web3.0

web3.0 Australia to License Digital Asset Service Providers, Turkey Suspends Digital Asset Taxation Plans

Australia to License Digital Asset Service Providers, Turkey Suspends Digital Asset Taxation PlansAustralia to License Digital Asset Service Providers, Turkey Suspends Digital Asset Taxation Plans

Virtual asset service providers (VASPs) in Australia will have to obtain financial services licenses under a new regulatory regime that some in the sector have criticized as ‘ambiguous.’

Australia’s financial services regulator plans to extend the country’s financial services licensing regime to cover virtual asset service providers (VASPs).

The Australian Securities and Investments Commission (ASIC) currently regulates digital asset exchanges under a specialized regime for the industry. However, ASIC plans to regard the exchanges as financial institutions and bring them under the Corporations Act.

Speaking at a recent digital assets event, ASIC Commissioner Alan Kirkland said that the commission believes the Corporations Act covers most major digital assets. This necessitates the inclusion of the exchanges that facilitate their trading under this Act.

“ASIC’s message is that a significant number of crypto-asset firms in the Australian market are likely to need a license under the current law,” Kirkland told The Australian Financial Review.

The commissioner added that he believes there’s a need for a balance between protecting investors and promoting innovation.

Australia has come under the spotlight in recent years for some massive digital asset scams, like the collapse of Digital Surge and the theft of A$330 million (US$230 million) in cryptocurrencies. These scams drew criticism on ASIC and its lax measures.

FTX, for instance, claimed to be registered to offer digital asset services by ASIC on its website. But when the exchange collapsed, it emerged that its ‘crypto’ business was not licensed.

Blowups like FTX have pushed ASIC to be stringent, with Commissioner Kirkland stating, “ASIC believes that licensing and its subsequent protections will mitigate risk while bolstering consumer confidence and market integrity — two elements that are crucial in encouraging innovation in the financial system.”

However, some legislators and industry stakeholders believe ASIC may be overcorrecting and strangling the burgeoning sector.

Caroline Bowler, the CEO of Australia’s oldest ‘crypto’ exchange, BTC Markets, opined that the upcoming rules over which activities will require a license are unclear, adding to the existing confusion for VASPS.

“It’s super broad, the ambiguity in the language if anything just creates more questions than it provides,” she told The Australian Financial Review.

Senator Andrew Bragg has also slammed the new regulatory stance, which he claims has pushed Australia “from crypto leader to crypto laggard.”

The opposition legislator blamed the ruling Labour Party for abandoning its campaign pledges, where it promised to issue enabling regulations for the industry. This, he said, has denied the country the opportunity to leverage exciting trends like tokenization, which could transform the country’s real estate market.

“By locking Australia in the crypto slow lane, Labor has stifled innovation and denied Australians the opportunities to reap the benefits that blockchain provides,” Bragg said in a statement.

“The government promised to introduce enabling legislation for digital assets, but instead, they have slapped the industry with burdensome red tape.”

Turkey suspends digital asset taxation plans

In Turkey, the government has shelved plans to tax income from digital assets and stocks that sparked an uproar among investors.

Vice President Cevdet Yilmaz told Bloomberg that the government’s focus now is on “narrowing the tax exemptions.”

“We don’t have a stocks tax on our agenda. It was discussed previously and fell from our agenda.”

The proposed tax package, which also extended to digital asset gains, was not well received by Turkish investors.

In June, the Finance Ministry attempted to increase capital market gains taxes in its bid to “leave no area untaxed in order to provide justice and effectiveness in taxation.”

However, it quickly led to a massive dip in trading volumes on the country’s bourses, and Finance Minister Mehmet Simsek soon reversed course. Despite the minister’s—and now the vice president’s—assurances that no new taxes will be implemented, Turkey’s stock market has yet to recover, with monthly trading volume down by nearly 50%.

For digital assets, President Recep Tayyip Erdoğan’s government sought to impose a 0.03% tax on all transactions. The finance ministry projected this would add 3.7 billion lira ($110 million) to the tax agency’s coffers.

Turkey joins South Korea in postponing digital asset taxes. The Asian nation initially intended to impose a 20% tax on annual digital asset gains in 2021. However, criticism from digital asset traders has pushed the ruling People Power Party to postpone it twice, and it’s now scheduled for January 1, 2028.

Watch: Building the future with blockchain—Insights with Ty Everett

The above is the detailed content of Australia to License Digital Asset Service Providers, Turkey Suspends Digital Asset Taxation Plans. For more information, please follow other related articles on the PHP Chinese website!

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AM

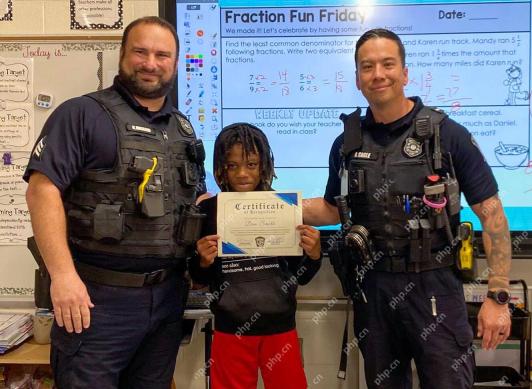

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AMFayetteville Police Department officers Kevin Ingram and David Cagle present Spring Hill Elementary fifth grader Dan Smith with a certificate of recognition for his heroic actions. By FPD

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AM

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AMArtificial Intelligence (AI) has begun to penetrate all aspects of human life, and governance is next. On April 14, the government of the United Arab Emirates (UAE) approved the implementation of what the media is calling the first AI-powered legisla

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AM

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AMOn-chain data reveals that large Shiba Inu investors, referred to as whales, sold their tokens as the coin's value declined.

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AM

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AMSmart crypto investors are looking for an asset with real-world utility and early potential gains in 2025. XRP and Chainlink (LINK) remain the bedrock of solid portfolios but new opportunities

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AM

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AMAs Bitcoin flirts with the $100,000 milestone and Ethereum climbs closer to the $2,000 mark, the eyes of crypto enthusiasts and investors alike are beginning to focus

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AM

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AMU.S. President Donald Trump’s media company, called Trump Media & Technology Group, is exploring yet another crypto-related venture, the company said in a letter to shareholders on Tuesday.

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AM

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AMTop 10 digital currency trading apps: 1. OKX, 2. Binance, 3. Coinbase, 4. Kraken, 5. Huobi, 6. KuCoin, 7. Bitfinex, 8. Gemini, 9. Bitstamp, 10. Poloniex, these platforms are all known for their security, user experience and diverse features, suitable for users with different needs to conduct digital currency transactions.

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AM

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AMA video by DA CONTENT TV on YouTube dives deep into a bold new prediction for Pi Network (PI). According to the discussion, there is growing optimism that the Pi price could surge dramatically, potentially hitting $5 much sooner than many expected.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

SublimeText3 English version

Recommended: Win version, supports code prompts!

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function