Bitcoin's (BTC) price is consolidating in a tight range as market participants are uncertain about the future direction of the price.

Bitcoin’s price has been consolidating in a tight range over the last few weeks as market participants remain uncertain about the future direction of the price following the significant drop below the 200-day moving average.

After dropping below the 200-day MA, BTC price took a hit and dropped toward the $50K area, where it found support and began to consolidate.

Currently, the market is consolidating below the moving average, which is located around the $63K mark, failing to climb back above.

Meanwhile, the $56K support level currently holds the market, preventing the price from dropping further. Therefore, a breakout from either this level or the 200-day moving average could determine the short-term price action of BTC and the crypto market.

Bitcoin’s 4-Hour Timeframe Analysis

Shifting our attention to the lower timeframe, specifically the 4-hour chart, we can observe a bullish flag pattern forming after the recent recovery from the $50K area.

The price has been consolidating within a narrowing range, with both the upper and lower trendlines converging. This type of price action usually indicates a period of indecision among traders before a breakout.

Considering the price action inside the flag pattern, it could only be a matter of time before the market breaks it to the upside, which could result in a rally toward the $64K resistance zone in the short term.

On the other hand, note that things could get ugly quickly if the flag gets broken to the downside.

Bitcoin On-Chain Analysis: Short-Term Holders SOPR

While Bitcoin’s price action has been quite choppy over the last few months, analyzing what the investors are going through can be insightful.

This chart presents the Bitcoin short-term holder SOPR, which measures the aggregate ratio of profits (or losses) realized by short-term investors. Values above one show aggregate profit realization, and values below one indicate losses being realized on aggregate.

As the chart suggests, during the last few months of consolidation, the profit margins for short-term holders have been declining, and they have even been realizing losses in the previous few weeks.

This could be a sign of impatience among short-term holders as they are selling at a loss to get out of the market quickly. While unfortunate, this shakeout could be a typical sign of a price bottom in the middle of a long-term bull run.

Yet, this is not guaranteed, as a wide range of factors can affect how the price will behave in the near future.

The above is the detailed content of Bitcoin (BTC) Price Consolidates, What to Expect?. For more information, please follow other related articles on the PHP Chinese website!

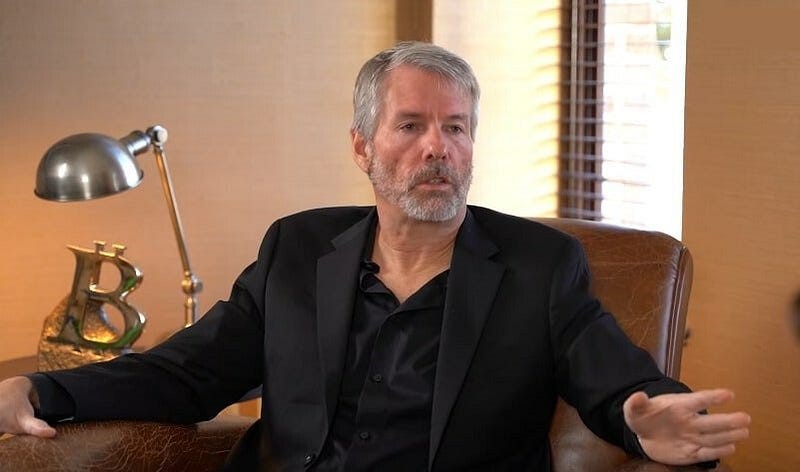

Michael Saylor Drops New Bitcoin Price Prediction, Now Targeting $13M per Coin by 2045Jul 27, 2024 pm 09:12 PM

Michael Saylor Drops New Bitcoin Price Prediction, Now Targeting $13M per Coin by 2045Jul 27, 2024 pm 09:12 PMMichael Saylor popular Bitcoin activist and co-founder of MicroStrategy, a business intelligence firm has dropped his latest prediction for Bitcoin price in the ongoing Bitcoin 2024 conference in Nashville.

SHIB Price Could Reach $0.0007 by 2050 if It Follows Bitcoin to Hit $2.9MJul 27, 2024 pm 06:25 PM

SHIB Price Could Reach $0.0007 by 2050 if It Follows Bitcoin to Hit $2.9MJul 27, 2024 pm 06:25 PMShiba Inu price could potentially reach unprecedented heights if SHIB follows Bitcoin should the premier crypto asset hit $2.9 million as predicted by VanEck.

Senator Bill Hagerty Welcomes Former US President Donald Trump to Nashville for Bitcoin 2024 ConferenceJul 27, 2024 am 07:22 AM

Senator Bill Hagerty Welcomes Former US President Donald Trump to Nashville for Bitcoin 2024 ConferenceJul 27, 2024 am 07:22 AMOne of the most important points of focus in the US Presidential race has been the policy of both parties regarding Bitcoin and cryptocurrencies.

Trump Courts Crypto Cash as Bitcoin Enthusiasts Unite Behind His Bid for the White HouseJul 27, 2024 pm 09:09 PM

Trump Courts Crypto Cash as Bitcoin Enthusiasts Unite Behind His Bid for the White HouseJul 27, 2024 pm 09:09 PMMany of the nation's leading cryptocurrency companies, executives, investors and fanatics are beginning to unite around former president Donald Trump's bid for the White House

Ferrari Expands Cryptocurrency Payment Option to European Merchants by End of July 2024Jul 25, 2024 pm 02:28 PM

Ferrari Expands Cryptocurrency Payment Option to European Merchants by End of July 2024Jul 25, 2024 pm 02:28 PMFollowing CNF's earlier update that Ferrari is accepting Bitcoin, Ripple (XRP), and other cryptocurrencies as payment for its cars, it is now reported that Ferrari will expand its cryptocurrency payment option to European dealers by the end o

Kamala Harris Won't Be Speaking at Bitcoin 2024 Conference, David Bailey Indirectly Shows Support for Donald TrumpJul 25, 2024 pm 02:31 PM

Kamala Harris Won't Be Speaking at Bitcoin 2024 Conference, David Bailey Indirectly Shows Support for Donald TrumpJul 25, 2024 pm 02:31 PMWith the American President Joe Biden deciding not to run for re-election, Vice President Kamala Harris is now a top contender for the presidential race. Recently, she spoke about Bitcoin and cryptocurrencies, making her stance clear.

Trump to Deliver Keynote Address at World's Largest Cryptocurrency ConferenceJul 28, 2024 am 12:19 AM

Trump to Deliver Keynote Address at World's Largest Cryptocurrency ConferenceJul 28, 2024 am 12:19 AMFormer President and current Republican presidential nominee Donald Trump will deliver the keynote address at the world's largest cryptocurrency conference.

Trump's Bitcoin Embrace Shakes Democrats 'to the Core,' Says Anthony Scaramucci Ahead of BTC ConferenceJul 27, 2024 pm 09:46 PM

Trump's Bitcoin Embrace Shakes Democrats 'to the Core,' Says Anthony Scaramucci Ahead of BTC ConferenceJul 27, 2024 pm 09:46 PMFormer White House Communications Director Anthony Scaramucci weighed in on the possible impact on Bitcoin (BTC) prices if former President Donald Trump wins his second term in the upcoming elections.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

SublimeText3 Chinese version

Chinese version, very easy to use