Bitcoin (BTC) Price Will Probably Rise in the Coming Months, Here's Why

The US FED decided to cut interest rates by 50 basis points, which came as a surprise to many investors. After this, we immediately saw gold reach new

The US FED decision to cut interest rates by 50 basis points surprised many investors. Gold immediately reached new all-time highs as investors interpreted the rate cut as a sign of future inflation and dollar depreciation. The S&P 500 indexes also hit new all-time highs after the US FED decision, but interestingly, Bitcoin didn’t reach it.

Similarly, China followed suit, promising even more liquidity for the market, with many expecting a historically favorable Q4 for Bitcoin.

There are several reasons why this dynamic may not be as fast, ranging from the potential influence of institutional investors to the time needed for liquidity to reach the market and retail investors too.

Bitcoin’s Dynamics and Correlation with the Rest of the Market

It has been steadily declining since March 2024 and is about 15% below its previous and historical high.

This is a bit odd since usually when the S&P 500 index, and especially when gold does, Bitcoin also shows a rise. This was partly true, but in the context of lower rates, the correlation was not as strong as some expected.

We are seeing the S&P 500 rise, while Bitcoin is declining and this is not the first time we have seen this kind of divergence between the market and Bitcoin. We have seen this many times over the last five years and sometimes Bitcoin catches up to the S&P 500 and sometimes the S&P 500 declines approaching Bitcoin price levels.

This is why Bitcoin’s important dynamics need to be looked at beyond Q4, and to do that we need to look at one of the most important factors influencing the financial markets.

The US Dollar Index which shows the strength of the US Dollar against other major world currencies, has a big impact on the financial markets, and here’s what the US Dollar Index looks like lately.

Notice all the times it has declined significantly look at what has happened with bitcoin. In all of these cases, it has shown a sharp rise in price during and after these declines in the dollar index, and this is no accident.

A weak US dollar directly increases external demand for bitcoin, let’s say bitcoin is worth $60K on all major cryptocurrency exchanges, but suddenly the US dollar weakens by 5% against the Indian rupee.

This means that the same $60K bitcoin on the cryptocurrency exchanges becomes 5% cheaper for Indian investors, and this could lead to a significant number of Indian investors investing in Bitcoin which could potentially cause the price to skyrocket.

When the US dollar index falls this is not just against the Indian rupee but against all major currencies in the world and so when the US dollar weakens bitcoin becomes cheaper for the rest of the world, creating an increase in foreign investment in bitcoin.

So, recently we have noticed a slight weakening of the US dollar and if we overlay US interest rates on it we can see that now the US dollar is directly dependent on the level of interest rates which are experiencing a down cycle after the US Fed decision.

If the Federal Reserve continues to cut interest rates as they have stated they will likely lead to further weakening of the US dollar. However, despite the current weakening of the dollar bitcoin continues to bounce between $60K and $65K.

The Bitcoin price model shows that over the last six months, its price should have increased by about 100%, but in fact, it did not happen.

This price model is based on the US Ador and the S&P 500 index and gives us an idea of where Bitcoin should be right now this model shows that Bitcoin is undervalued 50%

This is not the first time that Bitcoin is undervalued according to this model and guess when it has been in the past this has already happened in January last year in September 2020 and in January 2019.

Perhaps the prolonged stagnation will continue, or there will be some volatility in the coming time, but in general, there are no critical indicators that say Bitcoin is definitely going to fall instead of the bullish rally we are all waiting for.

Why Should We Be Careful About Expecting a Bullish Rally?

Despite the reasonable optimism about Bitcoin, and the hope for the effect of China’s upcoming money printing, as well as the U.S., we should realize that it will likely take longer.

Let’s take a cold-blooded look at this point, namely that the cryptocurrency market could potentially be heavily influenced by institutional investors, so following the crowd can be risky.

After all, when everyone expects one thing, investment funds can do the opposite, and that is the key argument of counter-investors, which may now apply to the crypto market as well. So while many are saying that the fourth quarter will be highly bullish we should exercise a bit of caution first we need to talk about the main reason why everyone is so built on the fourth quarter.

China is printing

The above is the detailed content of Bitcoin (BTC) Price Will Probably Rise in the Coming Months, Here's Why. For more information, please follow other related articles on the PHP Chinese website!

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AM

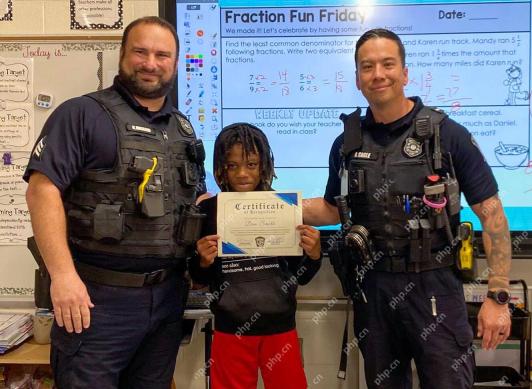

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AMFayetteville Police Department officers Kevin Ingram and David Cagle present Spring Hill Elementary fifth grader Dan Smith with a certificate of recognition for his heroic actions. By FPD

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AM

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AMArtificial Intelligence (AI) has begun to penetrate all aspects of human life, and governance is next. On April 14, the government of the United Arab Emirates (UAE) approved the implementation of what the media is calling the first AI-powered legisla

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AM

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AMOn-chain data reveals that large Shiba Inu investors, referred to as whales, sold their tokens as the coin's value declined.

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AM

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AMSmart crypto investors are looking for an asset with real-world utility and early potential gains in 2025. XRP and Chainlink (LINK) remain the bedrock of solid portfolios but new opportunities

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AM

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AMAs Bitcoin flirts with the $100,000 milestone and Ethereum climbs closer to the $2,000 mark, the eyes of crypto enthusiasts and investors alike are beginning to focus

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AM

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AMU.S. President Donald Trump’s media company, called Trump Media & Technology Group, is exploring yet another crypto-related venture, the company said in a letter to shareholders on Tuesday.

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AM

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AMTop 10 digital currency trading apps: 1. OKX, 2. Binance, 3. Coinbase, 4. Kraken, 5. Huobi, 6. KuCoin, 7. Bitfinex, 8. Gemini, 9. Bitstamp, 10. Poloniex, these platforms are all known for their security, user experience and diverse features, suitable for users with different needs to conduct digital currency transactions.

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AM

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AMA video by DA CONTENT TV on YouTube dives deep into a bold new prediction for Pi Network (PI). According to the discussion, there is growing optimism that the Pi price could surge dramatically, potentially hitting $5 much sooner than many expected.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

SublimeText3 English version

Recommended: Win version, supports code prompts!

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function