Bitcoin (BTC) Price Prediction: BTC Surges 7% in 48-Hours, Can Bulls Reclaim $65k?

Bitcoin began August with a shaky start, but over the past week, the cryptocurrency has gained steady upward momentum. The most recent wave of Bitcoin's rally can be linked to Grayscale

Bitcoin price soared on August 14, rising above $61,700 after a 7% gain in the last two days. On-chain data reveals increased demand from Grayscale’s investment trusts, coinciding with dovish US CPI data. Could BTC be poised for a $65,000 breakout?

BTC Surges 7% in 48-Hours

Bitcoin began August with a less-than-stellar performance, trading within a narrow range with minimal gains. However, over the past week, the cryptocurrency has gained steady upward momentum.

The most recent wave of Bitcoin’s rally can be linked to Grayscale, a major institutional investor, which announced new crypto asset offerings to its U.S.-based clientele.

On August 12, Grayscale launched new cryptocurrency trusts for SUI, TAO, and MKR. This event, and other institutional activity, signaled deeper adoption in the crypto space. The bullish sentiment from Grayscale’s move has since extended to Bitcoin, driving up its price.

As the chart above indicates, Bitcoin's price has risen 7% in the last two days. On August 12, BTC was trading around $58,000, and by August 14, it had surged to $61,700. This price increase can be largely attributed to the positive impact of Grayscale’s actions on the market.

Now, Bitcoin seems poised for further gains, driven by an imminent shift in the U.S. macroeconomic landscape.

Dovish CPI Could Drive BTC Further Upwards

Building on the momentum from Grayscale’s recent activity, Bitcoin's price is also being buoyed by favorable macroeconomic conditions.

On August 14, the U.S. Bureau of Labor Statistics disclosed the Consumer Price Index (CPI) data for July, which provided additional bullish sentiment for Bitcoin.

As shown in the chart above, the U.S. CPI rose by 2.9% year-over-year, which is slightly below the estimated 3.0%. Meanwhile, the core CPI, which excludes food and energy prices, increased by 3.2% year-over-year, matching the forecast. These figures suggest that inflation is slowing, reinforcing a dovish outlook on monetary policy.

A dovish CPI report can be interpreted as a signal that the Federal Reserve may halt its interest rate hikes or even consider a rate cut in the near future. Many market participants now expect an interest rate cut as early as September. Lower interest rates generally lead to a weaker U.S. dollar and higher demand for alternative assets like Bitcoin.

The combination of Grayscale’s institutional actions and the dovish CPI report presents a compelling case for a bullish Bitcoin price trajectory in the near term.

BTC Price Forecast: All Eyes on $65k Target

As Bitcoin continues its upward trajectory, strategic traders are keeping a close watch on the $65,000 target, which has been highlighted by several technical indicators.

The technical indicators in the chart below suggest that BTC is leaning bullish, with key resistance and support levels now in focus.

First, the Keltner Channels (KC) indicator highlights critical resistance at $65,000, with support solidified around $58,000.

If Bitcoin’s price breaks above the upper KC band at $65,000, it could trigger a robust bullish momentum, potentially driving the price even higher. On the downside, a breach of the lower KC band at $58,000 could signal a prolonged retracement, but this appears unlikely given the current market dynamics.

Bitcoin price outlook remains positive, supported by both institutional demand and favorable macroeconomic conditions.

The above is the detailed content of Bitcoin (BTC) Price Prediction: BTC Surges 7% in 48-Hours, Can Bulls Reclaim $65k?. For more information, please follow other related articles on the PHP Chinese website!

amazon project kuiper satellite launchApr 10, 2025 pm 05:36 PM

amazon project kuiper satellite launchApr 10, 2025 pm 05:36 PMAmazon's Project Kuiper satellite launch was postponed due to unfavorable weather conditions. The delay was likely influenced by factors such as high-altitude wind shear, lightning threats, and high surface winds, which are common hazards in space launches. This postponement highlights the need for meticulous planning and flexibility in the unpredictable environment of space operations.

