GM Harish Balayogi, a member of the Lok Sabha, asked questions concerning the country's laws governing virtual digital assets (VDAs).

India does not currently have any plans to regulate cryptocurrency transactions, the Ministry of Finance has stated. Member of the Lok Sabha GM Harish Balayogi raised questions in the legislature regarding the country’s laws governing virtual digital assets (VDAs). Pankaj Chaudhary, the Minister of State for Finance, responded in writing to the questions.

Chaudhary stated that the government of India does not collect any data on cryptocurrencies, and that they remain largely unregulated in the country. He stated, “At present, there isn’t a proposal to introduce legislation in the country to regulate the buying and selling of virtual digital assets.”

Government Assesses Risks, crypto transactions to Continue Without Immediate Regulation

The Minister highlighted that the Financial Intelligence Unit India (FIU-IND) has been authorized to classify Virtual Digital Asset Service Providers (VDSAPs) as Reporting Entities under the Prevention of Money Laundering Act, 2002 (PMLA) for specific oversight purposes such as anti-money laundering (AML) and counter-terrorism financing (CFT). Law Enforcement Agencies (LEAs) are also tasked with addressing illegal activities in accordance with existing legal provisions.

Current laws empower law enforcement agencies, including regulators like the Reserve Bank of India, to take action against illegal conduct. Recent orders by the Directorate General of GST Intelligence for Binance to pay $86 million in unpaid taxes put a spotlight on continuing regulatory measures.

Despite the lack of regulations, the Indian government is participating in global discussions on cryptocurrencies. A holistic policy approach was enabled by India’s G20 leadership with the adoption of a roadmap on crypto assets. The government is assessing risks specific to the country before deciding on regulations. A discussion paper outlining the government’s position is set to be submitted by September 2024. India’s central bank digital currency, the e-rupee, is seeing expanding adoption, with major payment firms like AmazonPay and GooglePay showing keen interest.

Indian investors and businesses in the crypto sector are keeping a close watch on any shifts in the regulatory landscape, navigating the current frameworks.

The above is the detailed content of India Has No Plans to Regulate Cryptocurrency Transactions, Ministry of Finance States. For more information, please follow other related articles on the PHP Chinese website!

The Sandbox's Largest Market for Creators Is Now India: Co-Founder Sebastien BorgetSep 04, 2024 pm 09:23 PM

The Sandbox's Largest Market for Creators Is Now India: Co-Founder Sebastien BorgetSep 04, 2024 pm 09:23 PMIndia has more than 66,000 creators on the Metaverse platform compared with 59,989 creators in the U.S. and 25,335 in Brazil.

Digital Rupee Garners 5 Million UsersAug 01, 2024 pm 09:43 PM

Digital Rupee Garners 5 Million UsersAug 01, 2024 pm 09:43 PMIndia's central bank, the Reserve Bank of India (RBI), has revealed that as of June, there were five million digital rupee users and 420,000 merchants participating

India and the UAE Complete First Crude Oil Transaction Using XRP, Bypassing the US DollarAug 15, 2024 am 12:46 AM

India and the UAE Complete First Crude Oil Transaction Using XRP, Bypassing the US DollarAug 15, 2024 am 12:46 AMThis historic trade is a significant step towards de-dollarization. This approach allowed both countries to use their local currencies while leveraging the speed and efficiency of blockchain technology.

India Has No Plans to Regulate Cryptocurrency Transactions, Ministry of Finance StatesAug 08, 2024 am 12:18 AM

India Has No Plans to Regulate Cryptocurrency Transactions, Ministry of Finance StatesAug 08, 2024 am 12:18 AMGM Harish Balayogi, a member of the Lok Sabha, asked questions concerning the country's laws governing virtual digital assets (VDAs).

India's first QR code-based coin vending machine installed in KozhikodeOct 26, 2024 pm 09:50 PM

India's first QR code-based coin vending machine installed in KozhikodeOct 26, 2024 pm 09:50 PMThis machine is set up in Kozhikode as a solution for those who want coins. Coins of Rs 1, 2, 5, and 10 are now available through this machine.

Floki Inu Announces High-Profile Marketing Campaign in Delhi NCR to Promote Its Play-to-Earn MMORPG, ValhallaNov 20, 2024 am 04:08 AM

Floki Inu Announces High-Profile Marketing Campaign in Delhi NCR to Promote Its Play-to-Earn MMORPG, ValhallaNov 20, 2024 am 04:08 AMFloki (FLOKI) has announced a high-profile marketing campaign in Delhi NCR to carry out an advertisement for its Play-to-Earn MMORPG, Valhalla.

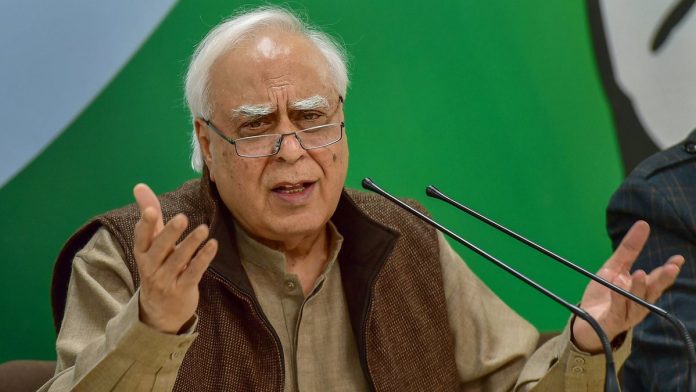

“Judge Population Ratio Abysmally Low In India”: Says SC Bar Association Head Kapil SibalAug 31, 2024 pm 03:07 PM

“Judge Population Ratio Abysmally Low In India”: Says SC Bar Association Head Kapil SibalAug 31, 2024 pm 03:07 PMNew Delhi, Aug 31: President of the Supreme Court Bar Association, Kapil Sibal on Friday expressed concern on the number of judges in the country saying that the judge

Bitcoin Faces Market Turbulence as Economic Storm Brews, 10X Research Predicts Deeper DownturnAug 05, 2024 am 09:54 AM

Bitcoin Faces Market Turbulence as Economic Storm Brews, 10X Research Predicts Deeper DownturnAug 05, 2024 am 09:54 AMThe cryptocurrency research group 10X Research predicts that the recent declines in the price of Bitcoin could be the start of a more serious decline, citing an upcoming economic storm and the asset's separation from the stock market.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Dreamweaver Mac version

Visual web development tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

Notepad++7.3.1

Easy-to-use and free code editor

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

SublimeText3 Mac version

God-level code editing software (SublimeText3)