web3.0

web3.0 Ethereum spot ETF saw net inflows for the first time! Grayscale ETHE selling pressure slows down

Ethereum spot ETF saw net inflows for the first time! Grayscale ETHE selling pressure slows down

This site (120bTC.coM): The actual opening time of the nine Ethereum spot ETFs came to the sixth day, and the daily inflow finally turned from negative to positive for the first time, achieving the first net inflow, with a total amount of 33.7 million Dollar. The reason is believed to be the slowdown in the huge outflow of Grayscale ETHE. Meanwhile, BlackRock’s investment chief noted that some investment banks are looking into incorporating Ethereum ETFs into their portfolios.

Ethereum spot ETF has positive net inflows for the first time

Farside Investors data points out that, as with previous data, eight of the nine Ethereum spot ETFs currently on the market have achieved net capital inflows, which is still grayscale ETHE Become the only net outflow target.

But the good news is that the overall market achieved positive daily net inflows for the first time during today's closing, with a scale of US$33.7 million; this is the first time since the listing that positive capital inflows have occurred, reversing the outflow of US$546 million in the past four days. the trend of.

However, the overall statistical traffic still had a net outflow of US$406 million.

BlackRock (ETHA) net inflow hit the second-highest opening of the market

First of all, BlackRock’s ETHA hit a net inflow of US$118 million today, which was about twice yesterday’s flow and is currently second only to the opening. A good result of US$266 million on the market day.

This inflow makes ETHA become the leader in the Ethereum spot ETF field with a total inflow of US$618 million.

Other competitors, such as Bitwise (ETHW) and Franklin (EZET), performed almost as usual, with inflows around US$3.5 million.

The outflow of Grayscale (ETHE) is gradually slowing down

However, the main reason for the positive net inflow is still that the capital outflow of Grayscale ETHE has been slowing down day by day, from 480 million US dollars last week to 120 million US dollars today. The net outflow is already a quarter of the outflow on the day of listing.

So far, more than 20% of fund holdings have been sold, and Farside said the outflow rate appears to be declining.

BlackRock Chief Investment Officer: ETHETF is expected to be included in institutional investment portfolios

It is worth mentioning that BlackRock ETF Chief Investment Officer Samara Cohen recently revealed in a Bloomberg interview that the Ethereum ETF will become a large-scale investment by the end of this year part of the investment portfolio offered by a bank.

Cohen pointed out that some asset management companies are now conducting risk analysis and due diligence, and studying whether Bitcoin and Ethereum are suitable to be placed in their investment portfolios: What will happen from the end of this year to next year is that we will see their allocation in portfolios and better guide investors on how to use them.

She stated that the investment portfolios provided by large investment service brokers usually have a diversified asset allocation to ensure a balance of risk and return: At this time, Bitcoin and Ethereum are two completely different asset classes and use cases, but they all work well as "portfolio diversification tools."

The above is the detailed content of Ethereum spot ETF saw net inflows for the first time! Grayscale ETHE selling pressure slows down. For more information, please follow other related articles on the PHP Chinese website!

灰度已将近11.3万枚比特币转换为现货ETF,总价值超过45亿美元Jan 25, 2024 pm 09:15 PM

灰度已将近11.3万枚比特币转换为现货ETF,总价值超过45亿美元Jan 25, 2024 pm 09:15 PM根据最新ArkhamIntelligence数据显示,自11日以来,灰度GBTC经过成功转换成比特币现货ETF后,持续出现大额资金流出。据报道,近期灰度已从其钱包地址中转出近113,000枚比特币,其中绝大多数比特币被转移到CoinbasePrime,预计用于出售。这一情况表明投资者对比特币现货ETF的需求较高,并且他们正在利用这一机会进行大规模的交易活动。灰度的资金流出可能会对比特币市场产生一定的影响,因此值得密切关注。根据灰度官网数据显示,目前GBTC持有的比特币数量约为53.7万枚。自11

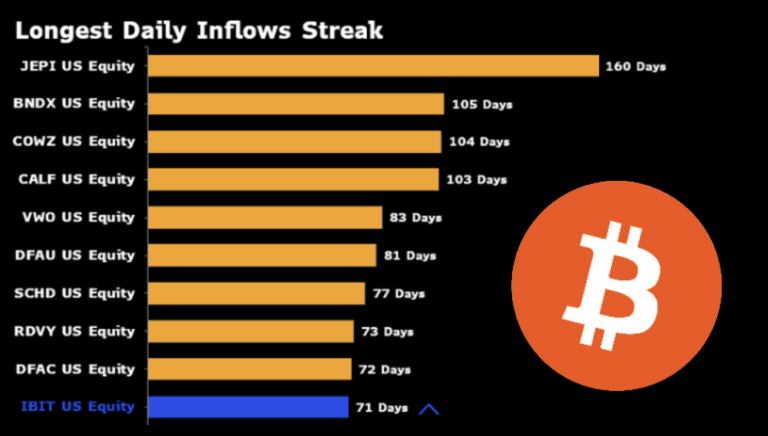

贝莱德IBIT止步连续净流入71天!灰度GBTC续创连续净流出记录Apr 26, 2024 pm 06:40 PM

贝莱德IBIT止步连续净流入71天!灰度GBTC续创连续净流出记录Apr 26, 2024 pm 06:40 PM根据彭博社ETF分析师EricBalchunas的统计,贝莱德比特币现货ETFIBIT在昨日未出现资金流入,故其每日连续流入的记录已终止在71天。而灰度的GBTC仍不断地在刷新记录,目前已连续72天净流出,无人能及。IBIT终止于第十强,连续净流入71天根据彭博社ETF分析师EricBalchunas的ETF连续净流入天数记录,贝莱德比特币现货ETFIBIT在昨日未出现资金流入,故其每日连续流入的记录已终止在71天。第一名是摩根大通股票溢价收入ETF(代码JEPI),于2020年发行,竟然有惊人

