Thailand Bank SCB Unveils New Stablecoin Remittance

Siam Commercial Bank (SCB) has teamed up with SCB 10X to launch the first cross-border payment using stablecoins in Thailand.

Siam Commercial Bank (SCB) has announced the launch of the first cross-border stablecoin payment solution in Thailand, in partnership with SCB 10X and Lightnet.

The new solution aims to provide a simple, fast, and cost-effective cross-border payment service, powered by stablecoins and public blockchain technology. It enables users to send and receive cross-border payments in a matter of minutes, around the clock, and at lower transaction costs compared to traditional methods.

Additionally, the service allows for easy conversion between stablecoins and local currencies at the point of transaction, enhancing flexibility and convenience for users. The initiative also marks a significant milestone in the financial services landscape in Thailand, thanks to the collaboration between SCB and Lightnet.

To ensure the secure handling of digital assets in this new payment solution, Fireblocks is providing its custody solutions. By leveraging Fireblocks’ custody technology, SCB aims to maintain the highest levels of security during the asset trading process, minimizing any risk of asset theft or loss.

Commenting on the partnership, Michael Shaulov, CEO and Co-founder of Fireblocks, said, “Through the use of Fireblocks’ secure custody technology, the cross-border transactions will not only be faster and easier but also more secure.”

This added layer of protection becomes crucial as the financial industry rapidly integrates digital assets, while concerns over security breaches remain prevalent.

The stablecoin remittance project is notably among the first to complete the Bank of Thailand’s (BOT) regulatory sandbox, which concluded in October 2024. The sandbox, overseen by the Thailand Securities and Exchange Commission (SEC), provides financial institutions with an opportunity to experiment with new financial solutions and products, such as those powered by blockchain technology and digital assets.

As part of a broader initiative to foster cryptocurrency and blockchain innovation in the country, Thai regulators established the regulatory sandbox. For instance, the SEC’s Digital Asset Regulatory Sandbox launched in 2024, allowing financial firms to conduct trials of cryptocurrencies within a legal framework. It received positive feedback during the public hearing and has opened up new avenues for financial innovation within Thailand’s digital asset market.

The completion of SCB’s stablecoin project through the sandboxing process signifies that the system has undergone the necessary regulatory assessment and is ready to be introduced to the commercial market. This milestone also paves the way for further adoption of blockchain technology within the traditional banking sector.

Following the successful launch of the service for retail use cases, SCB and Lightnet are now preparing to expand the service to corporate clients. The aim is to provide businesses with the same advantages currently enjoyed by individual customers, such as lower transaction costs, faster payments, and 24/7 availability.

Eliminating pre-funding requirements and operational inefficiencies will streamline cash flow management for corporate clients, especially those engaged in international trade. This will provide businesses with a seamless and cost-effective solution for both inbound and outbound remittances.

The above is the detailed content of Thailand Bank SCB Unveils New Stablecoin Remittance. For more information, please follow other related articles on the PHP Chinese website!

Tether CEO Paolo Ardoino Completes Visit to the United States, Meeting with Lawmakers in Washington, D.C. to Discuss Stablecoin RegulationApr 15, 2025 am 11:24 AM

Tether CEO Paolo Ardoino Completes Visit to the United States, Meeting with Lawmakers in Washington, D.C. to Discuss Stablecoin RegulationApr 15, 2025 am 11:24 AMHis visit comes as the U.S. Congress moves closer to introducing legislation regulating stablecoins, which Ardoino believes is necessary for financial inclusion and preserving U.S. dollar dominance.

Why XRP Price May Not 'Go Parabolic' Post-SEC SettlementApr 15, 2025 am 11:22 AM

Why XRP Price May Not 'Go Parabolic' Post-SEC SettlementApr 15, 2025 am 11:22 AMThe XRP price holds still in the $2.10-2.20 range for the past few days, but this is not stopping Ripple's community from continuing to post various content about XRP

Metaplanet Expands Its Bitcoin Treasury Holdings by Another 319 BTCApr 15, 2025 am 11:20 AM

Metaplanet Expands Its Bitcoin Treasury Holdings by Another 319 BTCApr 15, 2025 am 11:20 AMIn an announcement made earlier today, Japanese firm Metaplanet revealed it has acquired another 319 Bitcoin (BTC), pushing its total corporate holdings beyond 4,500 BTC.

