Bitcoin (BTC) Navigates a Rocky Path, Hovering Near $56,000

Bitcoin (BTC) is navigating a rocky path, with its price recently plummeting to $56,000 amid growing concerns about the U.S. economic landscape and anticipation of key employment data.

Bitcoin (BTC) encountered difficulties on October 7 as its price dropped to $56,000 amid worsening U.S. economic data and anticipation of key employment figures. Several analysts predicted a potential decline to $50,000 as the crypto market experienced a downturn.

Bitcoin (BTC) encountered difficulties on October 7 as its price dropped to $56,000 amid worsening U.S. economic data and anticipation of key employment figures. Several analysts predicted a potential decline to $50,000 as the crypto market experienced a downturn.

Bitcoin’s recent price drop was accompanied by a sharp decline in investor sentiment. The Crypto Fear & Greed Index plummeted to 22, indicating “extreme fear,” the highest level of pessimism observed since early August. This dramatic shift was a response to various factors, including the recent drop in Bitcoin’s price from $55,838 to a current level of $56,585. This dip erased approximately $29.7 billion from Bitcoin’s market capitalization, according to Coin Market Cap data. Such a significant loss underscored the gravity of the situation and the heightened caution among investors.

Bitcoin’s recent price drop was accompanied by a sharp decline in investor sentiment. The Crypto Fear & Greed Index plummeted to 22, indicating “extreme fear,” the highest level of pessimism observed since early August. This dramatic shift was a response to various factors, including the recent drop in Bitcoin’s price from $55,838 to a current level of $56,585. This dip erased approximately $29.7 billion from Bitcoin’s market capitalization, according to Coin Market Cap data. Such a significant loss underscored the gravity of the situation and the heightened caution among investors.

Arthur Hayes, the co-founder of BitMEX, expressed his concerns on social media platform X (formerly Twitter), predicting that Bitcoin might fall below $50,000 by this weekend. Hayes’s bearish outlook was driven by a combination of economic worries and disappointing job reports, adding to the general sense of dread in the market. His comment, “BTC is heavy, I’m gunning for sub $50k this weekend. I took a cheeky short. Pray for my soul, for I am a degen,” reflected the current sentiment of fear and uncertainty.

Arthur Hayes, the co-founder of BitMEX, expressed his concerns on social media platform X (formerly Twitter), predicting that Bitcoin might fall below $50,000 by this weekend. Hayes’s bearish outlook was driven by a combination of economic worries and disappointing job reports, adding to the general sense of dread in the market. His comment, “BTC is heavy, I’m gunning for sub $50k this weekend. I took a cheeky short. Pray for my soul, for I am a degen,” reflected the current sentiment of fear and uncertainty.

Bitcoin’s troubles were part of a broader trend affecting the entire cryptocurrency market. Major digital assets also experienced losses. Ether (ETH) decreased by 2.23%, Solana (SOL) by 2.82%, and XRP by 2.19%. The ripple effect of this market downturn led to substantial liquidations, with $94.26 million worth of positions being closed out. This included $36.71 million in Bitcoin longs and $17.36 million in Ethereum longs, highlighting the widespread market unease.

Bitcoin’s troubles were part of a broader trend affecting the entire cryptocurrency market. Major digital assets also experienced losses. Ether (ETH) decreased by 2.23%, Solana (SOL) by 2.82%, and XRP by 2.19%. The ripple effect of this market downturn led to substantial liquidations, with $94.26 million worth of positions being closed out. This included $36.71 million in Bitcoin longs and $17.36 million in Ethereum longs, highlighting the widespread market unease.

The overall market decline was a testament to the growing investor skepticism and the potential for further price drops in the near future. As cryptocurrencies faced increasing pressure, the sense of foreboding among traders and investors intensified.

The overall market decline was a testament to the growing investor skepticism and the potential for further price drops in the near future. As cryptocurrencies faced increasing pressure, the sense of foreboding among traders and investors intensified.

What Lies Ahead for Bitcoin?

What Lies Ahead for Bitcoin?

The current climate of extreme fear and uncertainty is a crucial indicator for Bitcoin’s potential future movements. Hayes’s prediction of a possible drop to $50,000 reflects a broader sentiment of caution among market participants. Investors are closely watching upcoming economic indicators and market trends, which will likely play a significant role in shaping Bitcoin’s trajectory.

The current climate of extreme fear and uncertainty is a crucial indicator for Bitcoin’s potential future movements. Hayes’s prediction of a possible drop to $50,000 reflects a broader sentiment of caution among market participants. Investors are closely watching upcoming economic indicators and market trends, which will likely play a significant role in shaping Bitcoin’s trajectory.