Is Wall Street Quietly Backing Solana? $42 Million Bet Says YesApr 10, 2025 pm 12:43 PM

Is Wall Street Quietly Backing Solana? $42 Million Bet Says YesApr 10, 2025 pm 12:43 PMA group of former Kraken executives acquired U.S.-listed company Janover, which secured $42 million in venture capital funding to begin building a Solana (SOL) treasury.

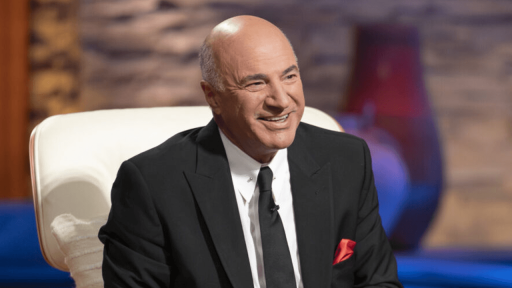

Kevin O'Leary Urges Trump to Impose 400% Tariff on Chinese GoodsApr 10, 2025 pm 12:35 PM

Kevin O'Leary Urges Trump to Impose 400% Tariff on Chinese GoodsApr 10, 2025 pm 12:35 PMCanadian businessman and investor Kevin O’Leary urged the Trump administration to impose a 400% tariff on Chinese goods, arguing that the current 104% tariff is insufficient to compel China to follow trade rules. O’Leary said these statements prior t

Regulatory roadblocks are crumbling as the U.S. Treasury signals a sweeping pivot toward blockchain, stablecoins, and digital assetsApr 10, 2025 pm 12:27 PM

Regulatory roadblocks are crumbling as the U.S. Treasury signals a sweeping pivot toward blockchain, stablecoins, and digital assetsApr 10, 2025 pm 12:27 PMU.S. Treasury Secretary Scott Bessent laid out a broad financial reform agenda at the Bankers Association Summit on April 9, pledging to remove regulatory barriers

China and Russia Have Started to Settle Some Trade Deals Using BitcoinApr 10, 2025 pm 12:19 PM

China and Russia Have Started to Settle Some Trade Deals Using BitcoinApr 10, 2025 pm 12:19 PMAccording to a report by VanEck, China and Russia have started to settle some trade deals using Bitcoin.

Skybridge Capital's founder warns China is preparing fierce economic retaliation as the U.S. slaps 125% tariffs on Chinese goods, signaling currency shocks, massive stimulus, and financial warfare.Apr 10, 2025 pm 12:03 PM

Skybridge Capital's founder warns China is preparing fierce economic retaliation as the U.S. slaps 125% tariffs on Chinese goods, signaling currency shocks, massive stimulus, and financial warfare.Apr 10, 2025 pm 12:03 PMucci Outlines 5-Point Forecast on China's Next Moves Amid Rising Trade Tensions

Ethereum (ETH) Underperforms Bitcoin (BTC)Apr 10, 2025 pm 12:01 PM

Ethereum (ETH) Underperforms Bitcoin (BTC)Apr 10, 2025 pm 12:01 PMunderperformed Bitcoin on 85% of all trading days since it launched in 2015. The ETH/BTC ratio, which tracks the value of Ether relative to Bitcoin, dropped to a five-year low of 0.018

President Trump's Tariff Announcement Sent Bitcoin Dropping 5.4%Apr 10, 2025 am 11:53 AM

President Trump's Tariff Announcement Sent Bitcoin Dropping 5.4%Apr 10, 2025 am 11:53 AMIn the world of cryptocurrencies, few events can shake things up like big government decisions. President Trump's recent tariff announcement did exactly that

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

Atom editor mac version download

The most popular open source editor

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

SublimeText3 Linux new version

SublimeText3 Linux latest version

SublimeText3 Chinese version

Chinese version, very easy to use