Aave (AAVE) a leading decentralized finance (DeFi) protocol, has experienced significant profit booking. AAVE crypto price retraced more than 15% this week.

Aave (AAVE) encountered significant profit booking this week, with its price retracing more than 15%.

The token faced challenges crossing the $150 mark and formed a double-top formation. It also formed a three black crows pattern, indicating a three-day bearish streak and selling pressure.

However, AAVE remained above key moving averages, indicating a bullish trend. The token faced challenges and increased liquidations, leading to a retracement.

Aave (AAVE) experienced a short-term accumulation phase that fueled a massive bullish surge in the last two months. Despite market turbulence, it continued spreading gains within a rising channel, showcasing outperformance.

The $150 mark served as a crucial resistance that bulls failed to flip. Until the barrier is breached, the token may consolidate near the upper Bollinger band.

Looking ahead, the token might revisit the 20-day EMA mark. It could drop toward the $120 mark in the next sessions.

AAVE Crypto Struggles Near Supply Zone: Price Analysis

On the daily chart, AAVE encountered profit booking throughout the week, displaying on the chart in a double top formation. It showed a rejection from its supply zone at $150 and lost momentum.

However, the trend is still bullish, and buyers want to gain further traction to beat the mighty bear cartel. Aave (AAVE) is likely to consolidate near the upper Bollinger band until the $150 mark is breached.

AAVE was trading at $127.36 at press time, down over 3.20% intraday. Its trading volume soared over 12.29%, indicating flat investor participation.

With a market cap of $1.93 Billion, it was ranked at 50 and had a total supply value of 16.24 Million.

The RSI line showed a negative crossover, indicating increased selling pressure on the chart. Similarly, the CMF indicator plotted a negative value and slipped below the zero line, conveying the bearish move.

DaanCrypto, in his recent tweet, said that AAVE was consolidating near its supply region and attempting to break its local highs.

$AAVE Some more consolidation and I want to see this attempt to break the yearly/cycle highs. Clear skies ahead if it can do so. $155 -> $260 would be on the board. https://t.co/JggF6NDQvh pic.twitter.com/r02vVK1Tez

According to Fib retracement levels, AAVE failed to cross the 61.8% resistance zone and reverted toward the 50% support trajectory near $120.

Development Activity Data Witnessed a Consistent Uptick

The bullish trend in AAVE’s development activity metric reflected a consistent rise, displaying sustained growth in the ecosystem. It showed a vertical rise, noted at 25.52, underscoring a positive sentiment.

However, the social dominance data continued to fluctuate, highlighting significant buzz. Noted at 0.267%, it conveyed a rise in investor chatter for the token and heightened online discussions on the media platforms.

The network growth line observed a massive downtick during the three-day bearish streak. It dropped below the median line, indicating new addresses lost interest.

Likewis,e the velocity line showed a downtick at 2.093, indicating a reduced transfer. It conveyed less activity involving AAVE.

Its Futures Open Interest dropped over 10.20% to $126.29 Million, reflecting a long unwinding move in the last 24 hours. If AAVE takes the support at around $125, it might show a pullback.

Aave (AAVE) could aim to sustain above the $135 mark, followed by the resistance mark of $142. If the token continues the bearish reversal; the token may reach the lower support region of $115. This would be followed by $110 in the near term.

The above is the detailed content of AAVE Struggles Near Supply Zone: Price Analysis. For more information, please follow other related articles on the PHP Chinese website!

AAVE Price Slips Despite Sky Aave Force InitiativeSep 04, 2024 am 03:37 AM

AAVE Price Slips Despite Sky Aave Force InitiativeSep 04, 2024 am 03:37 AMThe cryptocurrency market witnessed a surge in selling pressure during the U.S. trading session on Tuesday. As Bitcoin shows sustainability below $60000

XRP Ready For $150? Analyst Thinks SoAug 01, 2024 am 03:09 AM

XRP Ready For $150? Analyst Thinks SoAug 01, 2024 am 03:09 AMFrom the daily chart, XRP is trending above key reaction levels. Notably, the close above $0.55 (now key support) reversed losses posted in mid-April.

