MicroStrategy's Bitcoin Holdings Surge to $15 Billion, but Software Business Stagnates

(Bloomberg) — Analysts are starting to pay closer-than-usual attention to the underlying enterprise software business of Bitcoin-proxy MicroStrategy Inc.

MicroStrategy Inc.’s two-track strategy of investing in Bitcoin and growing its enterprise software operations has come under increasing scrutiny as the company’s cash flows are squeezed by the heavy debt load it has taken on to buy the digital asset.

While MicroStrategy’s Bitcoin stockpile has surged to almost $15 billion over the past few years to make it the largest corporate holder, revenue from the software business has largely remained stagnant. Analysts now expect revenue to be little changed when the company releases second-quarter results later Thursday.

“For me, I think the big question is just making sure that their cash flows are going to be sufficient to cover the incremental interest expense associated with the convertible debt they’ve issued,” said Lance Vitanza, an analyst at TD Cowen, which has a “buy” recommendation on MicroStrategy's shares. “If my estimates are right, they don’t have a lot of room for error if their software business underperforms.”

MicroStrategy has used various means to raise money to buy Bitcoin besides operational cash flow, such as issuing more than $2 billion in convertible notes this year. Proceeds from the software business are used to pay for the related interest expense, as well as taxes.

The company has about $45 million in interest expense, plus another $20 million in cash taxes this year; and about $82 million in earnings before items such as taxes, Vitanza estimates. Because of the tight cash conditions, Vitanza expects the company to hold off issuing additional notes to buy more Bitcoin until next year.

Despite the almost doubling in the value of the firm's Bitcoin holdings, the tokens don’t add to the top or bottom line because they don't generate any income.

That's been of little concern to most investors so far. The company's shares have surged 156% this year, outperforming the roughly 50% jump in the price of Bitcoin during the same period.

MicroStrategy will have a quarterly loss of 78 cents a share and revenue will be little changed at $119.3 million, according to analysts surveyed by Bloomberg. It earned $1.68 a share in the year-earlier period.

The company will probably also post an impairment charge on its stash of Bitcoin, which may be enough to make it unprofitable for 12 of the 16 quarters since they started buying Bitcoin, according to Bloomberg calculations.

Even if the software business stumbles, MicroStrategy still has a lot of options to keep paying its bills. None of the debt comes due until 2027 or later. To raise funds, it could issue another convertible, get a loan, issue more shares or even sell Bitcoin.

“They would have to sell if they need cash – mainly to repay debt, currently,” said Austin Campbell, an adjunct assistant professor at Columbia Business School.

Cash flow could also be affected by an accounting change coming next year that requires MicroStrategy to value its digital assets to market. The company may need to pay a 15% corporate alternative minimum tax if its average annual adjusted financial statement income for any consecutive three-tax-year period preceding the tax year exceeds $1 billion, according to a company filing.

With the rule's adoption, “we could become subject to the alternative minimum tax if, for example, we experience significant unrealized gains on our Bitcoin holdings,” MicroStrategy said in the filing. “If we become subject to these new taxes under the IRA for these or any other reasons, it could materially affect our financial results, including our earnings and cash flow, and our financial condition.”

“The likelihood of MicroStrategy or Michael Saylor selling their Bitcoin holdings seems very low if Michael Saylor’s public statements prove to be true,” said Jacob Joseph, an analyst at researcher CCData. “As a prominent advocate of the Bitcoin HODLing movement, Saylor has consistently shared optimistic projections for Bitcoin's future value.”

The above is the detailed content of MicroStrategy's Bitcoin Holdings Surge to $15 Billion, but Software Business Stagnates. For more information, please follow other related articles on the PHP Chinese website!

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PM

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PMThis sharp drop happened as investor interest faded and a major scandal hit the highly speculative market.

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PM

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PMDespite being pretty much the iconic example of “random” – well, that and dice rolls – we can't help but feel like there's some element of skill involved. Especially when we lose.

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AM

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AMBitwise, a leading digital asset manager, has announced the listing of four of its crypto Exchange-Traded Products (ETPs) on the London Stock Exchange (LSE).

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AM

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AMBitcoin may be poised for a massive rally—but only if gold continues its upward climb, according to Joe Consorti, Head of Growth at Theya.

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AM

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AMThe Shiba Inu price continues to attract the attention of analysts, who are watching for its next potential move. By Samuele Piar. Updated April 14, 2025.

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AM

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AMThe joint motion of Ripple and U.S. Securities and Exchange Commission (SEC) to hold the appeal in abeyance has been granted by the Circuit Judge Jose A. Cabranes.

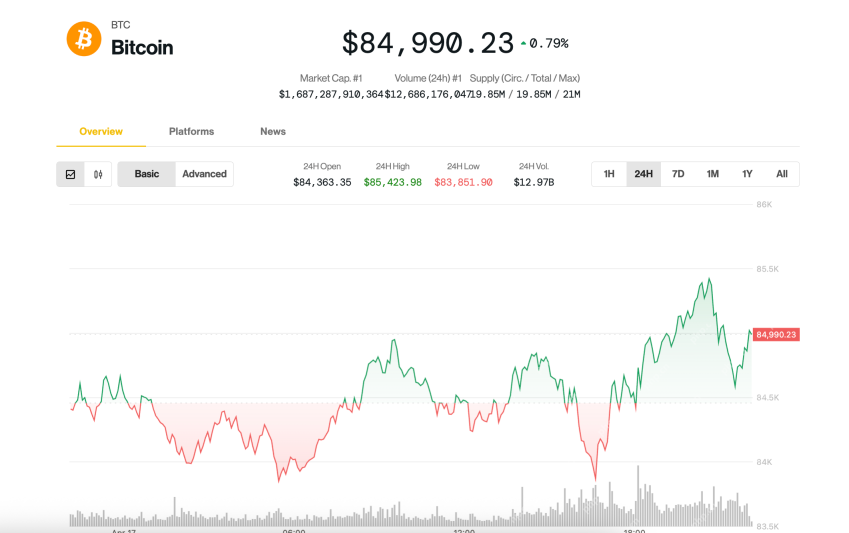

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AM

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AMBitcoin (BTC) was treading water just below $85,000 late Thursday as tensions between U.S. President Donald Trump and Federal Reserve Chair Jerome Powell added another layer of uncertainty for investors.

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AM

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AMToday, AB DAO officially announced the launch of a dual reward campaign in collaboration with Bitget (bitget.com), the world's second-largest digital asset trading platform.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 Chinese version

Chinese version, very easy to use

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

Dreamweaver CS6

Visual web development tools

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

Zend Studio 13.0.1

Powerful PHP integrated development environment