Bitdeer Technologies Group Sets the Stage for a $150 Million Convertible Notes Offering

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOriginal

- 2024-08-18 06:11:23569browse

The deal is scheduled to wrap up on Aug. 20, 2024. This move aligns with a broader trend in the bitcoin mining sector

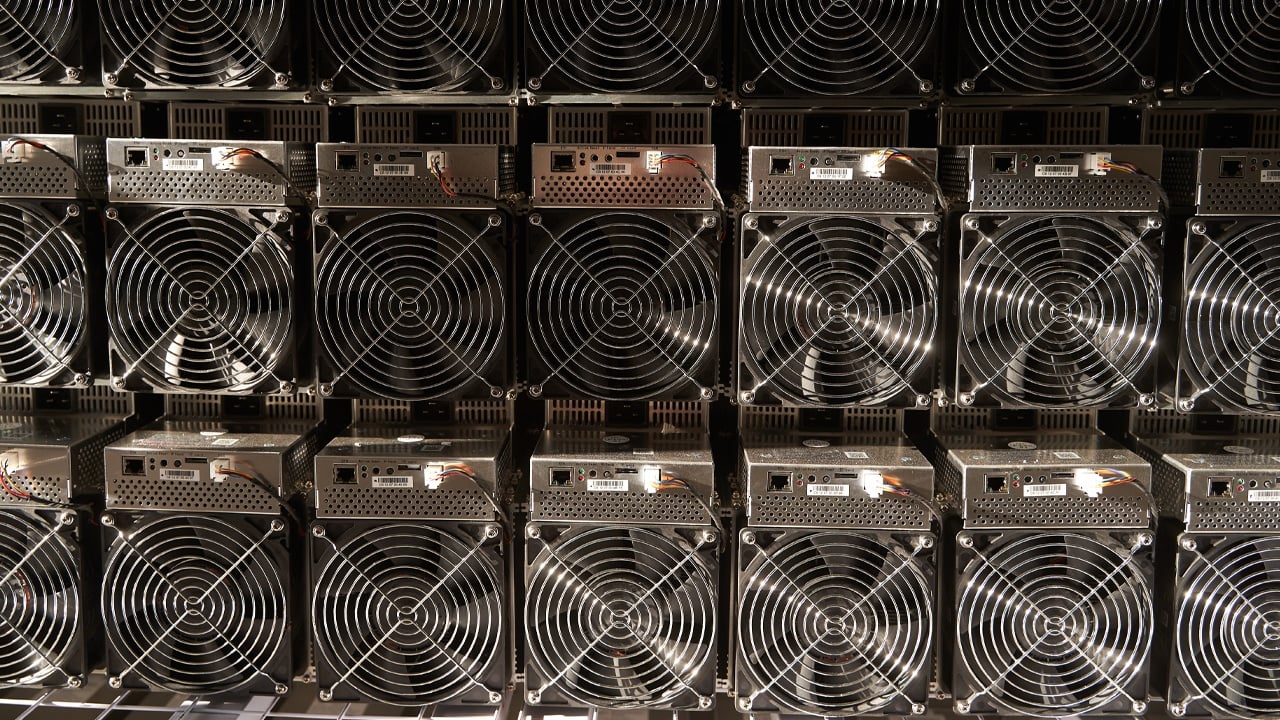

Bitcoin mining firm Bitdeer Technologies Group (NYSE:BTDR) has announced a $150 million convertible notes offering, with an annual interest rate of 8.5%. The notes will mature in 2029 and can be converted into Bitdeer’s Class A ordinary shares at an initial rate of 117.0207 shares per $1,000 principal amount. This equates to a conversion price of $8.55 per share, which is a 35% premium over the last recorded sale price of $6.33 on Aug. 15, 2024.

According to the announcement, Bitdeer plans to allocate approximately $144.5 million of the net proceeds to expand its data centers, develop application-specific integrated circuit (ASIC)-based mining rigs, and for other corporate uses.

The offering is being managed by BTIG, with A.G.P./Alliance Global Partners, The Benchmark Company, Needham & Company, and Roth Capital Partners serving as co-managers.

This follows a broader trend in the bitcoin mining sector, where firms have collectively secured $2.1 billion through stock offerings since the second quarter, as reported by theminermag.com. Among them, MARA raised $550 million, Hive secured $374 million, Core obtained $275 million, Terawulf raised $250 million, Cleanspark secured $175 million, Riot obtained $150 million, Bitfarms raised $125 million, and Cipher secured $75 million.

The annual yield of 8.5% that Bitdeer is offering is notably different from what other mining firms have done, which could potentially draw investors more swiftly.

On the day of the announcement, Bitdeer’s shares (BTDR) went up by 2.05%, closing at $7.05. However, the shares are still down 15.7% over the past five days.

The above is the detailed content of Bitdeer Technologies Group Sets the Stage for a $150 Million Convertible Notes Offering. For more information, please follow other related articles on the PHP Chinese website!