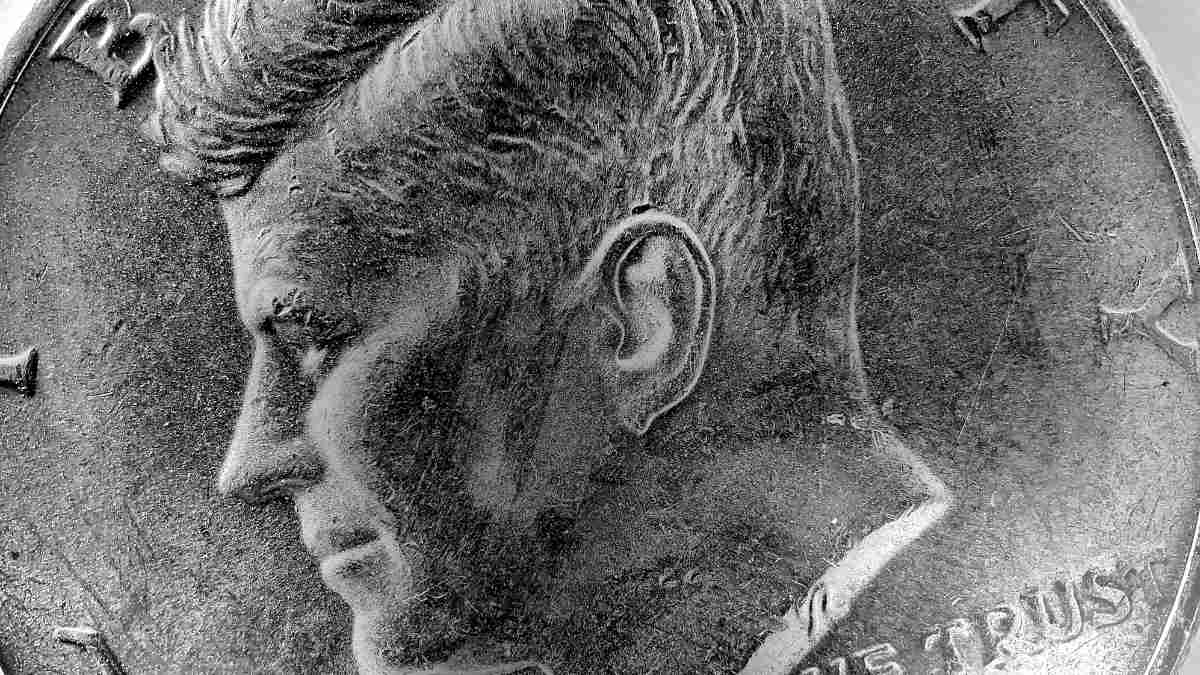

The Kennedy Half-Dollar: A Coveted Piece of HistoryAug 31, 2024 am 04:18 AM

The Kennedy Half-Dollar: A Coveted Piece of HistoryAug 31, 2024 am 04:18 AMJohn Fitzgerald Kennedy, the 35th President of the United States, has left a profound mark on the history of the country, both for his leadership and the tragic end of his life. His assassination in 1963 shocked the world and transformed Kennedy into

MoonTaurus (MNTR): A Promising New Crypto Asset Attracts Big Investors, Raises $150k in 72 HoursAug 01, 2024 am 06:05 AM

MoonTaurus (MNTR): A Promising New Crypto Asset Attracts Big Investors, Raises $150k in 72 HoursAug 01, 2024 am 06:05 AMCrypto whales have jumped on board with the new memecoin MoonTaurus, securing tokens at the initial presale price of just $0.005.

AAVE Price Prediction: AAVE Poised to Rally by 7% as Bulls Regain Control, Here's WhyAug 16, 2024 pm 09:38 PM

AAVE Price Prediction: AAVE Poised to Rally by 7% as Bulls Regain Control, Here's WhyAug 16, 2024 pm 09:38 PMprice surged by 7.22% in the last 24 hours while its trading volume nearly doubled to $220 million, a 93.26% increase, signaling high buyer and seller interaction.

AAVE Struggles Near Supply Zone: Price AnalysisAug 28, 2024 pm 12:41 PM

AAVE Struggles Near Supply Zone: Price AnalysisAug 28, 2024 pm 12:41 PMAave (AAVE) a leading decentralized finance (DeFi) protocol, has experienced significant profit booking. AAVE crypto price retraced more than 15% this week.

XRP Price May Hit $150, Outperforming Bitcoin as Market Optimism GrowsAug 02, 2024 am 12:08 AM

XRP Price May Hit $150, Outperforming Bitcoin as Market Optimism GrowsAug 02, 2024 am 12:08 AMAccording to Javon Marks, a popular technical analyst, XRP Price may hit $150 at some point in the future. His prediction comes at the back of a recent remarkable performance

Range Breakout Anticipated: Could AAVE Bulls Surpass The $120 Mark?Aug 18, 2024 am 03:48 AM

Range Breakout Anticipated: Could AAVE Bulls Surpass The $120 Mark?Aug 18, 2024 am 03:48 AMAave (AAVE), a decentralized finance protocol, has been in a bullish trend and has continued to outperform the crypto market.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

WebStorm Mac version

Useful JavaScript development tools

Dreamweaver Mac version

Visual web development tools

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

Notepad++7.3.1

Easy-to-use and free code editor