Will Dogecoin Ever Hit $1? Here's What the Chart Says

In typical fashion, it has been an extremely volatile year for Dogecoin (DOGE 2.31%). While the cryptocurrency market overall has gained 20% in value

Dogecoin (CRYPTO: DOGE) has had a wild ride in 2024, but not in a good way. While the cryptocurrency market has soared 20%, now valued at $2 trillion, the dog-themed token is up just 5% year to date (as of Aug. 6). Dogecoin trades a gut-wrenching 86% off its peak price of under $0.74 in 2021.

But can this cryptocurrency skyrocket more than tenfold from today's price to one day reach the psychologically important $1 mark? Let's find out.

The Dogecoin roller coaster

Dogecoin hit its record price in May 2021, around the time meme stock mania took over the stock market. That enthusiasm led to bullish activity in the crypto industry as well. As one of the most speculative tokens out there, Dogecoin benefited tremendously.

But in the crypto market, what quickly goes up usually comes down rapidly as well. That's what happens when a particular token's price is driven more by speculative behavior than by any sort of fundamentals.

For example, Dogecoin's price has gained anytime one of its well-known supporters, Tesla founder and CEO Elon Musk, talks about it publicly. There is hope that the social media platform the tech mogul owns, X (formerly known as Twitter), could integrate Dogecoin as a potential payment facilitator.

However, any excitement is usually short-lived. This has happened in 2024, too. From the start of this year to March 29, Dogecoin soared 144%. Since then, it's down 57%. I don't think there's any reason to believe this kind of boom-and-bust price action is going to change. And that makes it difficult for someone to invest.

Focus on the fundamentals

What would it take for Dogecoin to rise tenfold to reach $1? It's actually a simple answer. There needs to be strong demand for people to want to own Dogecoin in their portfolios. I'm not sure if this will happen in a meaningful way.

Dogecoin was created to be a lighthearted rival to Bitcoin (CRYPTO: BTC). Dogecoin aims to be a payment network, and it also runs a proof-of-work consensus protocol. But that's where the similarities probably end.

Bitcoin has become a legitimate financial asset over the years. Investors find immense value in its decentralized nature and fixed supply cap. Bitcoin is not only taking on gold as a popular store of value, but the network is a competitor to the current monetary system.

On the other hand, there are currently 145 billion Dogecoin tokens in circulation. That figure expands by 10,000 every single minute, and there is no upper limit. This couldn't be further from Bitcoin's level of scarcity. In fact, Dogecoin's abundant supply makes it hard for the price to significantly rise.

The community support that Dogecoin has been able to attract is admirable. Right now, it's the ninth-most-valuable blockchain network, with a market cap of $14 billion.

However, I believe it has virtually no utility. And it doesn't have that many developers working on advancing the network. This doesn't bode well for its long-term viability. Eventually, the market might start to question if Dogecoin should even exist.

For someone looking to invest their hard-earned savings into an asset, there are many better choices. Digital assets like Bitcoin and Ethereum could satisfy your crypto allocation. There are even growth tech stocks that could provide a better alternative for investors who are comfortable taking on more risk in the equity markets.

Not only do I view Dogecoin as an investment you're better off not making, I don't see its price ever getting to $1 per token.

The above is the detailed content of Will Dogecoin Ever Hit $1? Here's What the Chart Says. For more information, please follow other related articles on the PHP Chinese website!

Tether CEO Paolo Ardoino Completes Visit to the United States, Meeting with Lawmakers in Washington, D.C. to Discuss Stablecoin RegulationApr 15, 2025 am 11:24 AM

Tether CEO Paolo Ardoino Completes Visit to the United States, Meeting with Lawmakers in Washington, D.C. to Discuss Stablecoin RegulationApr 15, 2025 am 11:24 AMHis visit comes as the U.S. Congress moves closer to introducing legislation regulating stablecoins, which Ardoino believes is necessary for financial inclusion and preserving U.S. dollar dominance.

