Ripple Confirms XRP and RLUSD Stablecoin Will Co-Exist Within Its Payment Solution

With growing anticipation for the launch of Ripple stablecoin RLUSD, Ripple has confirmed its ongoing commitment to utilizing both XRP and the stablecoin within its payment solutions.

Ripple Stablecoin RLUSD to Work Alongside XRP in Payment Solutions

With growing anticipation for the launch of Ripple stablecoin RLUSD, Ripple has confirmed its ongoing commitment to utilizing both XRP and the stablecoin within its payment solutions. During the first day of Ripple’s annual Swell conference, Ripple’s President Monica Long revealed key details about RLUSD’s exchange partners.

The stablecoin, once approved by the New York Department of Financial Services (NYDFS), will be listed on several major exchanges. These include Bitstamp, Independent Reserve, Bitso, MoonPay, CoinMENA, Bullish, and Uphold. The stablecoin is designed for use in various financial applications, including payments, tokenization, and decentralized finance (DeFi).

She stated that the stablecoin was developed in response to the demand for an enterprise-grade stablecoin, which is expected to provide stability and trust in the digital payments landscape.

Ripple highlighted RLUSD’s intended role within its ecosystem, emphasizing its utility for large-scale financial applications. The stablecoin is built to serve Ripple’s institutional clients and enterprise partners, providing a reliable and compliant solution for payments and tokenization. Long stressed that the stablecoin was designed to offer liquidity, security, and compliant infrastructure for businesses relying on stable digital currencies.

Ripple also announced that RLUSD will be supported by regular independent audits of its reserves, which are backed by U.S. Treasury bonds, dollar deposits, and cash equivalents. This level of transparency is aimed at instilling confidence in the stablecoin as it nears its public launch.

There have been speculations that RLUSD could overshadow the native token in Ripple’s payment solution, particularly as Ripple navigates its ongoing legal battle with the U.S. Securities and Exchange Commission (SEC). Long assured the community that both the token and stablecoin will work together.

Long dismissed these concerns, reaffirming that XRP would continue to play a central role in cross-border settlements. Ripple’s clients will have the flexibility to choose between the native token and RLUSD, allowing for more efficient, reliable, and cost-effective transactions. Both assets will be integral to Ripple’s broader vision for facilitating cross-border payments.

In addition to Long’s comments, Ripple CTO David Schwartz also addressed the concerns surrounding the asset’s future. He confirmed that the stablecoin would not replace the native token, especially given the token’s unique role in Ripple’s payment infrastructure.

Schwartz pointed out that only the token can be used to pay transaction fees on the XRP Ledger, a function that cannot be fulfilled by the stablecoin or any other tokens. He further emphasized that the token carries certain advantages over other digital assets, including its ability to operate without counterparty risk, its jurisdictional flexibility, and the fact that the token cannot be frozen on the XRPL. These features make it distinct and irreplaceable within Ripple’s ecosystem.

RLUSD is currently undergoing beta testing on the XRP Ledger and Ethereum networks, and Ripple has been actively preparing for its full public release. As of October 16, the stablecoin’s total supply was $47.4 million, with $34.8 million issued on XRPL and $12.6 million minted on Ethereum.

Ripple has also formed an advisory board for the stablecoin, which includes prominent financial figures such as Ripple co-founder Chris Larsen, former FDIC Chair Sheila Bair, and former JPMorgan executive David Ruth. The advisory board will guide as Ripple navigates the regulatory landscape and prepares for the stablecoin’s mainnet launch.

However, the public release of the stablecoin remains contingent upon approval from the New York Department of Financial Services. Ripple has indicated that the regulatory review is ongoing, with the launch expected to occur before the end of the year. Once approved, the stablecoin will be available on the previously mentioned exchanges, marking a significant milestone for Ripple’s payment solution.

With the stablecoin’s launch and the native token’s continued role in cross-border settlements, Ripple is poised to strengthen its position in the digital payments industry. The focus now shifts to regulatory approval, as Ripple awaits the green light from NYDFS to move forward with RLUSD’s public debut.

