web3.0

web3.0 Crypto Market in Limbo as It Awaits Key Events, Including US PCE Inflation Data and Remarks From Federal Reserve Officials

Crypto Market in Limbo as It Awaits Key Events, Including US PCE Inflation Data and Remarks From Federal Reserve OfficialsCrypto Market in Limbo as It Awaits Key Events, Including US PCE Inflation Data and Remarks From Federal Reserve Officials

The crypto economy has exploded by $623 billion in just seven months! Bitcoin's market value surged by over $20,000, while Ethereum jumped more than $470. However, the crypto market is on high alert as it awaits several key events, including releasing the US Personal Consumption Expenditures (PCE) inflation data and remarks from Federal Reserve officials. These events are anticipated to significantly influence market sentiment and could potentially impact the Federal Reserve's upcoming decisions regarding rate cuts.

The crypto economy has seen a rapid expansion, with a $623 billion surge in market value in just seven months. Bitcoin's market value has surged by over $20,000, while Ethereum has jumped by more than $470 during this period.

However, the crypto market is now on high alert as it awaits several key events, including the release of the US Personal Consumption Expenditures (PCE) inflation data and remarks from Federal Reserve officials. These events are expected to significantly influence market sentiment and could potentially impact the Federal Reserve’s upcoming decisions regarding rate cuts.

Recent comments from Federal Reserve officials, including Fed Chair Jerome Powell, have fueled optimism in the market, suggesting a possible softening of monetary policy. This dovish stance has led to heightened expectations of a rate cut in September, which has already spurred a robust rally in the crypto market.

Continuing the bullish streak, Bitcoin surpassed $65,000 and Ethereum approached $2,800 over the weekend. San Francisco Fed President Mary Daly and Atlanta Fed President Raphael Bostic’s remarks are expected to provide key clues, but the market remains in fear. Any hint of hawkishness might cause a selloff in the financial and crypto markets.

The upcoming US PCE inflation figures are also crucial. Market estimates predict a slight increase to 0.2% for July, up from 0.1% in June. The Core PCE is expected to remain steady at 0.2% every month but could see a year-over-year increase to 2.7%.

These figures will be closely watched as they will influence the Federal Reserve’s decision-making process, particularly concerning the potential rate cut in September. A higher-than-expected inflation figure could dampen the recent bullish sentiment in the crypto market.

Finally, the second revision of the Q2 US GDP data, scheduled for release on August 29, will also be a key focus. This data could provide further insights into the US’s overall economic health and may have significant implications for the stock and crypto markets.

Recent increases in the crypto market are fueled by Fed dovishness. However, markets are cautious ahead of PCE data and Fed remarks. These occurrences could strengthen the rally or cause instability, emphasizing the significance of due research in the current market.

Crypto’s Fate Hinges on Political Decisions

In the long term, politics will play a crucial role, but before that, the Fed’s September rate cut decision might cause short-term volatility. So far, only Donald Trump has openly embraced crypto, while others like Kamala Harris have taken a diplomatic stance. Whatever the future holds, crypto is poised to make some major moves this year.

Also Check Out: Bitcoin News: Is BTC Price Setting Up for a Major Rally? Fed Rate Cut Sparks Frenzy

What are your predictions for the crypto market after the September event?

The above is the detailed content of Crypto Market in Limbo as It Awaits Key Events, Including US PCE Inflation Data and Remarks From Federal Reserve Officials. For more information, please follow other related articles on the PHP Chinese website!

Tether CEO Paolo Ardoino Completes Visit to the United States, Meeting with Lawmakers in Washington, D.C. to Discuss Stablecoin RegulationApr 15, 2025 am 11:24 AM

Tether CEO Paolo Ardoino Completes Visit to the United States, Meeting with Lawmakers in Washington, D.C. to Discuss Stablecoin RegulationApr 15, 2025 am 11:24 AMHis visit comes as the U.S. Congress moves closer to introducing legislation regulating stablecoins, which Ardoino believes is necessary for financial inclusion and preserving U.S. dollar dominance.