Why XRP Price May Not 'Go Parabolic' Post-SEC SettlementApr 15, 2025 am 11:22 AM

Why XRP Price May Not 'Go Parabolic' Post-SEC SettlementApr 15, 2025 am 11:22 AMThe XRP price holds still in the $2.10-2.20 range for the past few days, but this is not stopping Ripple's community from continuing to post various content about XRP

Metaplanet Expands Its Bitcoin Treasury Holdings by Another 319 BTCApr 15, 2025 am 11:20 AM

Metaplanet Expands Its Bitcoin Treasury Holdings by Another 319 BTCApr 15, 2025 am 11:20 AMIn an announcement made earlier today, Japanese firm Metaplanet revealed it has acquired another 319 Bitcoin (BTC), pushing its total corporate holdings beyond 4,500 BTC.

Metaplanet Scoops Another 319 Bitcoin, Pushing Its Total Corporate Holdings Beyond 4500Apr 15, 2025 am 11:18 AM

Metaplanet Scoops Another 319 Bitcoin, Pushing Its Total Corporate Holdings Beyond 4500Apr 15, 2025 am 11:18 AMIn an announcement made earlier today, Japanese firm Metaplanet revealed it has acquired another 319 Bitcoin (BTC), pushing its total corporate holdings beyond 4,500 BTC.

Ripple (XRP) price rallied through a weekend riseApr 15, 2025 am 11:16 AM

Ripple (XRP) price rallied through a weekend riseApr 15, 2025 am 11:16 AMRipple (XRP) price rallied through a weekend rise from its $2.00 critical support mark to reach $2.23.

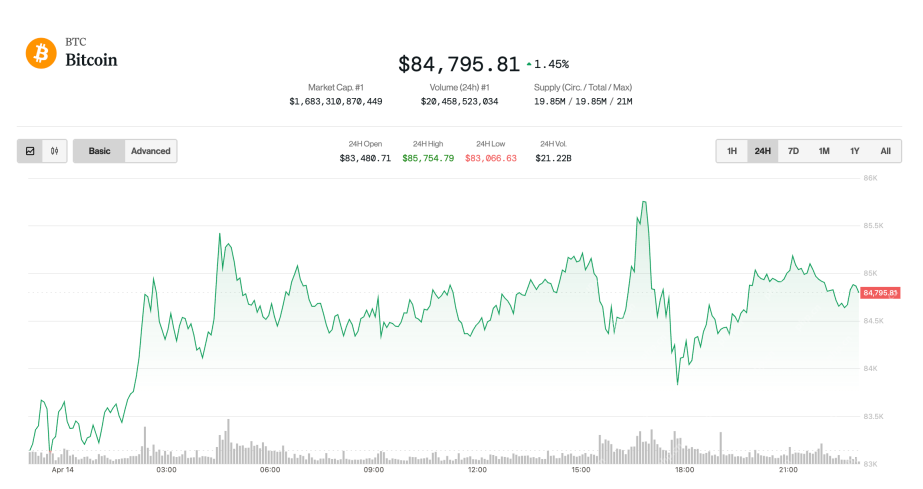

Bitcoin (BTC) drifts upwards as the broader market adjusts favorably to trade-related newsApr 15, 2025 am 11:14 AM

Bitcoin (BTC) drifts upwards as the broader market adjusts favorably to trade-related newsApr 15, 2025 am 11:14 AMThe largest cryptocurrency was up 1.6% in the last 24 hours and is now trading just shy of $85,000. Ether (ETH), meanwhile, rose 2.7%

Is ADA the Sleeper Pick for the Next Bull Run? Hoskinson's $250K BTC Forecast Says YesApr 15, 2025 am 11:12 AM

Is ADA the Sleeper Pick for the Next Bull Run? Hoskinson's $250K BTC Forecast Says YesApr 15, 2025 am 11:12 AMADA has risen by 1.5% in the past 24 hours, with its move to $0.644 coming as the crypto market suffers a 2% loss today.

Solana Leads Market Recovery After Brief Dip Below $100Apr 15, 2025 am 11:10 AM

Solana Leads Market Recovery After Brief Dip Below $100Apr 15, 2025 am 11:10 AMJimmy has nearly 10 years of experience as a journalist and writer in the blockchain industry. He has worked with well-known publications such as Bitcoin Magazine, CCN, and Blockonomi, covering news...

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 Chinese version

Chinese version, very easy to use

Atom editor mac version download

The most popular open source editor

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

Zend Studio 13.0.1

Powerful PHP integrated development environment

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software