: 이 콘텐츠는 정보를 제공하기 위한 것이며 재정적 조언으로 간주되어서는 안 됩니다. 본 기사에 표현된 견해는 작성자의 개인적인 의견을 포함할 수 있으며 타임즈 타블로이드의 의견을 대변하지 않습니다. 독자들은 투자 결정을 내리기 전에 심층적인 조사를 수행할 것을 권장합니다. 독자가 취한 모든 조치는 전적으로 독자의 책임입니다. 타임즈 타블로이드는 어떠한 금전적 손실에 대해서도 책임을 지지 않습니다.

Twitter, Facebook, Telegram, Google News에서 팔로우하여 최신 소식을 받아보세요.

The above is the detailed content of Ripple Confirms XRP and RLUSD Stablecoin Will Co-Exist Within Its Payment Solution. For more information, please follow other related articles on the PHP Chinese website!

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PM

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PMThis sharp drop happened as investor interest faded and a major scandal hit the highly speculative market.

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PM

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PMDespite being pretty much the iconic example of “random” – well, that and dice rolls – we can't help but feel like there's some element of skill involved. Especially when we lose.

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AM

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AMBitwise, a leading digital asset manager, has announced the listing of four of its crypto Exchange-Traded Products (ETPs) on the London Stock Exchange (LSE).

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AM

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AMBitcoin may be poised for a massive rally—but only if gold continues its upward climb, according to Joe Consorti, Head of Growth at Theya.

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AM

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AMThe Shiba Inu price continues to attract the attention of analysts, who are watching for its next potential move. By Samuele Piar. Updated April 14, 2025.

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AM

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AMThe joint motion of Ripple and U.S. Securities and Exchange Commission (SEC) to hold the appeal in abeyance has been granted by the Circuit Judge Jose A. Cabranes.

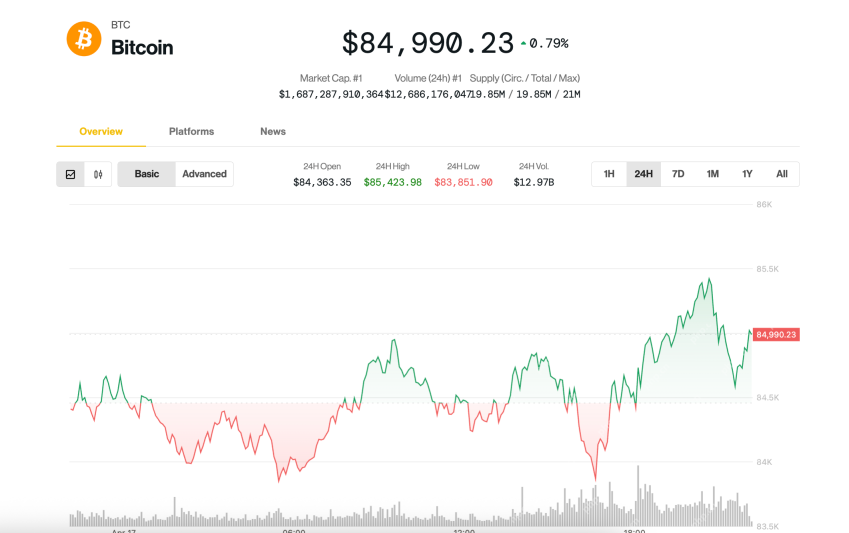

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AM

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AMBitcoin (BTC) was treading water just below $85,000 late Thursday as tensions between U.S. President Donald Trump and Federal Reserve Chair Jerome Powell added another layer of uncertainty for investors.

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AM

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AMToday, AB DAO officially announced the launch of a dual reward campaign in collaboration with Bitget (bitget.com), the world's second-largest digital asset trading platform.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

Dreamweaver CS6

Visual web development tools

WebStorm Mac version

Useful JavaScript development tools

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

Notepad++7.3.1

Easy-to-use and free code editor