Bitcoin Rally In Q4? Whales Have Been Accumulating BTC Heavily Over the Past Six Months

Bitcoin is experiencing significant volatility and uncertainty after falling below the $60,000 mark. This dip has sparked mixed reactions among investors.

Bitcoin’s price continues to experience significant volatility and uncertainty after dipping below the crucial $60,000 mark. This price movement has elicited contrasting reactions from investors.

While some view this dip as a potential bear trap, indicating that the price may soon rally, others express concerns that the market could be headed for a deeper correction.

However, critical data from CryptoQuant reveals that Bitcoin whales have accumulated BTC heavily over the past six months.

As the price hovers just above the key $60,000 level, many speculate on the current market conditions. Could this prolonged accumulation period by large holders signal a bullish outlook for the coming months? Or is the market still at risk of further downside?

Bitcoin has been in a 6-month accumulation phase, according to on-chain data from CryptoQuant. After reaching new all-time highs of around $73,000 in March, the price entered a falling range that has persisted, leaving many wondering if BTC’s decline was part of a larger strategy.

Some suggest that the downward movement was influenced by price manipulation and accumulation tactics employed by Bitcoin whales and market makers. These large holders have been buying heavily over the past several months.

Crypto analyst and investor Axel Adler has highlighted this trend, sharing a chart on Twitter that shows whales’ aggressive accumulation. According to his analysis, whales with balances of over 1,000 BTC have added a staggering 1.5 million BTC to their holdings in the past six months.

This buying activity typically precedes a major bullish movement, as large holders accumulate during periods of uncertainty, expecting a significant price surge shortly.

For investors keeping a close eye on Bitcoin, this data paints a promising picture. Many believe this accumulation phase could trigger a rally in the final quarter of 2024, pushing BTC to new highs. As whales continue to buy, the potential for a sharp upward move grows, creating a positive outlook for long-term holders who remain bullish on Bitcoin’s future trajectory.

BTC Holding Above Key Demand Level

Bitcoin is currently trading at $61,000, just 1% away from the 4-hour 200 moving average (MA) and 200 exponential moving average (EMA). These levels are critical for determining the short-term price action. The key level to watch is $62,000 for bullish momentum to continue.

If BTC can reclaim the 4-hour MA and EMA and break above the $62,000 resistance, a bullish continuation toward $66,000 is likely.

However, the market remains uncertain, and if Bitcoin fails to hold above the $60,000 support level and does not push higher toward $62,000, traders could see a deeper correction. In such a scenario, BTC may fall to test lower support levels, with a potential retracement to $57,500.

Investors are closely watching these key levels as the price movement in the coming days will likely set the tone for Bitcoin’s next major trend. Whether Bitcoin rallies past $62,000 or dips below $60,000 will determine whether bulls or bears will dominate the market in the short term.

The above is the detailed content of Bitcoin Rally In Q4? Whales Have Been Accumulating BTC Heavily Over the Past Six Months. For more information, please follow other related articles on the PHP Chinese website!

amazon project kuiper satellite launchApr 10, 2025 pm 05:36 PM

amazon project kuiper satellite launchApr 10, 2025 pm 05:36 PMAmazon's Project Kuiper satellite launch was postponed due to unfavorable weather conditions. The delay was likely influenced by factors such as high-altitude wind shear, lightning threats, and high surface winds, which are common hazards in space launches. This postponement highlights the need for meticulous planning and flexibility in the unpredictable environment of space operations.

Is Wall Street Quietly Backing Solana? $42 Million Bet Says YesApr 10, 2025 pm 12:43 PM

Is Wall Street Quietly Backing Solana? $42 Million Bet Says YesApr 10, 2025 pm 12:43 PMA group of former Kraken executives acquired U.S.-listed company Janover, which secured $42 million in venture capital funding to begin building a Solana (SOL) treasury.

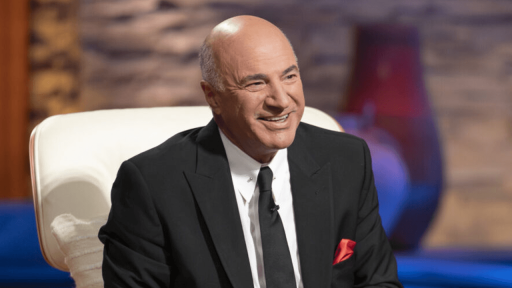

Kevin O'Leary Urges Trump to Impose 400% Tariff on Chinese GoodsApr 10, 2025 pm 12:35 PM

Kevin O'Leary Urges Trump to Impose 400% Tariff on Chinese GoodsApr 10, 2025 pm 12:35 PMCanadian businessman and investor Kevin O’Leary urged the Trump administration to impose a 400% tariff on Chinese goods, arguing that the current 104% tariff is insufficient to compel China to follow trade rules. O’Leary said these statements prior t

Regulatory roadblocks are crumbling as the U.S. Treasury signals a sweeping pivot toward blockchain, stablecoins, and digital assetsApr 10, 2025 pm 12:27 PM

Regulatory roadblocks are crumbling as the U.S. Treasury signals a sweeping pivot toward blockchain, stablecoins, and digital assetsApr 10, 2025 pm 12:27 PMU.S. Treasury Secretary Scott Bessent laid out a broad financial reform agenda at the Bankers Association Summit on April 9, pledging to remove regulatory barriers

China and Russia Have Started to Settle Some Trade Deals Using BitcoinApr 10, 2025 pm 12:19 PM

China and Russia Have Started to Settle Some Trade Deals Using BitcoinApr 10, 2025 pm 12:19 PMAccording to a report by VanEck, China and Russia have started to settle some trade deals using Bitcoin.

Skybridge Capital's founder warns China is preparing fierce economic retaliation as the U.S. slaps 125% tariffs on Chinese goods, signaling currency shocks, massive stimulus, and financial warfare.Apr 10, 2025 pm 12:03 PM

Skybridge Capital's founder warns China is preparing fierce economic retaliation as the U.S. slaps 125% tariffs on Chinese goods, signaling currency shocks, massive stimulus, and financial warfare.Apr 10, 2025 pm 12:03 PMucci Outlines 5-Point Forecast on China's Next Moves Amid Rising Trade Tensions

Ethereum (ETH) Underperforms Bitcoin (BTC)Apr 10, 2025 pm 12:01 PM

Ethereum (ETH) Underperforms Bitcoin (BTC)Apr 10, 2025 pm 12:01 PMunderperformed Bitcoin on 85% of all trading days since it launched in 2015. The ETH/BTC ratio, which tracks the value of Ether relative to Bitcoin, dropped to a five-year low of 0.018

President Trump's Tariff Announcement Sent Bitcoin Dropping 5.4%Apr 10, 2025 am 11:53 AM

President Trump's Tariff Announcement Sent Bitcoin Dropping 5.4%Apr 10, 2025 am 11:53 AMIn the world of cryptocurrencies, few events can shake things up like big government decisions. President Trump's recent tariff announcement did exactly that

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

SublimeText3 Chinese version

Chinese version, very easy to use

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.