web3.0

web3.0 Trump-Themed Political Finance (PoliFi) Tokens Show Resilience, as the US presidential election intensifies

Trump-Themed Political Finance (PoliFi) Tokens Show Resilience, as the US presidential election intensifiesThe competition between candidates Donald Trump and Kamala Harris is heating up. Right now, prevailing trends on Polymarket suggest Trump is likely to win

As the U.S presidential election draws near, the competition between candidates Donald Trump and Kamala Harris is intensifying. According to prevailing trends on Polymarket, Trump is likely to win the 2024 elections. However, the election is still too close to call.

PoliFi tokens show resilience

Lately, Donald Trump-themed Political Finance (PoliFi) tokens have shown resilience, defying the low volatility that Bitcoin [BTC] and the broader cryptocurrency market have been experiencing. This surge in interest is a sign of the growing optimism surrounding Trump’s electoral prospects, which climbed to a two-month high on Polymarket.

On 10 October, BTC slid by over 4%. The following day, it rebounded and stabilized above $60,000.

Many suggest that the surge in inflation pressure in September contributed to this downturn. Major cryptocurrencies such as Ethereum [ETH] and Dogecoin [DOGE] saw large declines too, plunging by as much as 6%.

Trump-themed memecoins soared high

On the contrary, Trump-themed tokens, including MAGA [TRUMP], MAGA HAT [MAGA], and Doland Tremp [TREMP], showcased remarkable resilience – Each soaring by double digits this week.

Notably, MAGA, the largest of these tokens, surged by 55% over the week, surpassing a market cap of $200 million. MAGA HAT and TREMP recorded impressive gains of 102% and 93%, respectively, too.

By 11 October, the broader cryptocurrency market showed some signs of recovery though, according to CoinMarketCap. BTC gained by 0.30% at press time, while ETH and DOGE hiked by 1.24% and 2.07%, respectively, on the 24-hour charts.

According to the latest update from CoinGecko, the total market cap for PolitiFi tokens hit $819 million after posting a 14.2% hike in just a day.

TRUMP surged by 14.3%, TREMP climbed by 15.5%, and MAGA rose by 19.7% within 24 hours.

These three tokens emerged as the trending assets in the top PolitiFi coins by market cap. This is a sign of their significant impact on the market, as per CoinGecko.

Update on KAMA

On the other hand, the Kamala Harris-themed memecoin, Kamala Horris [KAMA], also saw a double-digit hike of 10.4% in a day.

However, it remained far behind, ranking in the 10th position and being overshadowed by nine Trump-related memecoins that dominated the market.

This trend was not limited to memecoins either as Polymarket indicated that Trump is significantly outpacing Harris in popularity and potential support.

Polymarket’s trend

The prediction market highlighted this disparity, showcasing the ongoing momentum behind Trump-themed assets as the election race intensifies.

Echoing a similar sentiment was an X (formerly Twitter) user who said,

However, not everyone shares this sentiment. Another user on X, classicsgroyp, raised an important point. He stated,

“Polymarket is owned by Peter Thiel who owns JD Vance btw.”

The post emphasized that Polymarket’s predictions can be unreliable, as they are often influenced by Trump and his vice-presidential running mate, J.D. Vance.

Therefore, while current trends suggest a clear lead for Trump, the outcome remains uncertain until 5 November.

The above is the detailed content of Trump-Themed Political Finance (PoliFi) Tokens Show Resilience, as the US presidential election intensifies. For more information, please follow other related articles on the PHP Chinese website!

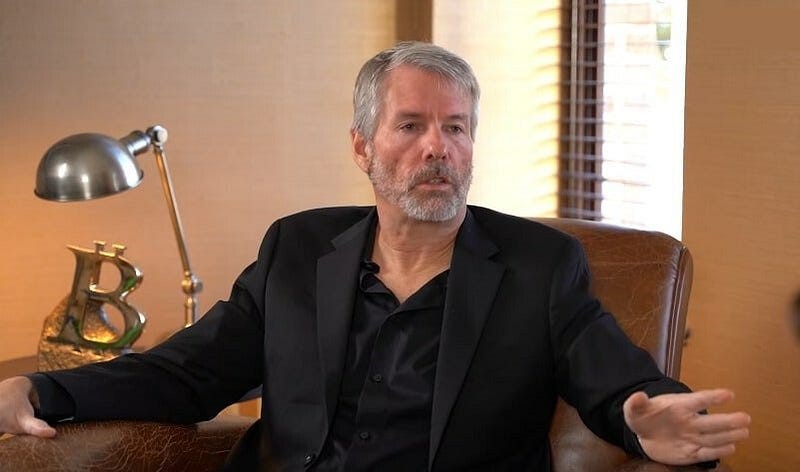

Michael Saylor Drops New Bitcoin Price Prediction, Now Targeting $13M per Coin by 2045Jul 27, 2024 pm 09:12 PM

