web3.0

web3.0 Ethereum (ETH) Price Analysis: Key Support Level at $2300, Potential Market Sell-off if Breached

Ethereum (ETH) Price Analysis: Key Support Level at $2300, Potential Market Sell-off if BreachedEthereum [ETH] has followed a different trajectory to Bitcoin in the past week, registering moderate gains on its monthly price charts.

Ethereum [ETH] price action has been moderate compared to Bitcoin’s trajectory in the past week. While BTC registered losses, ETH noted gains on the monthly price charts.

At the time of writing, Ethereum was trading at $2,404, noting a 1.06% increase on the weekly charts. Interestingly, ETH also noted gains on the daily charts.

However, ETH is still trading at a distance from its recent high of $2,700 and 50.7% away from its all-time high of $4,878. But crypto analyst Ali Martinez highlighted a crucial support level for the second-largest cryptocurrency.

According to Martinez, the key support level for Ethereum is at $2,300. His analysis pointed out that 2.4 million addresses purchased 52.6 million ETH tokens at $2,300. He added that ETH needs to hold above this level to avoid a mass sell-off.

If Ethereum fails to maintain this demand zone, it could trigger a mass sell-off as investors try to minimize losses, leading to increased selling pressure and driving prices down.

Crucially, Ethereum’s Exchange Supply ratio noted a slight increase from 0.143 on 21 May to 0.1443 on 25 May. This suggests that holders may be preparing to sell or take profits. It is typically a bearish signal as investors move their ETH from private wallets to exchanges.

Moreover, Ethereum’s Exchange Reserve has been increasing throughout the week and was valued at $18.7 million at press time. This observation supports the notion that investors are transferring their ETH to exchanges, potentially leading to selling pressure and pushing prices down.

Interestingly, Ethereum’s MVRV long/short difference has remained negative over the past month. This indicates that long-term holders are seeing losses while short-term holders are profitable, potentially leading to long-term holder capitulation and greater selling pressure.

According to an analysis, Ethereum has been trading within a multi-month descending channel. Accompanied by negative market sentiment, Ethereum could decline before a breakout from this trend. If it sees a pullback, Ethereum will find the net support at $2,325.

The above is the detailed content of Ethereum (ETH) Price Analysis: Key Support Level at $2300, Potential Market Sell-off if Breached. For more information, please follow other related articles on the PHP Chinese website!

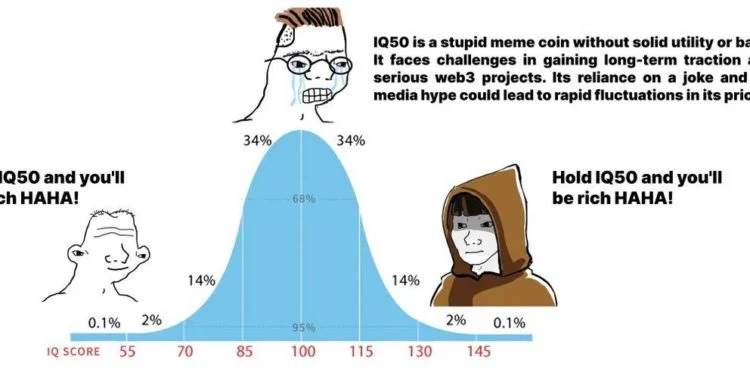

IQ50模因币免费空投教学!先签署ETH钱包再登记SOL链Mar 10, 2024 am 09:10 AM

IQ50模因币免费空投教学!先签署ETH钱包再登记SOL链Mar 10, 2024 am 09:10 AM一款名为“IQ50”的模因币项目近日引发社群热议,被戏称为“低智商才能暴富”的极具魔性。据悉,该Meme币将于今日北京时间下午5点(UTC9:00AM)在DeFi平台BakerySwap的BakeryLaunchpad上展开免费IDO,引起了投资者的关注。IQ50发行在Solana链上,总供应量505,050,505,050颗,其中80%(404,040,404,040颗)用于本次Launchpad空投,20%用于流动性池。如何参与IQ50的Launchpad?1.前往BakeryLaunchp

孙宇晨从币安撤资6000万美元,ETH占比最高,其次为AAVE、SHIB等Jan 24, 2024 pm 01:39 PM

孙宇晨从币安撤资6000万美元,ETH占比最高,其次为AAVE、SHIB等Jan 24, 2024 pm 01:39 PM最近,与波场创始人孙宇晨的加密货币生态系统相关的问题出现了一些骚动。首先,市值排名第五的稳定币TUSD在16日宣布与波场脱钩。然后,火币交易所在19日晚上8点发生了大规模故障。提领6,000万美元等值代币根据Lookonchain数据,从2023年12月18日开始,孙哥开始将资产从币安交易所撤出,并在链上大量囤币,总计提取价值达到6,000万美元等值的加密货币资产。这些资产包括多种加密货币,其中占比最高的是17,433枚ETH,价值高达4,300万美元。除此之外,在这一个月中,他还提取了68,9