Why XRP Price May Not 'Go Parabolic' Post-SEC SettlementApr 15, 2025 am 11:22 AM

Why XRP Price May Not 'Go Parabolic' Post-SEC SettlementApr 15, 2025 am 11:22 AMThe XRP price holds still in the $2.10-2.20 range for the past few days, but this is not stopping Ripple's community from continuing to post various content about XRP

Metaplanet Expands Its Bitcoin Treasury Holdings by Another 319 BTCApr 15, 2025 am 11:20 AM

Metaplanet Expands Its Bitcoin Treasury Holdings by Another 319 BTCApr 15, 2025 am 11:20 AMIn an announcement made earlier today, Japanese firm Metaplanet revealed it has acquired another 319 Bitcoin (BTC), pushing its total corporate holdings beyond 4,500 BTC.

Metaplanet Scoops Another 319 Bitcoin, Pushing Its Total Corporate Holdings Beyond 4500Apr 15, 2025 am 11:18 AM

Metaplanet Scoops Another 319 Bitcoin, Pushing Its Total Corporate Holdings Beyond 4500Apr 15, 2025 am 11:18 AMIn an announcement made earlier today, Japanese firm Metaplanet revealed it has acquired another 319 Bitcoin (BTC), pushing its total corporate holdings beyond 4,500 BTC.

Ripple (XRP) price rallied through a weekend riseApr 15, 2025 am 11:16 AM

Ripple (XRP) price rallied through a weekend riseApr 15, 2025 am 11:16 AMRipple (XRP) price rallied through a weekend rise from its $2.00 critical support mark to reach $2.23.

Bitcoin (BTC) drifts upwards as the broader market adjusts favorably to trade-related newsApr 15, 2025 am 11:14 AM

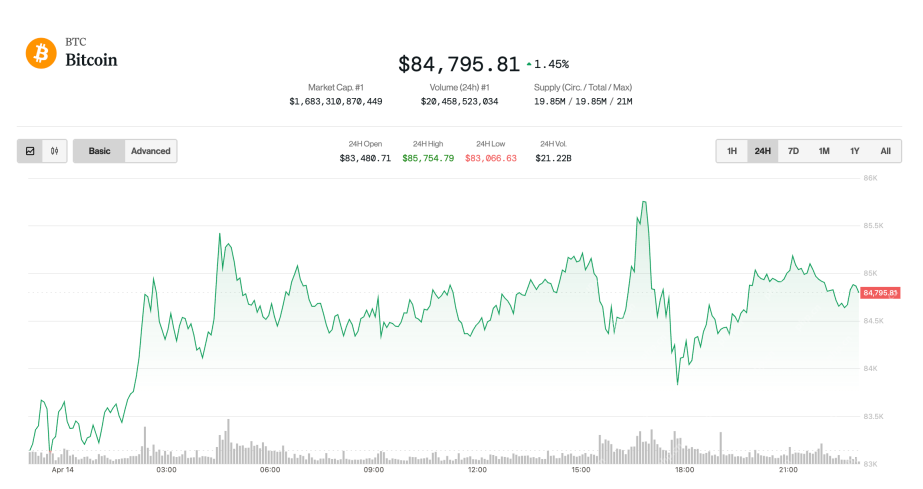

Bitcoin (BTC) drifts upwards as the broader market adjusts favorably to trade-related newsApr 15, 2025 am 11:14 AMThe largest cryptocurrency was up 1.6% in the last 24 hours and is now trading just shy of $85,000. Ether (ETH), meanwhile, rose 2.7%

Is ADA the Sleeper Pick for the Next Bull Run? Hoskinson's $250K BTC Forecast Says YesApr 15, 2025 am 11:12 AM

Is ADA the Sleeper Pick for the Next Bull Run? Hoskinson's $250K BTC Forecast Says YesApr 15, 2025 am 11:12 AMADA has risen by 1.5% in the past 24 hours, with its move to $0.644 coming as the crypto market suffers a 2% loss today.

Solana Leads Market Recovery After Brief Dip Below $100Apr 15, 2025 am 11:10 AM

Solana Leads Market Recovery After Brief Dip Below $100Apr 15, 2025 am 11:10 AMJimmy has nearly 10 years of experience as a journalist and writer in the blockchain industry. He has worked with well-known publications such as Bitcoin Magazine, CCN, and Blockonomi, covering news...

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

Zend Studio 13.0.1

Powerful PHP integrated development environment

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.