Michael Saylor Drops New Bitcoin Price Prediction, Now Targeting $13M per Coin by 2045Jul 27, 2024 pm 09:12 PMMichael Saylor popular Bitcoin activist and co-founder of MicroStrategy, a business intelligence firm has dropped his latest prediction for Bitcoin price in the ongoing Bitcoin 2024 conference in Nashville.

Kamala Harris Rumored to Be More Open-Minded About Cryptocurrency and Blockchain TechnologyJul 28, 2024 am 12:23 AM

Kamala Harris Rumored to Be More Open-Minded About Cryptocurrency and Blockchain TechnologyJul 28, 2024 am 12:23 AMThe crypto world was abuzz this week with rumors that Kamala Harris, the newly declared Democratic presidential candidate, was in talks to speak at the Bitcoin 2024 conference in Nashville.

Senator Bill Hagerty Welcomes Former US President Donald Trump to Nashville for Bitcoin 2024 ConferenceJul 27, 2024 am 07:22 AM

Senator Bill Hagerty Welcomes Former US President Donald Trump to Nashville for Bitcoin 2024 ConferenceJul 27, 2024 am 07:22 AMOne of the most important points of focus in the US Presidential race has been the policy of both parties regarding Bitcoin and cryptocurrencies.

SHIB Price Could Reach $0.0007 by 2050 if It Follows Bitcoin to Hit $2.9MJul 27, 2024 pm 06:25 PM

SHIB Price Could Reach $0.0007 by 2050 if It Follows Bitcoin to Hit $2.9MJul 27, 2024 pm 06:25 PMShiba Inu price could potentially reach unprecedented heights if SHIB follows Bitcoin should the premier crypto asset hit $2.9 million as predicted by VanEck.

MicroStrategy CEO Michael Saylor Still Uber-Bullish on Bitcoin, Predicts $13M per BTC by 2045Jul 28, 2024 am 12:21 AM

MicroStrategy CEO Michael Saylor Still Uber-Bullish on Bitcoin, Predicts $13M per BTC by 2045Jul 28, 2024 am 12:21 AMMicroStrategy's Chairman and CEO Michael Saylor is still uber-bullish on Bitcoin [BTC]. During his keynote addresss at the Bitcoin 2024 conference in Nashville

Trump Courts Crypto Cash as Bitcoin Enthusiasts Unite Behind His Bid for the White HouseJul 27, 2024 pm 09:09 PM

Trump Courts Crypto Cash as Bitcoin Enthusiasts Unite Behind His Bid for the White HouseJul 27, 2024 pm 09:09 PMMany of the nation's leading cryptocurrency companies, executives, investors and fanatics are beginning to unite around former president Donald Trump's bid for the White House

Ferrari Expands Cryptocurrency Payment Option to European Merchants by End of July 2024Jul 25, 2024 pm 02:28 PM

Ferrari Expands Cryptocurrency Payment Option to European Merchants by End of July 2024Jul 25, 2024 pm 02:28 PMFollowing CNF's earlier update that Ferrari is accepting Bitcoin, Ripple (XRP), and other cryptocurrencies as payment for its cars, it is now reported that Ferrari will expand its cryptocurrency payment option to European dealers by the end o

Kamala Harris Won't Be Speaking at Bitcoin 2024 Conference, David Bailey Indirectly Shows Support for Donald TrumpJul 25, 2024 pm 02:31 PM

Kamala Harris Won't Be Speaking at Bitcoin 2024 Conference, David Bailey Indirectly Shows Support for Donald TrumpJul 25, 2024 pm 02:31 PMWith the American President Joe Biden deciding not to run for re-election, Vice President Kamala Harris is now a top contender for the presidential race. Recently, she spoke about Bitcoin and cryptocurrencies, making her stance clear.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

Atom editor mac version download

The most popular open source editor

Dreamweaver Mac version

Visual web development tools

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 English version

Recommended: Win version, supports code prompts!