Jupiter Community Prepares to Vote on 30% Token Supply Reduction Proposal

The community for Jupiter, a Solana-based decentralized exchange aggregator, is preparing to vote on a proposal to reduce its token's supply by 30%.

Solana-based decentralized exchange (DEX) aggregator Jupiter is preparing for its community to vote on a proposal to reduce the token's supply by 30%.

According to a recent report, voting will begin on Aug. 1 with the proposal advocating to reduce JUP's supply by nearly one-third. The proposal aims to reduce both team allocations and new token emissions by 30%.

The proposal to reduce JUP's supply was first floated in June. Meow, Jupiter’s pseudonymous founder, said the move will “cut the fat” from the project's fully-diluted valuation (FDV) and address community concerns regarding JUP's high rate of new token emissions.

JUP is currently the 68th largest cryptocurrency with a market capitalization of $1.3 billion and a circulating supply of 1.35 billion tokens. However, one billion JUP is scheduled to be distributed to community members in annual airdrops over four years. This means that JUP's supply will be heavily inflated moving forward.

The claim period for the first JUP airdrop closed on July 31, with 780 million of the one billion JUP being claimed by nearly 640,000 users. The remaining 220 million JUP were returned to Jupiter's community wallet.

The Jupiter team is also set to receive four billion JUP, which will be split evenly between a “strategic reserve” and team member allocations, held in a four-of-seven multisig account. Team member tokens are subject to a two-year lock-up from February 2024, with vesting to commence from February 2025. Additionally, Jupiter's four-person core team were allocated 450,000 USDC worth of JUP for first-year salaries.

In total, JUP's supply is programmed to max out at 10 billion JUP, giving it an FDV of nearly $10 billion at present.

‘Community eats first’On July 31, Meow also penned a lengthy manifesto outlining the core principles that will underpin how the Jupiter team's tokens are managed, ensuring that the community “eats first.”

Meow stated that Jupiter team tokens originally scheduled to begin unlocking during the first year of vesting will be staked for an additional two years. Both Meow and his fellow co-founder, Siong, also committed to locking up all of their tokens until at least June 2026.

He added that most other team members have similarly committed to locking up the majority of their token allocations over the same period of time, pledging to liquidate “only what they need for their personal financial security” from February 2025.

Finally, the Jupiter community will receive at least three months advance notice ahead of the project releasing any of its strategic reserve tokens for strategic reasons, with Meow emphasizing that reserve sales will be managed proportionally to available market liquidity.

According to DeFi Llama, Jupiter consistently hosted at least $200 million in trading volume throughout July, down from more than $1 billion in Q2. The protocol also boasts a total value locked (TVL) of $599.4 million, ranking it as a top 10 Solana protocol.

The price of JUP is down 43% since posting a local high in April, according to The Defiant’s crypto price feeds.

Related: Jupiter’s Launchpad Mechanism Riles Up Crypto Community

The above is the detailed content of Jupiter Community Prepares to Vote on 30% Token Supply Reduction Proposal. For more information, please follow other related articles on the PHP Chinese website!

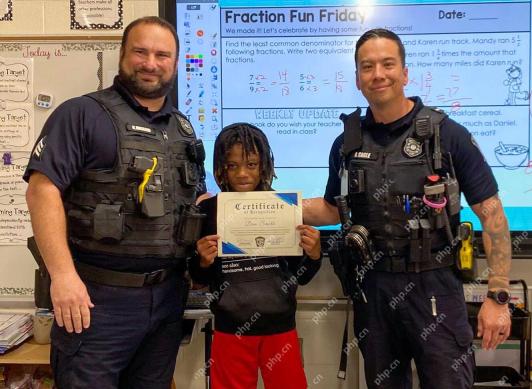

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AM

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AMFayetteville Police Department officers Kevin Ingram and David Cagle present Spring Hill Elementary fifth grader Dan Smith with a certificate of recognition for his heroic actions. By FPD

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AM

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AMArtificial Intelligence (AI) has begun to penetrate all aspects of human life, and governance is next. On April 14, the government of the United Arab Emirates (UAE) approved the implementation of what the media is calling the first AI-powered legisla

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AM

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AMOn-chain data reveals that large Shiba Inu investors, referred to as whales, sold their tokens as the coin's value declined.

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AM

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AMSmart crypto investors are looking for an asset with real-world utility and early potential gains in 2025. XRP and Chainlink (LINK) remain the bedrock of solid portfolios but new opportunities

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AM

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AMAs Bitcoin flirts with the $100,000 milestone and Ethereum climbs closer to the $2,000 mark, the eyes of crypto enthusiasts and investors alike are beginning to focus

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AM

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AMU.S. President Donald Trump’s media company, called Trump Media & Technology Group, is exploring yet another crypto-related venture, the company said in a letter to shareholders on Tuesday.

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AM

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AMTop 10 digital currency trading apps: 1. OKX, 2. Binance, 3. Coinbase, 4. Kraken, 5. Huobi, 6. KuCoin, 7. Bitfinex, 8. Gemini, 9. Bitstamp, 10. Poloniex, these platforms are all known for their security, user experience and diverse features, suitable for users with different needs to conduct digital currency transactions.

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AM

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AMA video by DA CONTENT TV on YouTube dives deep into a bold new prediction for Pi Network (PI). According to the discussion, there is growing optimism that the Pi price could surge dramatically, potentially hitting $5 much sooner than many expected.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SublimeText3 Linux new version

SublimeText3 Linux latest version

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

Zend Studio 13.0.1

Powerful PHP integrated development environment