Metaplanet Scoops Another 319 Bitcoin, Pushing Its Total Corporate Holdings Beyond 4500Apr 15, 2025 am 11:18 AM

Metaplanet Scoops Another 319 Bitcoin, Pushing Its Total Corporate Holdings Beyond 4500Apr 15, 2025 am 11:18 AMIn an announcement made earlier today, Japanese firm Metaplanet revealed it has acquired another 319 Bitcoin (BTC), pushing its total corporate holdings beyond 4,500 BTC.

Ripple (XRP) price rallied through a weekend riseApr 15, 2025 am 11:16 AM

Ripple (XRP) price rallied through a weekend riseApr 15, 2025 am 11:16 AMRipple (XRP) price rallied through a weekend rise from its $2.00 critical support mark to reach $2.23.

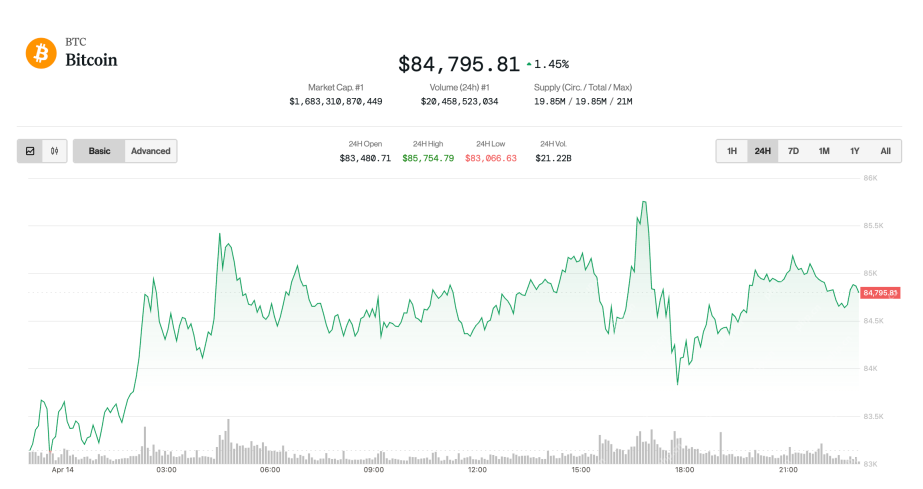

Bitcoin (BTC) drifts upwards as the broader market adjusts favorably to trade-related newsApr 15, 2025 am 11:14 AM

Bitcoin (BTC) drifts upwards as the broader market adjusts favorably to trade-related newsApr 15, 2025 am 11:14 AMThe largest cryptocurrency was up 1.6% in the last 24 hours and is now trading just shy of $85,000. Ether (ETH), meanwhile, rose 2.7%

Is ADA the Sleeper Pick for the Next Bull Run? Hoskinson's $250K BTC Forecast Says YesApr 15, 2025 am 11:12 AM

Is ADA the Sleeper Pick for the Next Bull Run? Hoskinson's $250K BTC Forecast Says YesApr 15, 2025 am 11:12 AMADA has risen by 1.5% in the past 24 hours, with its move to $0.644 coming as the crypto market suffers a 2% loss today.

Solana Leads Market Recovery After Brief Dip Below $100Apr 15, 2025 am 11:10 AM

Solana Leads Market Recovery After Brief Dip Below $100Apr 15, 2025 am 11:10 AMJimmy has nearly 10 years of experience as a journalist and writer in the blockchain industry. He has worked with well-known publications such as Bitcoin Magazine, CCN, and Blockonomi, covering news...

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 Chinese version

Chinese version, very easy to use

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

Zend Studio 13.0.1

Powerful PHP integrated development environment

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

Atom editor mac version download

The most popular open source editor