Media & Technology Group, is exploring yet another crypto-related venture, the company said in a letter to shareholders on Tuesday.

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AM

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AMTop 10 digital currency trading apps: 1. OKX, 2. Binance, 3. Coinbase, 4. Kraken, 5. Huobi, 6. KuCoin, 7. Bitfinex, 8. Gemini, 9. Bitstamp, 10. Poloniex, these platforms are all known for their security, user experience and diverse features, suitable for users with different needs to conduct digital currency transactions.

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AM

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AMA video by DA CONTENT TV on YouTube dives deep into a bold new prediction for Pi Network (PI). According to the discussion, there is growing optimism that the Pi price could surge dramatically, potentially hitting $5 much sooner than many expected.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

SublimeText3 English version

Recommended: Win version, supports code prompts!

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function