Coinbase财报:第一季净利逾11亿美元!持有9千枚BTC、9万枚ETHMay 03, 2024 pm 03:40 PM

Coinbase财报:第一季净利逾11亿美元!持有9千枚BTC、9万枚ETHMay 03, 2024 pm 03:40 PM本站(120bTC.coM):美国合规交易所Coinbase在2024年第一季创造了16亿美元的收入,较上去年同期增长112%。净利逾11亿美元。而Coinbase自身因投资持有的加密资产,在本季增值认列了6.5亿美元的收益,股价持稳在200美元上方。交易收入大增,第一季营收达16亿美元Coinbase在2024年第一季创造了16亿美元的收入,较上去年同期增长112%。其中国际交易所(International)贡献了17%的收入。第一季消费者交易收入为9.35亿美元,季增99%。第一季消费者交

Pirate Nation将发币!免费Mint创世海盗NFT地板价暴涨1.3枚ETHJun 13, 2024 pm 01:20 PM

Pirate Nation将发币!免费Mint创世海盗NFT地板价暴涨1.3枚ETHJun 13, 2024 pm 01:20 PM本站(120btC.coM):在去年9月获得知名风投a16z领投3,300万美元种子轮融资的链游开发商ProofofPlay,在2022年4月推出链上RPG游戏PirateNation的beta测试版版本并测试至今,该链游最初在Polygon上线,后来转移至ArbitrumNova上。PirateNation目前仅开放有邀请码或持有PirateNation创世海盗NFT的用户游玩,游戏背景设定在一个海盗国度之中,玩家扮演海盗船长,需要建造船只、招募船员,为领地赚取经验、制作物品、升级装备,与具有

黄立成砸962枚ETH抄底FRIEND:币价上涨至10美元May 07, 2024 pm 01:43 PM

黄立成砸962枚ETH抄底FRIEND:币价上涨至10美元May 07, 2024 pm 01:43 PM基于Layer2网络Base的去中心化社交平台Friend.tech在去年8月正式上线后,因空投预期、获Paradigm等知名风投加持而迅速爆红,但这波热潮在去年10月就大幅消退,直到上月预告即将推出V2和开放空投申领后,才再度重拾社群关注。而Friend.tech在3日终于正式开放代币FRIEND空投申领,并在4日上线V2版本,不过FRIEND申领却惹出争议,社群抱怨申领网站太卡无法申领、以及无法全部申领,Friend.tech的V2版本引入主要新功能club,只有加入club,才有机会领取全

Ethereum (ETH) Open Interest Soars as Spot ETFs Go Live, Signaling Bullish Sentiment and Impending VolatilityJul 30, 2024 am 01:04 AM

Ethereum (ETH) Open Interest Soars as Spot ETFs Go Live, Signaling Bullish Sentiment and Impending VolatilityJul 30, 2024 am 01:04 AMThe value of Ether (ETH) has been on the rise lately, and so has Ethereum's open interest. While this signals bullish sentiment from traders, it also indicates

美国48名国会议员联名上书!要SEC主席讲清楚ETH是不是证券Mar 27, 2024 pm 09:20 PM

美国48名国会议员联名上书!要SEC主席讲清楚ETH是不是证券Mar 27, 2024 pm 09:20 PM美国国会再度施压美国证券交易委员会(SEC)澄清以太坊(ETH)是否为「证券」。两位具权威影响力的共和党众议员,即众议院金融服务委员会主席PatrickMcHenry和农业委员会主席Glenn“GT”Thompson,今日发表了一封联名信。他们要求SEC主席GaryGensler澄清,作为第一家数字资产证券特殊目的经纪商(SPBD)的Prometheum将如何在以太坊(ETH)尚未被定义为「证券」之前,合法地向客户提供ETH托管服务。这一举措引发了市场和监管机构之间对数字资产监管的持续关注,尤其

最强加密货币ETF要来了?BTC、ETH和SOL联合基金将出现申请Jul 23, 2024 am 09:10 AM

最强加密货币ETF要来了?BTC、ETH和SOL联合基金将出现申请Jul 23, 2024 am 09:10 AM本站(120bTC.coM):以太坊现货ETF正式上市的预期在经过多次落空之后,目前看来美东时间本周23日上市正逐渐成为现实。据芝加哥期权交易所(Cboe)显示,该平台已新增VanEck、Invesco、Fidelity、21Shares、FranklinTempleton等5档以太坊现货ETF信息,预计开放交易的时间就在7月23日。“我们很高兴地宣布,一种交易所交易产品(ETP)将于2024年7月23日在Cboe上架并作为新发行产品开始交易,这有待监管的有效性。”Cboe官网信息未来几个月内将

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

Atom editor mac version download

The most popular open source editor

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

Dreamweaver Mac version

Visual web development tools

Zend Studio 13.0.1

Powerful PHP integrated development environment