(Bloomberg) -- Bitcoin Trails Traditional Assets in August as Month Draws to a Close

- PHPzOriginal

- 2024-08-31 03:32:13660browse

Most Read from BloombergDense Cities With Low Emissions Suffer Most From Air Pollution, Study FindsIntergenerational Housing Could Help Older Adults Combat LonelinessTurkey Plans Istanbul Taxi Surge to Tackle ComplaintsA Guide to Urban Swimming in Europe, Beyond the SeineAs Rural Hospitals Shutter Maternity Wards, Urban Ones Follow

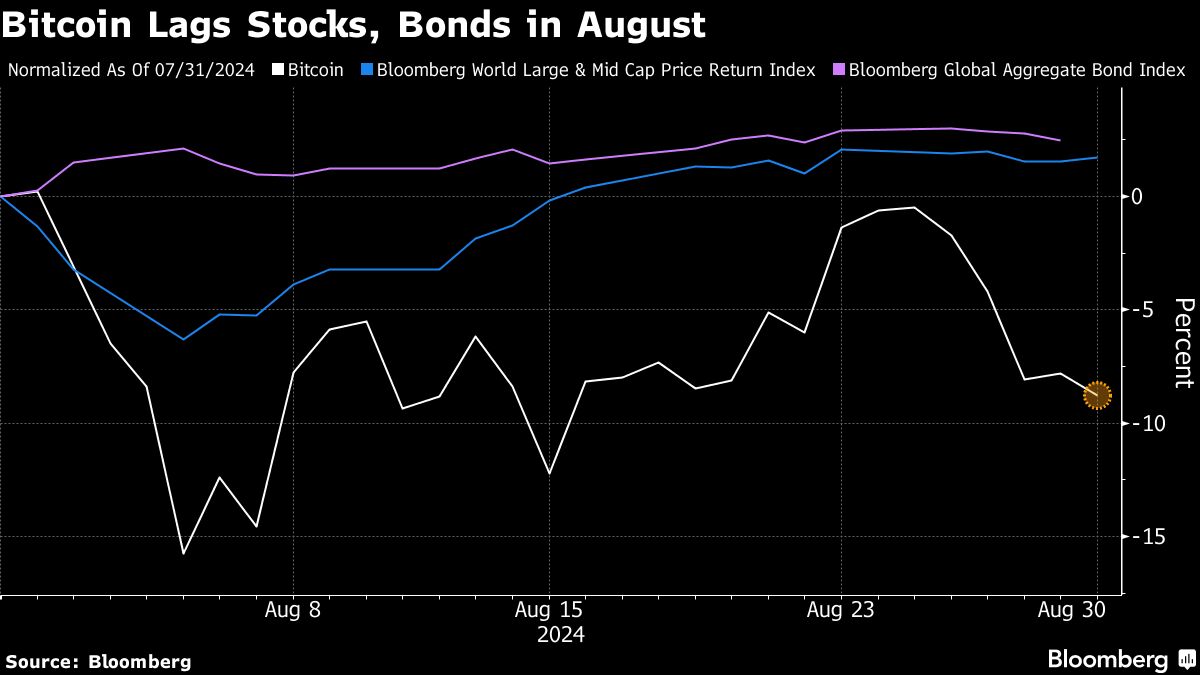

Bitcoin trails traditional assets in August as the month draws to a close, hampered by ebbing liquidity and lingering worries that governments may sell from their stockpiles of the cryptocurrency.

Most Read from Bloomberg

Dense Cities With Low Emissions Suffer Most From Air Pollution, Study Finds

Intergenerational Housing Could Help Older Adults Combat Loneliness

Turkey Plans Istanbul Taxi Surge to Tackle Complaints

A Guide to Urban Swimming in Europe, Beyond the Seine

As Rural Hospitals Shutter Maternity Wards, Urban Ones Follow

The US, China, UK and Ukraine are potential sources of such disposals, as are creditors receiving tokens from the collapsed Mt. Gox digital-asset exchange, research company Kaiko wrote in a note. That’s part of a possible $33 billion overhang of Bitcoin supply, according to the analysis.

Kaiko estimated the US administration holds about 203,220 Bitcoin, followed by China’s 190,000, the UK’s 61,200 and 46,350 for Ukraine. Governments seize tokens in criminal cases, while Ukraine is thought to have received donations to help fund its defense against Russia’s invasion. Meanwhile, Mt. Gox has roughly 46,170 of tokens left to distribute, Kaiko said.

“Supply overhang has been a topic in crypto markets throughout the summer,” Kaiko analysts Adam Morgan McCarthy and Dessislava Aubert said. There are several “prominent holders that could be potential sources of selling pressure in the coming months,” they added.

Bitcoin fell as much as 2.9% to $57,800 on Friday, about $16,000 below its March peak. Tokens such as Polygon and Solana fell more, with each dropping more than 5%.

Waning Liquidity

The fears of punchy sell orders come alongside a thinning of liquidity in the Bitcoin market that can amplify price swings in response to big trades. The digital asset has dropped some 10% so far this month against that backdrop, compared with gains of about 2% in global gauges of stocks and bonds.

“Spot market volumes for Bitcoin remain subdued, contributing to recent choppy price action,” Sean Farrell, head of digital-asset strategy at Fundstrat Global Advisors LLC, wrote in a note. Seasonal trends suggest activity typically picks up after Monday’s US Labor Day holiday, he added.

One of the metrics Farrell flagged is the seven-day average of Bitcoin turnover — trading volume divided by the token’s market value — which has declined toward 2% after peaking near 5% around the digital asset’s record rally in March.

Bitcoin has struggled in August despite net inflows into US spot-Bitcoin exchange-traded funds and growing expectations that the Federal Reserve will loosen monetary policy in coming weeks.

ETF Backdrop

The trading backdrop has also become more challenging in the US Bitcoin ETF sector, according to JPMorgan Chase & Co. strategists. That’s based in part on a metric known as the Hui-Heubel ratio, which purports to provide insights into liquidity by measuring the number of trades it takes to move prices.

“It is striking that this metric has been deteriorating for all spot-Bitcoin ETFs since March, pointing to overall deterioration of spot-Bitcoin ETF liquidity over the past six months,” the JPMorgan team including Nikolaos Panigirtzoglou said.

Combined daily trading volume for the US Bitcoin ETFs has dropped to less than $2 billion from a peak of more than $10 billion in March, according to data compiled by Bloomberg.

Most Read from Bloomberg Businessweek

Private Equity Is Coming for Youth Sports

How Rent Controls Are Deepening the Dutch Housing Crisis

Need 100,000 Balloons for a Convention? Here’s the Guy to Call

Hong Kong’s Old Airport Becomes Symbol of City’s Property Pain

Far-Right ‘Terrorgram’ Chatrooms Are Fueling a Wave of Power Grid Attacks

©2024 Bloomberg L.P.

The above is the detailed content of (Bloomberg) -- Bitcoin Trails Traditional Assets in August as Month Draws to a Close. For more information, please follow other related articles on the PHP Chinese website!