幻兽帕鲁在Steam上大热!以太坊和Solana的Meme币PALW与PAL登场Jan 27, 2024 pm 03:36 PM

幻兽帕鲁在Steam上大热!以太坊和Solana的Meme币PALW与PAL登场Jan 27, 2024 pm 03:36 PMPocketpair发布的Steam游戏《幻兽帕鲁》在1月19日开启抢先体验后迅速走红,并在首发24小时内突破了200万套的销量。游戏的同时在线人数也超过了129万,成为该平台上最畅销和最受欢迎的游戏。《幻兽帕鲁》Meme币现身以太坊、Solana在加密货币世界中,Meme币是非常独特的一类,许多Meme币都因知名IP的影响而诞生,并创造了百倍、千倍的财富神话。例如与特斯拉创办人马斯克(ElonMusk)有关的Doge、Shib、Troll等。同样,在《幻兽帕鲁》卖翻全球的背景下,其相关Meme

灰度拟发行迷你GBTC、业界最低管理费0.15%!能吸引资金流入?Apr 23, 2024 am 09:04 AM

灰度拟发行迷你GBTC、业界最低管理费0.15%!能吸引资金流入?Apr 23, 2024 am 09:04 AM本站(120bTC.coM):灰度在上月向美国证券交易委员会(SEC)提交申请,寻求发行管理费更低的迷你版灰度比特币现货ETF「BitcoinMiniTrust」(BTC),如今据灰度最新提交的预估财务报表,该ETF将收取0.15%管理费用,比当前所有比特币现货ETF都要低。灰度GBTC目前收取高达1.5%的管理费用,并持续出现资金净流出,根据最新文件,当迷你版GBTC推出时,灰度将把GBTC的10%资产注入该基金,迷你版GBTC的份额将自动发行、并分配给GBTC份额持有者。Coindesk报导

Google上架多个比特币现货ETF广告!贝莱德、富达、灰度已投放Jan 31, 2024 pm 04:03 PM

Google上架多个比特币现货ETF广告!贝莱德、富达、灰度已投放Jan 31, 2024 pm 04:03 PM本站(120bTC.coM):Web2科技巨头谷歌(Google)在去年12月曾预告,即将在2024年1月更新其加密货币相关产品的广告政策,将自2024年1月29日起正式开放广告商针对美国的「加密货币信托」产品进行广告。Google将加密货币信托定义为「允许投资者交易持有大量数字货币的信托股票的金融产品」,因此市场推测届时广告商将能够在Google平台推广符合此定义的「比特币现货ETF」。Google上架多个比特币现货ETF广告而在今(30)日,根据多个社群来源提供的截图显示,在搜寻栏输入“bi

以太坊现货ETF第二天净流出1.33亿美元!灰度成罪魁祸首Jul 26, 2024 am 05:10 AM

以太坊现货ETF第二天净流出1.33亿美元!灰度成罪魁祸首Jul 26, 2024 am 05:10 AM本站(120btC.coM):随着以太坊现货ETF开市来到第二天,该市场出现了1.33亿美元的资金外流,主要原遭指因是灰度(Grayscale)以太坊信托基金(ETHE)的大量资金流失。同时,BTC在北京时间中午一度跌穿64k、ETH24小时跌幅更超过5%。以太坊现货ETF第二天净流出1.33亿美元FarsideInvesters数据指出,当前市面上九档以太坊现货ETF中,有八个在第二天实现了净资金流入。然而即便如此,整体市场仍有着1.333亿美元的净流出,逆转了周二原先1.066亿美元的净流入

消息人士透露:SEC计划否决以太坊现货ETFJan 24, 2024 pm 09:42 PM

消息人士透露:SEC计划否决以太坊现货ETFJan 24, 2024 pm 09:42 PM美国证券交易委员会(SEC)最近批准了11个比特币现货ETF,这让人们对以太坊现货ETF今年能否获批的乐观情绪升温。彭博的ETF分析师EricBalchunas表示,以太坊现货ETF在5月获批的可能性已上升至70%。当前有7档以太坊现货ETF正在等待SEC核准,申请人包括贝莱德(BlackRock)、富达(Fidelity)、灰度(Grayscale)、VanEck、方舟/21Shares、Invesco/Galaxy以及Hashdex。知情人士:SEC想「强行拒绝」批准以太坊现货ETF根据Fo

SEC担忧以太坊PoS的集中化问题,推迟了灰度ETHE转变为现货ETF的计划Jan 26, 2024 pm 12:15 PM

SEC担忧以太坊PoS的集中化问题,推迟了灰度ETHE转变为现货ETF的计划Jan 26, 2024 pm 12:15 PM市场对以太坊现货ETF的批准普遍持乐观态度,尤其是在美国批准比特币现货ETF后。然而,美国证券交易委员会(SEC)表示他们仍在审慎考虑相关提案。此前,富达和贝莱德的申请也被推迟了。最近,SEC又推迟了Grayscale(灰度)将其以太坊信托产品(ETHE)转换为现货ETF的申请。质疑PoS机制容易受操纵根据文件,SEC在昨(25)日发布命令,要求就该提案展开程序并征求公众意见。除此之外,SEC还在文件中特别询问了以太坊的权益证明机制,并提出ETH由个人或实体的「控制或影响集中」是否可能导致该基金

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 English version

Recommended: Win version, supports code prompts!

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

Zend Studio 13.0.1

Powerful PHP integrated development environment

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),