web3.0

web3.0 US Employment Data Falls Short of Expectations, Raising the Chances of a Fed Rate Cut in September

US Employment Data Falls Short of Expectations, Raising the Chances of a Fed Rate Cut in SeptemberUS Employment Data Falls Short of Expectations, Raising the Chances of a Fed Rate Cut in September

The chance of the US Federal Reserve cutting interest rates in September has significantly increased. However, financial experts are keeping a close eye on the weaker-than-expected employment data.

The latest US employment data has shown weaker-than-expected job growth, increasing the likelihood of the Federal Reserve cutting interest rates in September.

According to the report by the Bureau of Labor Statistics, non-farm payrolls rose by an average of 818,000 fewer jobs year-over-year from March 2023 to the same month of 2024, indicating a 0.5% decrease between the two periods. Total employment in the private sector also fell by 0.6%, translating to 819,000 fewer jobs.

The steepest decline was observed in the professional and business services sector, which experienced a negative 1.6% growth, adding up to 358,000 fewer jobs. The leisure and hospitality and manufacturing sectors followed closely, losing 150,000 and 115,000 jobs, respectively.

While the numbers generally aligned with analysts' forecasts, they quashed expectations of a significant recovery in the job market this year. The weaker-than-expected employment data provided an opportunity for the Republican party to criticize the Biden administration's economic policies, dubbed "Bidenomics."

The report also comes as the Fed is widely expected to cut interest rates again next month. Despite the upbeat tone, the central bank's chair, Jerome Powell, hinted at an upcoming rate decrease in a speech at the Jackson Hole event on Friday.

At this point, analysts are expecting a series of interest rate cuts to 3.7% this year, followed by potential 4.5% cuts in 2025. Their projections are mainly influenced by the upcoming US presidential election in November.

In the political arena, the Democrats are considering a potential shift in their perspective regarding cryptocurrencies and digital assets. However, the Republicans, led by presidential bet Donald Trump and vice presidential candidate JD Vance, are set on halting the federal government's "unlawful and un-American crypto crackdown" of the crypto market.

The impact of an interest rate cut on Bitcoin (BTC) and the crypto market as a whole is complex, especially given the weaker-than-expected employment data. However, the positive news from the Fed has contributed to the crypto asset's key recovery to $64K this Saturday morning (at UTC standard).

To establish a more precise short-term estimate of Bitcoin and crypto prices, one must consider the sentiment of the equity market and the strength of the US dollar. If BTC manages to hold its own against dollar devaluation and fixed-income investments, its narrative as an inflation hedge could attract retail and institutional investors.

On the other hand, if the Fed fails to achieve a soft landing with the rate adjustment, it could trigger a risk-off sentiment in the equity markets, potentially dampening investor risk appetite and driving them away from high-risk assets like Bitcoin and crypto. Under such a scenario, members of the crypto community should prepare for a possible breach in BTC's critical support level.

Moreover, the flight to safety may not directly benefit Bitcoin and other digital assets if cautious investors choose tangible investments like gold or real estate instead.

The above is the detailed content of US Employment Data Falls Short of Expectations, Raising the Chances of a Fed Rate Cut in September. For more information, please follow other related articles on the PHP Chinese website!

Ripple (XRP) price rebounded to $2.59 Tuesday, fueled by $5.5B open interest and SEC Chair, Paul Atkins signalling softer crypto regulation.May 14, 2025 am 10:32 AM

Ripple (XRP) price rebounded to $2.59 Tuesday, fueled by $5.5B open interest and SEC Chair, Paul Atkins signalling softer crypto regulation.May 14, 2025 am 10:32 AMPaul Atkins Signals Softer Crypto Regulation, XRP Traders React Positively

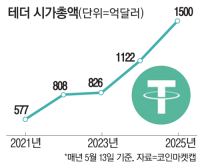

Tether, the issuer of the world's largest stablecoin 'Tether (USDT),' has begun hiring employees to expand its business in Korea.May 14, 2025 am 10:30 AM

Tether, the issuer of the world's largest stablecoin 'Tether (USDT),' has begun hiring employees to expand its business in Korea.May 14, 2025 am 10:30 AMTether has a market capitalization of $150 billion and is used as the key currency of the global virtual asset market.

After Explosive Rally, Bitcoin Pauses Its Upward Momentum at the $105K LevelMay 14, 2025 am 10:28 AM

After Explosive Rally, Bitcoin Pauses Its Upward Momentum at the $105K LevelMay 14, 2025 am 10:28 AMAfter an explosive multi-week rally, Bitcoin has paused its upward momentum at the $105K level, retracing to find support in the $101K–$100K range.

BlockDAG (BDAG) Clears CertiK Audit, DOT Price Stays Below $4, and LTC Gains 10%May 14, 2025 am 10:26 AM

BlockDAG (BDAG) Clears CertiK Audit, DOT Price Stays Below $4, and LTC Gains 10%May 14, 2025 am 10:26 AMFinding the best long-term crypto investments often comes from looking past headlines to focus on value, timing, and future growth potential.

Ruvi (RV) Has Long Been a Heavyweight in the Crypto Space, boasting a Current Price of $0.2641May 14, 2025 am 10:24 AM

Ruvi (RV) Has Long Been a Heavyweight in the Crypto Space, boasting a Current Price of $0.2641May 14, 2025 am 10:24 AMTRON (TRX) has long been a heavyweight in the crypto space, boasting a current price of $0.2641, a 2.12% dip in the past 24 hours, and a market capitalization of $25.07 billion.

Coinbase Listing on S&P 500 Index Sparks Bullish Trend in Cryptocurrency MarketMay 14, 2025 am 10:22 AM

Coinbase Listing on S&P 500 Index Sparks Bullish Trend in Cryptocurrency MarketMay 14, 2025 am 10:22 AMRecently, following President Trump's tariff policy exemption, the global cryptocurrency exchange Coinbase has been added to the S&P 500 index

Pi Coin Price Prediction for Today (May 14)May 14, 2025 am 10:20 AM

Pi Coin Price Prediction for Today (May 14)May 14, 2025 am 10:20 AMThe price of Pi coin has shown some strong signs of bullish momentum. After holding support near $1.05 earlier this week

Jack Mallers' Twenty One Capital Buys 4,812 Bitcoin from Tether for $458.7M Ahead of Public ListingMay 14, 2025 am 10:18 AM

Jack Mallers' Twenty One Capital Buys 4,812 Bitcoin from Tether for $458.7M Ahead of Public ListingMay 14, 2025 am 10:18 AMToday, Cantor Equity Partners, Inc. revealed in a new filing with the SEC that Tether bought 4812.2 Bitcoin for a total of $458.7 million

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

Dreamweaver Mac version

Visual web development tools

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function