Several analysts have offered varied predictions regarding Bitcoin’s future. Some forecast a decline to $46,000, a level that hasn’t been seen since February. On the other hand, 10x Research suggests that Bitcoin could find a potential support level in the low $40,000s, which might signal an entry point for a bull market. Meanwhile, others believe that Bitcoin might stabilize around $57,000, drawing on historical patterns as a basis for their forecasts.

Several analysts have offered varied predictions regarding Bitcoin’s future. Some forecast a decline to $46,000, a level that hasn’t been seen since February. On the other hand, 10x Research suggests that Bitcoin could find a potential support level in the low $40,000s, which might signal an entry point for a bull market. Meanwhile, others believe that Bitcoin might stabilize around $57,000, drawing on historical patterns as a basis for their forecasts.

The convergence of economic uncertainties and market sentiment creates a complex environment for Bitcoin and the broader cryptocurrency market. As investors brace for potential further declines, the next few days will be crucial in determining whether Bitcoin will indeed drop to $50,000 or find support at a higher level.

The convergence of economic uncertainties and market sentiment creates a complex environment for Bitcoin and the broader cryptocurrency market. As investors brace for potential further declines, the next few days will be crucial in determining whether Bitcoin will indeed drop to $50,000 or find support at a higher level.

In summary, Bitcoin’s current volatility reflects broader market challenges and investor concerns. As the cryptocurrency faces potential declines, staying informed about market developments and economic indicators will be essential for navigating the turbulent landscape. The coming weekend could prove pivotal in shaping Bitcoin’s short-term future, and investors should remain vigilant as the situation unfolds.

In summary, Bitcoin’s current volatility reflects broader market challenges and investor concerns. As the cryptocurrency faces potential declines, staying informed about market developments and economic indicators will be essential for navigating the turbulent landscape. The coming weekend could prove pivotal in shaping Bitcoin’s short-term future, and investors should remain vigilant as the situation unfolds.

The above is the detailed content of Bitcoin (BTC) Navigates a Rocky Path, Hovering Near $56,000. For more information, please follow other related articles on the PHP Chinese website!

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PM

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PMThis sharp drop happened as investor interest faded and a major scandal hit the highly speculative market.

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PM

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PMDespite being pretty much the iconic example of “random” – well, that and dice rolls – we can't help but feel like there's some element of skill involved. Especially when we lose.

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AM

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AMBitwise, a leading digital asset manager, has announced the listing of four of its crypto Exchange-Traded Products (ETPs) on the London Stock Exchange (LSE).

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AM

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AMBitcoin may be poised for a massive rally—but only if gold continues its upward climb, according to Joe Consorti, Head of Growth at Theya.

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AM

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AMThe Shiba Inu price continues to attract the attention of analysts, who are watching for its next potential move. By Samuele Piar. Updated April 14, 2025.

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AM

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AMThe joint motion of Ripple and U.S. Securities and Exchange Commission (SEC) to hold the appeal in abeyance has been granted by the Circuit Judge Jose A. Cabranes.

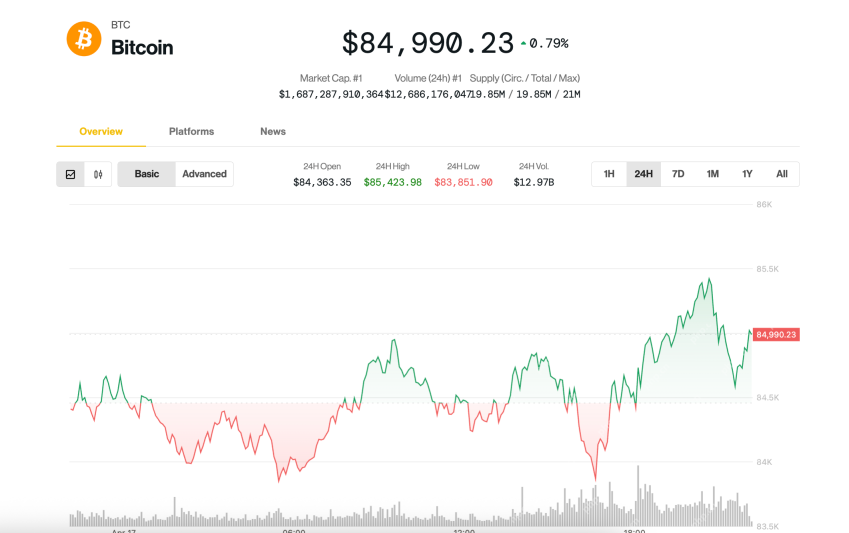

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AM

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AMBitcoin (BTC) was treading water just below $85,000 late Thursday as tensions between U.S. President Donald Trump and Federal Reserve Chair Jerome Powell added another layer of uncertainty for investors.

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AM

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AMToday, AB DAO officially announced the launch of a dual reward campaign in collaboration with Bitget (bitget.com), the world's second-largest digital asset trading platform.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

SublimeText3 Chinese version

Chinese version, very easy to use