These Bitcoin Indicators Could Be To Follow For Bear Market Signals

In a new post on X, on-chain analyst Checkmate replied to a user asking about an on-chain metric indicating when it's time to turn bearish on cryptocurrency.

An on-chain analyst has shared two signals in key metrics that could be used to gauge whether Bitcoin is due for a bearish phase.

Bitcoin has observed a choppy price movement over the past few weeks. After rallying to highs of $62,000 earlier this week, the coin slipped to lows of $57,800 at press time. Now, an on-chain analyst has shared two signals in key metrics that could be used to gauge whether the coin is due for a bearish phase.

In a new post on X, the analyst, known as Checkmate, replied to a user asking about an on-chain metric indicating when it’s time to turn bearish on the cryptocurrency.

Checkmate has shared two indicators: the Short-Term Holder Realized Profit/Loss Momentum and the Short-Term Holder MVRV Ratio Momentum. “Short-Term Holders” (STHs) here refer to the Bitcoin investors who bought their coins within the past 155 days, meaning that both of these metrics are only for the recent buyers in the market.

Short-Term Holder Realized Profit/Loss Momentum

First, the “Realized Profit/Loss Momentum” measures, as its name suggests, the momentum in the ratio of the profit and loss that the STHs are realizing through their selling.

Below is the chart for the indicator posted by the analyst.

According to the analyst, it is time to be bearish when the oscillator on the bottom of this chart turns red (corresponding to negative momentum in the STH Realized Profit/Loss).

The graph shows that this oscillator assumed negative values soon after the price set its new all-time high (ATH) and has since remained in the region. And indeed, while the indicator has seen these values, Bitcoin has been going through a rough phase.

Short-Term Holder MVRV Ratio Momentum

The second indicator works similarly and keeps track of the distance between the Market Value to Realized Value (MVRV) Ratio for this cohort and its 155-day moving average (MA).

The MVRV Ratio is a popular indicator that tells us how the value held by the investors (the market cap) compares against what they used to purchase their coins (the Realized Cap). In other words, the metric provides information about the unrealized profit/loss of the holders.

Thus, whereas the Realized Profit/Loss keeps track of the net profit/loss the investors are harvesting through their selling, this metric tells us about the profit/loss they have yet to take.

Here is the data for the momentum indicator for the MVRV Ratio specifically for the STHs:

According to the analyst, just like with the first indicator, this one also gives a bearish signal when the momentum turns red. As the chart shows, the STH MVRV Ratio has been under its 155-day MA for the same period as the bearish momentum in the Realized Profit/Loss, thus providing confluence to the signal.

The above is the detailed content of These Bitcoin Indicators Could Be To Follow For Bear Market Signals. For more information, please follow other related articles on the PHP Chinese website!

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PM

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PMThis sharp drop happened as investor interest faded and a major scandal hit the highly speculative market.

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PM

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PMDespite being pretty much the iconic example of “random” – well, that and dice rolls – we can't help but feel like there's some element of skill involved. Especially when we lose.

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AM

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AMBitwise, a leading digital asset manager, has announced the listing of four of its crypto Exchange-Traded Products (ETPs) on the London Stock Exchange (LSE).

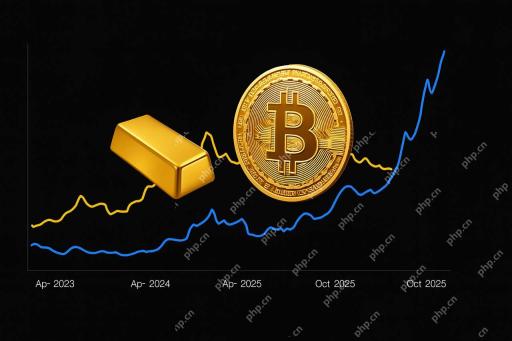

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AM

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AMBitcoin may be poised for a massive rally—but only if gold continues its upward climb, according to Joe Consorti, Head of Growth at Theya.

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AM

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AMThe Shiba Inu price continues to attract the attention of analysts, who are watching for its next potential move. By Samuele Piar. Updated April 14, 2025.

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AM

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AMThe joint motion of Ripple and U.S. Securities and Exchange Commission (SEC) to hold the appeal in abeyance has been granted by the Circuit Judge Jose A. Cabranes.

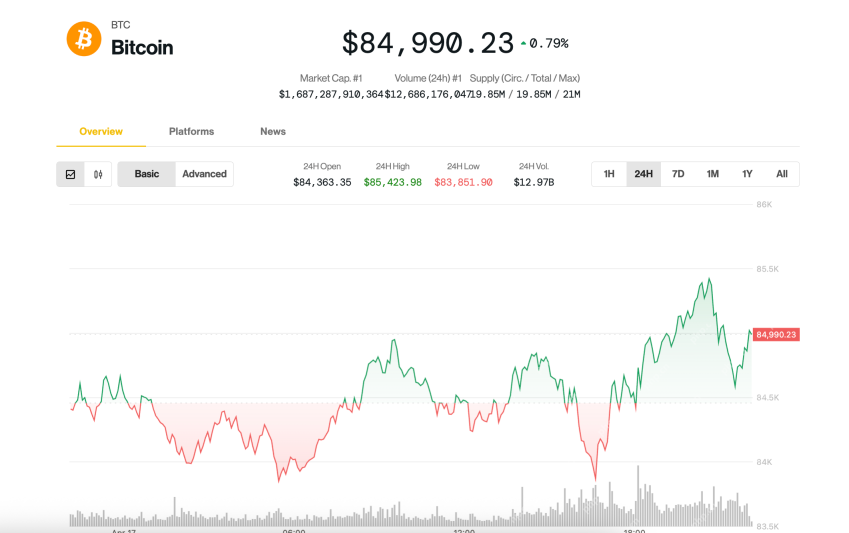

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AM

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AMBitcoin (BTC) was treading water just below $85,000 late Thursday as tensions between U.S. President Donald Trump and Federal Reserve Chair Jerome Powell added another layer of uncertainty for investors.

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AM

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AMToday, AB DAO officially announced the launch of a dual reward campaign in collaboration with Bitget (bitget.com), the world's second-largest digital asset trading platform.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Dreamweaver Mac version

Visual web development tools

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

SublimeText3 Chinese version

Chinese version, very easy to use

WebStorm Mac version

Useful JavaScript development tools

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.