Ethereum (ETH) Layer-1 Network Revenue Crashes 99% Since March 2024, But Monthly Users and Transaction Volumes on Layer-2 Solutions Increase

- 王林Original

- 2024-09-04 09:30:12556browse

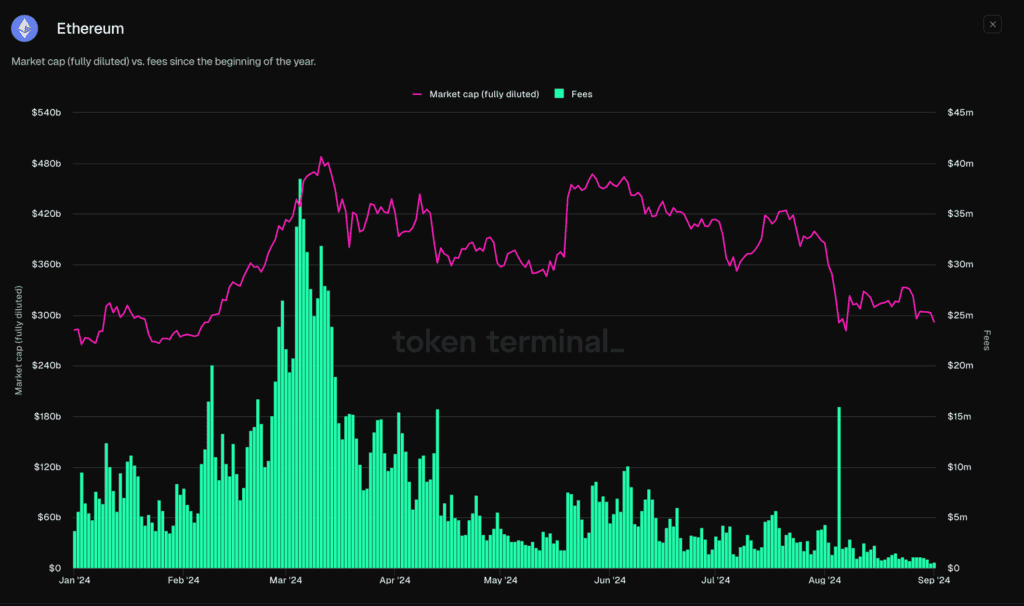

Token Terminal data shows that the network fees reached a high of $35.5 million on March 5, 2024, but the Dencun upgrade release just eight days later significantly cut fees for Layer-2 transactions.

The revenue generated by Ethereum’s Layer-1 network has seen a massive decline of 99% since March 2024, despite a surge in monthly users and transaction volumes on Layer-2 solutions. Data from Token Terminal shows that the network fees reached a peak of $35.5 million on March 5, 2024, but the subsequent release of the Dencun upgrade just eight days later led to a significant reduction in fees for Layer-2 transactions.

A passionate supporter of Ethereum and artificial intelligence (AI), Adriano Feria took to X to counter critics of Ethereum. He stated that Ether is making significant progress towards being adopted by institutions, with major companies like Coinbase, Circle, BlackRock, and the latest one being Sony, showing their support for the token.

Hate to break it to the #Ethereum doubters, but $ETH is well on its way to securing solid institutional adoption, led by industry giants like Coinbase, Circle, BlackRock, and more recently, Sony. And it looks like Toyota and Robinhood might be jumping on board soon too.

Anon is… pic.twitter.com/2QdaC7sVJx

Feria went on to suggest that perhaps Robinhood and Toyota would soon join the list. He believed that the main reason for the success is the institutional adoption, which is more permanent. On the other hand, the speculative tactics of “degen anons” who are quickly flipping tokens or NFTs for profits are not the driving force behind the institutional adoption.

Feria highlighted the advantages of scaling Ether through “network extensions,” which provide functionalities that cannot be achieved on layer 1. The additional networks allow for greater control over the fee market and the definition of standards for different features, ultimately enhancing the end-user experience.

He criticized those who choose to ignore these technologies simply because they are on Ethereum and use different vocabulary. Feria pointed out that while some believe monolithic chains will have to become modular to stay relevant in the future, Solana is already doing it, albeit at the cost of rebranding efforts that have been largely successful.

Even though the Ethereum layer-2 solutions are sometimes seen as fragmented or parasitic, Feria said that they are rapidly expanding and creating vast opportunities. He observed that the leading layer-2 solutions, including Coinbase’s Base, Arbitrum, and the new layer-2 from Sony, are thriving on Ethereum’s liquidity and network effects. As a result, it is crucial for the industry leaders to recognize and adapt to this shift.

Feria concluded that although Ethereum is constantly being hated on and imitated, it is a development that he believes their opponents will follow. He says that further development of Ethereum is a new picture of the financial world that their opponents will follow, regardless of what they might say. But the rapid development and institutional interest in the layer-2 solutions are a testament to Ethereum’s primacy in the evolution of blockchain.

Related Reading | Bitcoin’s Bearish Trend Raises Concerns of a Potential Crash to $43,000

The above is the detailed content of Ethereum (ETH) Layer-1 Network Revenue Crashes 99% Since March 2024, But Monthly Users and Transaction Volumes on Layer-2 Solutions Increase. For more information, please follow other related articles on the PHP Chinese website!