Bitcoin ETFs Bounce Back with Over $117 Million in Inflows

Analyst Eric Balchunas has dismissed the current commotion over the alleged failure of Bitcoin ETFs. He stated that these items have been identified recently again as part of the inflows.

Analyst Eric Balchunas has downplayed the recent buzz around the supposed failure of Bitcoin ETFs. He noted that these instruments have been highlighted again recently in the context of the inflows. Now consider a scenario where the skeptics were preparing to write about such instruments after a string of poor performances.

Balchunas' data shows that year-to-date inflows of Bitcoin ETFs are back in positive territory at $17.1 billion. The analyst poked fun at both crypto proponents and skeptics for being overly "reactionary," noting that equities investors tend to behave differently.

So after all the drama/hand-wringing about the "failure" of the bitcoin ETFs (insert 'leads?' cop from Big Lebowski laughing hysterically) they back to taking in cash. YTD net flows back over high water mark of +$17.1b and the 1W and 1M outflows have shrunk to less than 1% of… pic.twitter.com/nWE8kpUOdk

Bitcoin ETFs rebound with over $117 million in inflows

On Tuesday, US spot Bitcoin ETFs saw a resurgence with $117 million in inflows. Leading this was the $63 million net infusion from Fidelity's Bitcoin Fund (FBTC). This follows several huge withdrawals from some of the biggest cryptocurrency ETFs in recent weeks.

It was on Tuesday that saw the highest net investment into Fidelity’s Bitcoin Fund, to the tune of $63 million. This also brings the total net fund inflows to $9.5 billion after just eight months of operation.

Currently, FBTC has $10.5 billion in assets, making it the world’s third-largest Bitcoin ETF after Grayscale Bitcoin Trust (GBTC) and BlackRock's iShares Bitcoin Trust (IBIT). Other funds also saw positive inflows.

Grayscale’s Bitcoin Mining Trust pulled in $41 million, and ARK Invests Bitcoin ETF had $13 million. While multiple ETFs saw one-day inflows of Bitcoin purchases, the largest one, BlackRock's IBIT, and several smaller ones, showed no inflows.

Despite recent losses, the interest from investors is evident in the surging inflows. After major outflows that began at the end of August and continued into the first few days of September, inflows resumed on Tuesday. During this time, over $1 billion in Bitcoin and Ethereum funds were withdrawn.

BlackRock’s IBIT, saw its second withdrawal since it was launched in January. In an effort to protect themselves from lower prices, short-Bitcoin products were ‘topped up’ with $3.9 million from wary investors.

Bitcoin in particular had a rough September, which in the crypto world is called “Rektember.”

Restoring Confidence Among the Investors

There were some instances and skepticism in the early days, but the concept is slowly gaining traction. The withdrawal percentage from the total capital during the past week and month was less than 1% AUM.

While analysts have previously raised concerns about the performance of these ETFs, they are now stabilizing. According to Bloomberg analyst Eric Balchunas, Bitcoin ETFs have “done a great job” at preventing outflows amid volatile market conditions, which is helping to restore confidence among investors.

Additionally, Bitwise CIO Matt Hougan stated that financial advisers have adopted Bitcoin ETFs at the fastest rate among any new ETF category in history. The rapid adoption showcases the increasing interest from financial professionals, despite the market volatility.

The above is the detailed content of Bitcoin ETFs Bounce Back with Over $117 Million in Inflows. For more information, please follow other related articles on the PHP Chinese website!

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AM

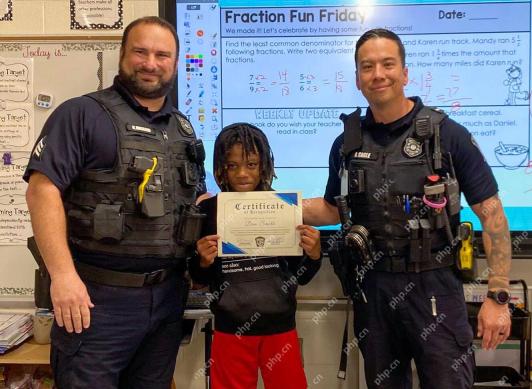

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AMFayetteville Police Department officers Kevin Ingram and David Cagle present Spring Hill Elementary fifth grader Dan Smith with a certificate of recognition for his heroic actions. By FPD

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AM

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AMArtificial Intelligence (AI) has begun to penetrate all aspects of human life, and governance is next. On April 14, the government of the United Arab Emirates (UAE) approved the implementation of what the media is calling the first AI-powered legisla

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AM

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AMOn-chain data reveals that large Shiba Inu investors, referred to as whales, sold their tokens as the coin's value declined.

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AM

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AMSmart crypto investors are looking for an asset with real-world utility and early potential gains in 2025. XRP and Chainlink (LINK) remain the bedrock of solid portfolios but new opportunities

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AM

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AMAs Bitcoin flirts with the $100,000 milestone and Ethereum climbs closer to the $2,000 mark, the eyes of crypto enthusiasts and investors alike are beginning to focus

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AM

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AMU.S. President Donald Trump’s media company, called Trump Media & Technology Group, is exploring yet another crypto-related venture, the company said in a letter to shareholders on Tuesday.

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AM

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AMTop 10 digital currency trading apps: 1. OKX, 2. Binance, 3. Coinbase, 4. Kraken, 5. Huobi, 6. KuCoin, 7. Bitfinex, 8. Gemini, 9. Bitstamp, 10. Poloniex, these platforms are all known for their security, user experience and diverse features, suitable for users with different needs to conduct digital currency transactions.

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AM

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AMA video by DA CONTENT TV on YouTube dives deep into a bold new prediction for Pi Network (PI). According to the discussion, there is growing optimism that the Pi price could surge dramatically, potentially hitting $5 much sooner than many expected.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

SublimeText3 English version

Recommended: Win version, supports code prompts!

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function